- 2 Min Read

Consumers now have more control over their own financial decisions and loan options.

6 Min ReadComplaints to the bureau hit an all-time high in April. More than one in five said servicers wouldn't grant deferrals, forced borrowers into forbearance or violated other requirements of the coronavirus relief law.

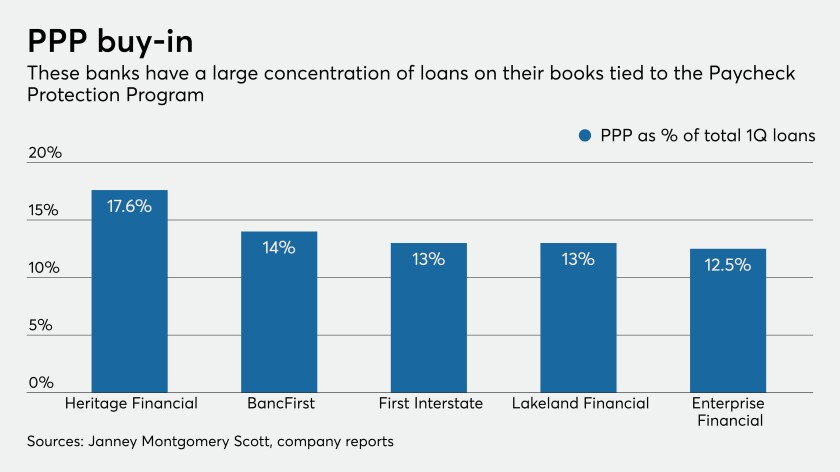

6 Min ReadBankers are bracing for accusations of discrimination in the way Paycheck Protection Program loans were allocated.

1 Min ReadCredit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

1 Min ReadThe bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

2 Min ReadThe bureau said it began developing the standards before the coronavirus pandemic. But more transfers may occur as some servicers struggle to meet their obligations during the economic downturn.

5 Min ReadThe agency is still moving forward on key regulations dealing with payday lending and mortgage underwriting despite new demands posed by the crisis.

1 Min ReadThe Borrower Protection Program enables the two agencies to exchange information about loss mitigation efforts and consumer complaints regarding specific servicers.

2 Min ReadThe agency said lenders should avoid reporting delinquent payments to credit bureaus for consumers who have sought payment relief due to the pandemic.

2 Min ReadThe ICBA chief’s plea for a six-month halt to regulations not related to the pandemic followed similar calls by community groups and a key Senate Democrat.