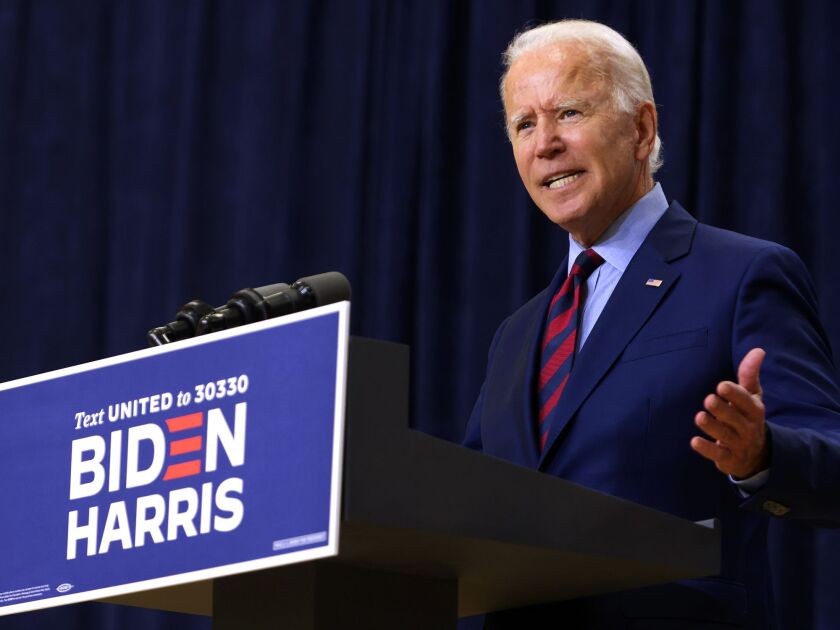

Democratic presidential nominee Joe Biden released his 2019 tax returns hours before the first debate with President Donald Trump, showing that he paid $299,346 in income taxes in 2019.

According to documents released by Biden’s campaign Tuesday, the former vice president and his wife, Jill, got a refund of $46,858 after paying $346,204 in income taxes. He reported a taxable income of $944,737, paying 31.7 percent of it in taxes.

The Bidens, along with Democratic vice presidential nominee Kamala Harris and her husband, released their returns two days after a New York Times report that Trump, a billionaire, paid $750 in incomes taxes in both 2016 and 2017. TheTimessaid it has not analyzed his most recent tax data. But the details that were released are sure to provide lines of attack for Democrats heading into the Nov. 3 election.

Trump has defied decades of practice by U.S. presidents by refusing to release his tax returns, incorrectly saying he cannot make them public because he is under audit. The audit stems from a $72.9 million refund claimed by Trump in 2010. He has dismissed the New York Times reporting, saying he has paid millions in real estate and payroll taxes.

The outcomes of two elections in Georgia that are scheduled for Jan. 5 are expected to determine the balance of power in the Senate and may also have an impact on the kind of tax planning that accountants should be advising their clients to do.

Economic experts believe the current surge is not enough to stop continued losses incurred by various segments of economy.

Concerns are increasing over the growing spread of COVID-19 and the preparedness of the incoming administration to deal with vaccine distribution and other critical issues.

The Bidens reported $517,334 in wages, including $135,166 from Joe Biden’s role as a professor at the University of Pennsylvania and $73,286 from Jill Biden’s teaching at Northern Virginia Community College. The tax returns also show wages of $112,500 from CelticCapri Corp. and $196,432 from Giacoppa Corp., entities owned by the Bidens.

CelticCapri and Giacoppa are both S corporations, closely held entities that could allow the Bidens to lower their tax bills for outside income such as speaking fees or book income with careful planning. It’s a tactic that other politicians have used when out of office. The Obama administration, while Biden was vice president, had proposed to restrict some of the tax benefits from using S corporations.

The personal financial disclosure that Biden was required to file as a presidential candidate also shows he took a $50,014 net distributive share from CelticCapri, which manages his speaking and writing fees. Biden took a leave of absence from the university when he declared his candidacy and hasn’t taken a paid speaking engagement since January 2019.

The couple also reported $33,291 in pension income from the state of Delaware and $160,908 pension from the federal government for Biden’s work as a Senator.

A revision in Trump’s 2017 tax law that capped the deduction for state and local taxes at $10,000 prevented the Bidens from deducting all of the $111,717 in local levies they paid in 2019. In all, the Bidens had $40,496 in itemized deductions. That included $14,700 in charitable contributions — about 1.5 percent of their adjusted gross income.

“This is a historic level of transparency and to give the American people faith, once again, that their leaders will look out for them, and not their own bottom line,“ deputy campaign manager Kate Bedingfield said on a pre-debate call with reporters. Quoting comments Biden made last year, she added “Mr. President, release your tax returns or shut up.”

Harris also released tax returns. She and her husband Doug Emhoff owed $1.2 million on taxable income of $3 million, paying an effective rate of 39 percent. They also paid $316,423 in state and local taxes, from which under current law they could deduct $10,000. They also deducted $35,390 in charitable contributions.

The bulk of their earnings, more than $2.7 million, came from Emhoff’s law firm, DLA Piper LLP. Harris’s Senate salary was $157,327, and she earned $264,825 for her work as an author. She disclosed the same amount on her Senate financial disclosure form from Penguin Random House as an advance. Emhoff said in August he was taking a leave of absence from his law firm during the campaign.

Biden’s tax proposals would significantly increase his own IRS bills, as well as those of other high-income taxpayers earning at least $400,000. He has called for increasing the top tax rate to 39.6 percent from 37 percent and adding new payroll tax levies. He has also said he wants to roughly double the capital gains rate so income from investment is taxed the same as ordinary income for taxpayers earning at least $1 million.

— With assistance from Jennifer Epstein