- 2 Min Read

Customers are increasingly concerned about taking a financial hit from the COVID-19 crisis and want to know more about fee waivers, credit-line increases and other things banks could do for them.

4 Min ReadAutomated and interactive teller machines aren’t germ-free in the best of times, and the pandemic has raised new concerns about the possibility of those devices infecting consumers and staff.

2 Min ReadFirst Horizon, Pacific Premier and South State are warning in regulatory filings that the pandemic could complicate deals that have not been completed.

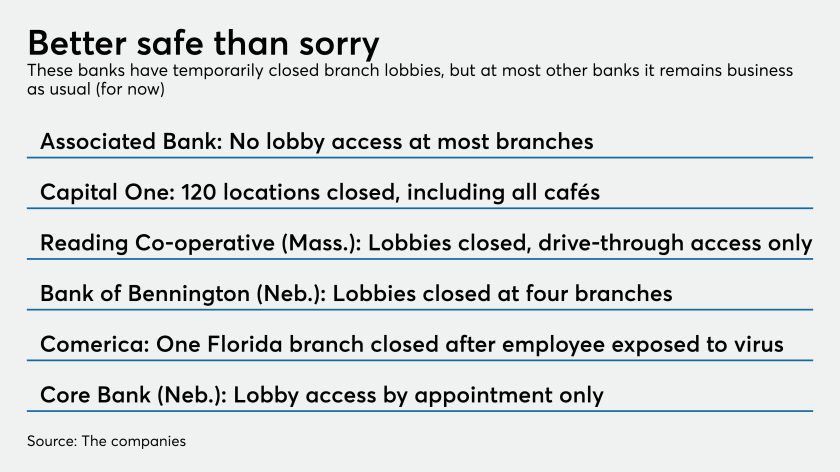

5 Min ReadMany institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.

5 Min ReadLenders are rallying around a bill from Sen. Rubio that would give them access to another $50 billion under the 7(a) program. It could face obstacles in the House, where a bill favors direct lending by the Small Business Administration.

3 Min ReadCoronavirus concerns, along with the Fed's emergency rate cut and an erratic stock market, have forced most bankers to take pause and reassess potential deals.

5 Min ReadNo-interest loans and overdraft forgiveness are among the lifelines banks are offering to consumers and small businesses whose livelihoods are being upended by the economic fallout.

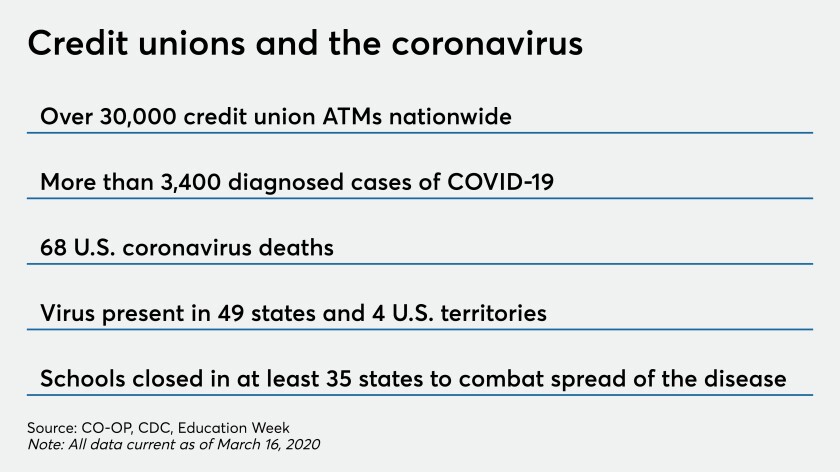

4 Min ReadAs the pandemic spreads, credit unions must take steps to make branches safer for members and staff. Here's how.

6 Min ReadNoah Wilcox, a fourth-generation banker, says community banks are well positioned to provide stability and capital in underserved markets during uncertain times.

3 Min ReadThe outbreak and a free fall of oil and stock prices are rattling bankers at this year's ICBA gathering in Orlando, Fla.

5 Min ReadAs the COVID-19 virus spreads globally, many U.S. financial institutions are said to be taking steps to protect employees and minimize disruption. But only a handful are sharing specifics, to avoid contributing to any public panic.