With offices closed, and staff and clients scattered, maintaining relationships (and sanity) can be hard.

Senior leaders at the No. 1 IBD meet daily about the pandemic as large enterprises set their own continuity plans into motion with an eye toward ensuring operations.

The Fed must set up a "family financial facility" that sends billions to households and small businesses so banks don’t misdirect relief funds.

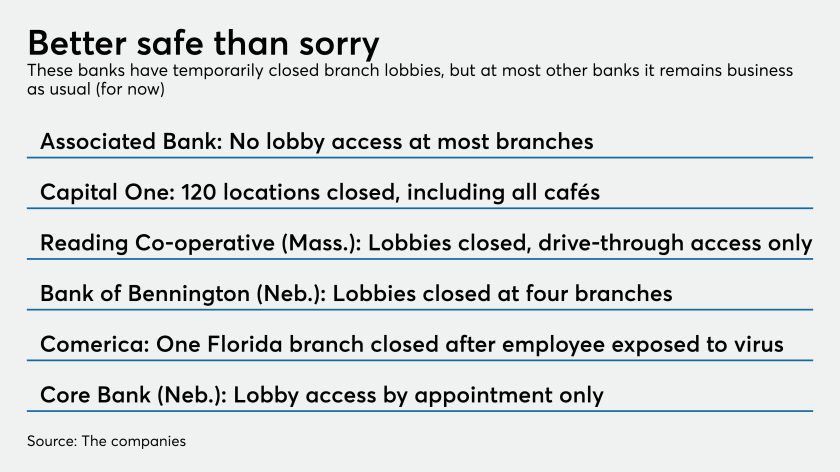

Institutions across the country are restricting entrance to their facilities to help curb the spread of COVID-19 but profitability issues could crop up if the pandemic drags on.

The Money Market Mutual Fund Liquidity Facility, established under the central bank’s emergency authority, echoes a version that was set up during the global financial crisis.

Customers are increasingly concerned about taking a financial hit from the COVID-19 crisis and want to know more about fee waivers, credit-line increases and other things banks could do for them.

Mortgage real estate investment trusts are taking stock of their financial ability to respond to market shocks and other concerns stemming from the coronavirus.

There are several forbearance measures the agencies can take now to keep banks from failing in a downturn triggered by the coronavirus.

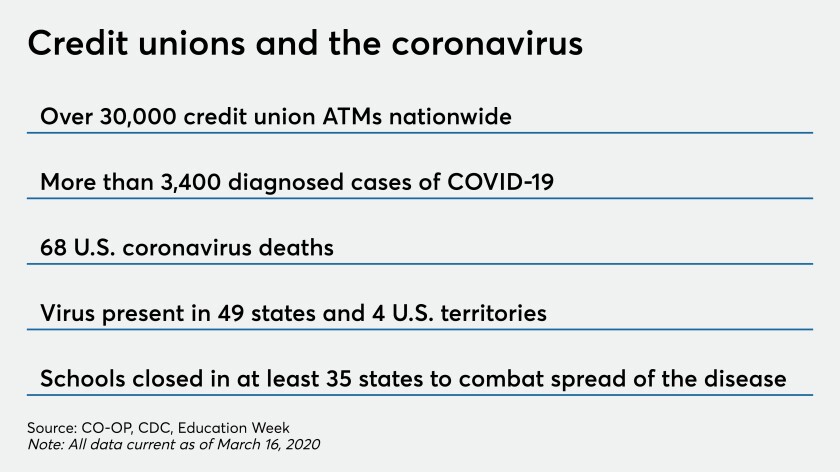

Automated and interactive teller machines aren’t germ-free in the best of times, and the pandemic has raised new concerns about the possibility of those devices infecting consumers and staff.

Many institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.