For more than one-third of the owners of small U.S. businesses, keeping their ventures alive during the coronavirus pandemic is coming at a high personal cost.

As the American economy faces an unprecedented contraction and COVID-19 deaths top 150,000, the debate over reopening states has hinged in some quarters on how to balance protecting lives and livelihoods. Government loans through the Paycheck Protection Program have helped support some businesses, but the accumulating months of reduced revenue are forcing entrepreneurs to buoy their own businesses with their personal assets and credit. Many have already succumbed.

“People have really put their livelihoods on the line here. I think they feel really responsible, too — that they’ve already put in so much blood, sweat and tears, and they don’t want to see it fail,” said CreditCards.com analyst Ted Rossman.

Seven in 10 small-business owners say they’ve used some form of support for their business since March, according to a new CreditCards.com survey. The most common option was PPP loans, with 30% of respondents saying they received one, followed by 24% saying they turned to personal credit cards and business savings accounts. In total, 35% of owners used either personal credit cards or savings accounts, with 10% using both, to support their business.

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

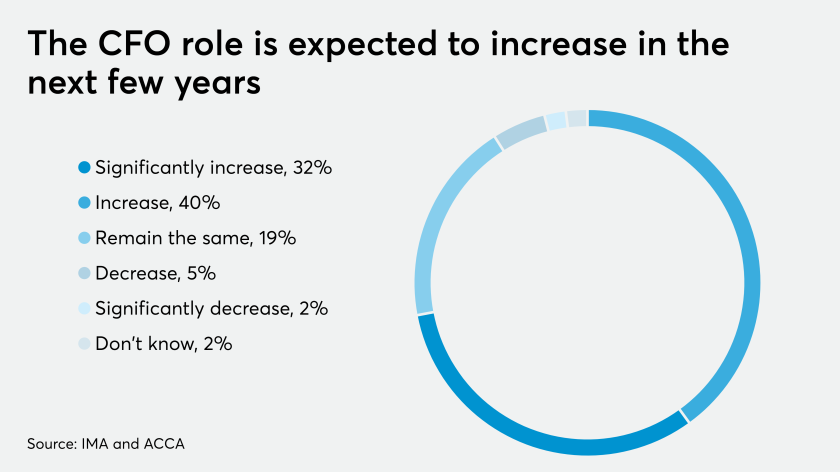

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

This personal funding has further blurred the line between personal and business finances. Small businesses that bring in less than $1 million annually typically need the owner to personally back the debt, meaning they’re responsible if the company can’t pay, Rossman said. This leaves entrepreneurs on the hook for the risk, even if it’s in the name of their business.

While this has always been the case, the pandemic has intensified the personal financial risk to small entrepreneurs.

Now, small-business owners are looking to customers to help them out: Some 32% of respondents said they need sales to increase for them to stay afloat this year. About one in five said they would need government assistance — a $669 billion federal relief program has doled out funds, and more money is being considered.

More than half of respondents say they won’t survive long past the new year without additional support.

Looking ahead, small businesses face high degrees of uncertainty as the rules for reopenings shift under their feet. Additionally, the economic brunt of the shutdown is coming down disproportionately on African American-run businesses. On the big-business scale, more than 140 companies have declared bankruptcy.

“It's going to be hard to get more customers when people are worried about their own finances and health,” Rossman said. “I tend to think that this one is going to be a longer fix, not a shorter one, unfortunately.”

The survey, conducted July 14 to July 20 by YouGov for CreditCards.com, had about 500 responses from small-business owners, which were weighted to be nationally representative.