While LendingClub, Prosper, Avant and SoFi are giving existing borrowers breaks in the short term, they're considering tightening credit as the coronavirus outbreak threatens to drag the economy into a recession.

The joint statement said examiners will not impede banks’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

High Rock Accounting provides clients with cash flow assistance and guidance. But what happens when a firm needs the same assistance?

The rush to unload mortgage-backed securities signals that a credit meltdown that began with corporate bonds is spreading to other corners of the market.

The Federal Reserve committed Monday to conducting more asset purchases of Treasury securities and mortgage-backed securities and announced $300 billion in new financing for credit facilities.

While collapsing market prices do not present immediate worries for CLO managers, the prospect of future downgrades and defaults becomes more problematic.

With small businesses feeling the financial scourge of the coronavirus, bridge loans could be the direction they turn to keep things afloat.

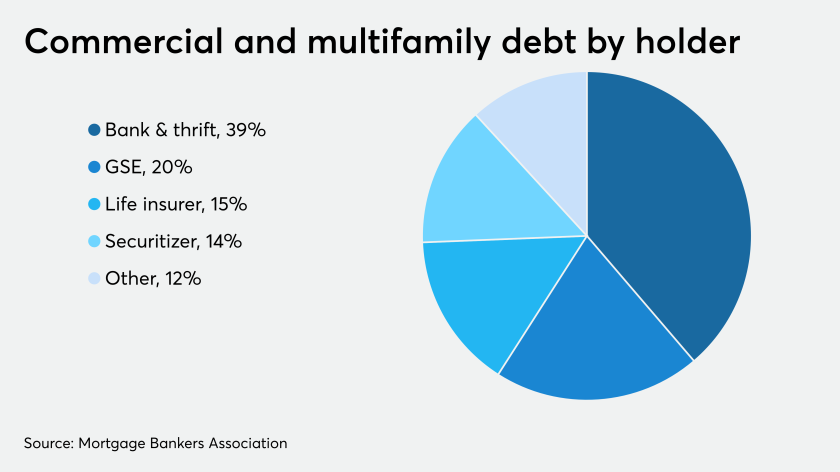

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

Bankers say they understand the need for an extraordinary government response to the coronavirus outbreak, but worry that even slashing interest rates won’t stimulate demand.