- 5 Min Read

"It's on-demand capital for us," Optus Bank's CEO says of the payment company's deposit. The funds are part of PayPal's broader effort to confront race and income inequality.

6 Min ReadLenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

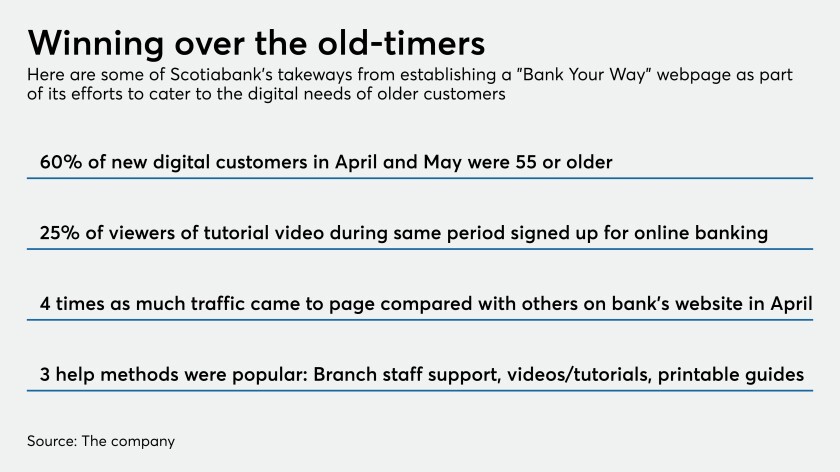

5 Min ReadThe Canadian bank is doing something few U.S. institutions have done: build an online hub with tutorials designed expressly to simplify the online banking process for newcomers.

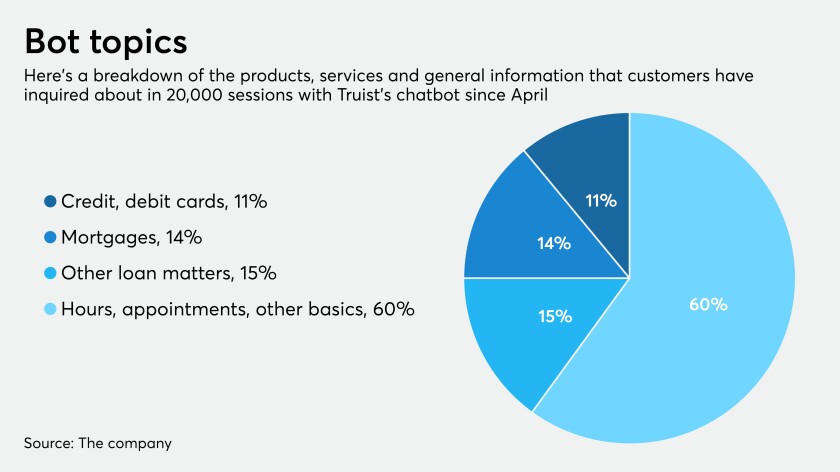

4 Min ReadBuilt to respond to borrowers' questions about mortgage deferrals, the bot created by Salesforce is evolving and in the future could conduct transactions, handle a wide range of queries or help with emergencies.

3 Min ReadA public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

3 Min ReadAs more consumers do business online, some deposits are being unfairly categorized as brokered, inviting burdensome regulatory scrutiny.

6 Min ReadThe digital bank, founded by a former Western Union president, offers tools to help low- and moderate-income people access their wages early, pay bills and engage in other financial services activities for a monthly fee.

3 Min ReadThe coronavirus pandemic has forced some branches to close, but demand for in-person advice remains strong.

2 Min ReadThe prepaid card company benefited from payments that were designed to offset the pandemic’s impact on U.S. consumers.

7 Min ReadKeyBank, Regions and others are using self-service portals, robotic processing automation and virtual assistants to digitize the collections process and make it more humane in anticipation of rising delinquencies.

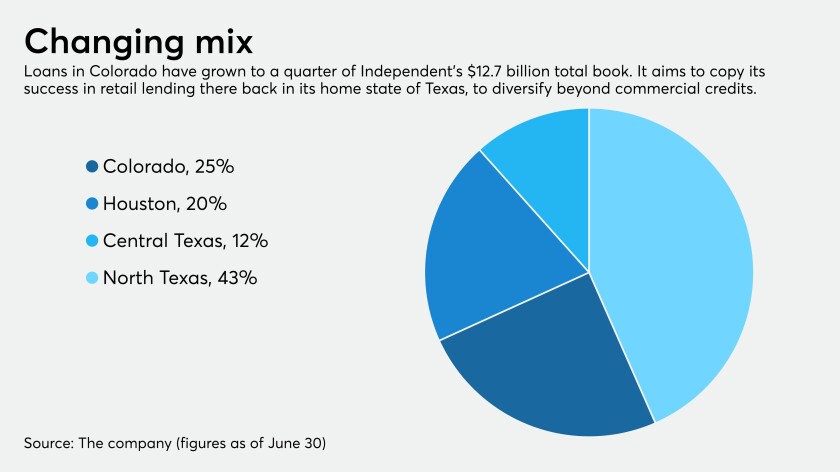

3 Min ReadNow that its deal with Texas Capital has been called off, Independent Bank in McKinney plans to scale back or exit some commercial lines and will seek to duplicate its retail banking successes in Colorado.

3 Min ReadThe pressure is on the fintech, which helps banks make digital loans, to stanch its losses and show its lofty market valuation was deserved.

9 Min ReadCurrent, Stoovo and other companies are reaching out with low-cost, low-fee financial services and even tools to help users search for part-time jobs.

7 Min ReadBBVA and Rockland Trust have taken a highly numbers-driven approach to branch reopenings. All banks are having to rethink their branch networks during the pandemic and beyond, and analytics software is helping.

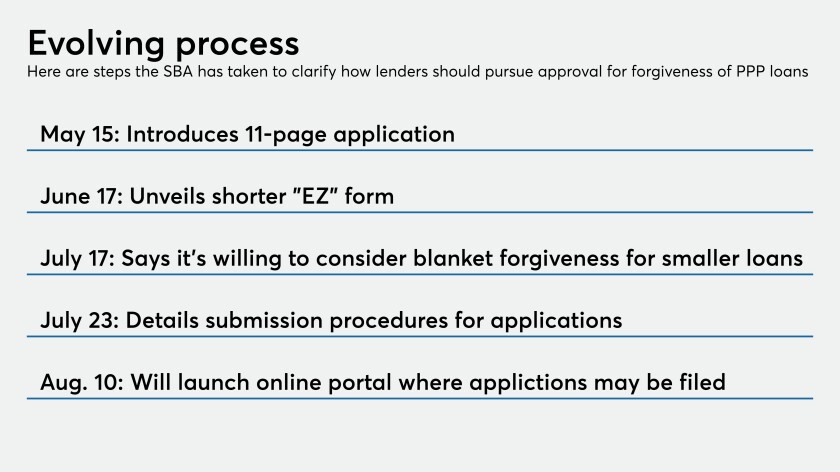

4 Min ReadA new Small Business Administration notice explains what steps lenders must take to seek approval of their forgiveness decisions under the Paycheck Protection Program. But lenders say lawmakers and regulators must do more to cut red tape.

3 Min ReadLenders need to use alternative data as an overlay to traditional underwriting methods to help creditworthy customers in hardship because of the coronavirus crisis.

7 Min ReadThe Federal Reserve, U.S. Mint and financial industry representatives are strongly considering a public call for Americans to deposit their spare change, among other fixes, to get coins circulating again. Meanwhile, banks of all sizes are getting creative at the local level.

6 Min ReadBusiness models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

4 Min ReadThe coronavirus pandemic has exposed weaknesses even at well-established fintechs. They could become more resilient by partnering with traditional financial institutions.

2 Min ReadConsumers now have more control over their own financial decisions and loan options.