Rather than selling off assets at a steep discount, the Dallas company is considering taking equity positions in energy firms struggling to make loan payments in the wake of collapsing prices.

Lawmakers are considering a plan to reserve at least $50 billion in Paycheck Protection Program funds for customers of community banks and small regionals.

From stimulus checks to the Paycheck Protection Program, the government’s infusion of cash into an economy reeling from the coronavirus pandemic has primarily helped those who already strong banking relationships.

Square Capital and other online lenders joined the Paycheck Protection Program just before it ran out of money. Now they’re ready and waiting for Congress to reload funds that could be better aimed at the smallest companies.

The Small Business Administration stopped approving loans when the Paycheck Protection Program hit its cap.

The SBA’s Paycheck Protection Program is nearly depleted, but there are ways small banks and fintechs, with help from Congress, can remedy the situation.

Online lenders, core providers and software companies have created digital platforms that speed up and simplify Paycheck Protection Program loans for businesses reeling from the coronavirus pandemic.

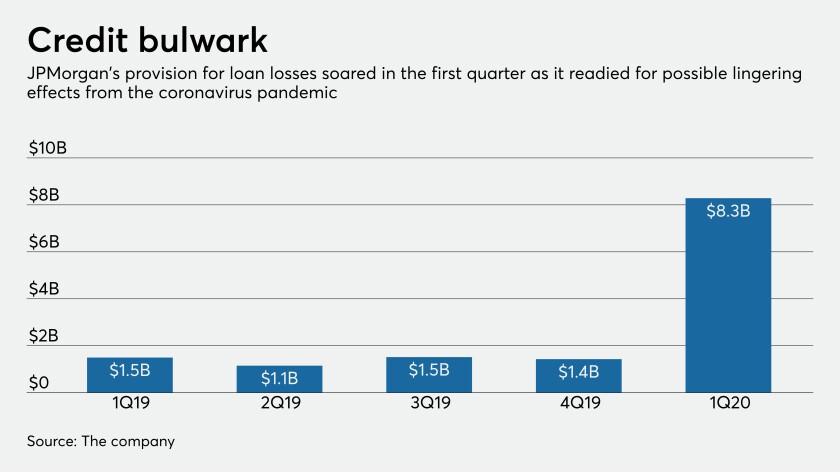

Its prediction that business conditions will remain weak this year — and into next year — stands in stark contrast to forecasts from political leaders that the economy will rebound quickly from the coronavirus pandemic.

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

PayPie is offering access to its network of Small Business Association-authorized lending partners to businesses seeking funds through the SBA Payroll Protection Program during the COVID-19 pandemic and economic slowdown.