More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

Midsize businesses and state and local governments are among the beneficiaries of the central bank's latest $2 trillion effort to mitigate the economic damage caused by the coronavirus pandemic.

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

Real estate investor Tom Barrack said predicted a “domino effect” of catastrophic economic consequences if banks and government don’t take prompt action to keep commercial mortgage borrowers from defaulting.

The credit watch involves single-borrower securitizations of commercial mortgages for high-priced resorts in Florida and Hawaii.

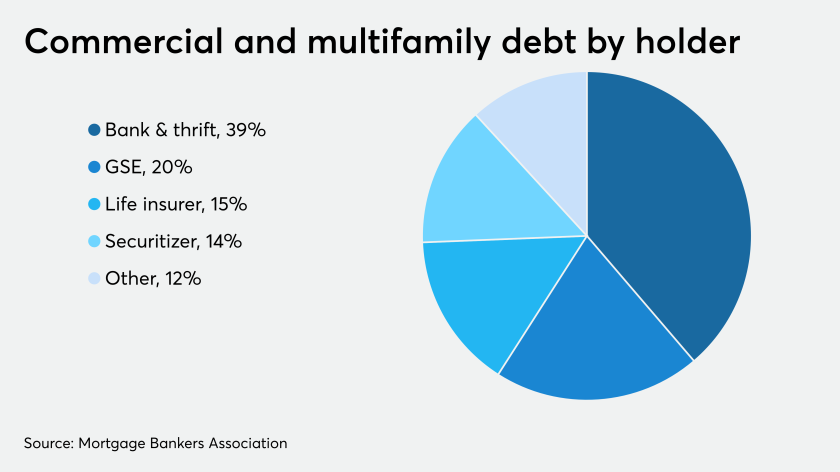

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.