What is real and unreal about the times we're living through may have become hard to differentiate for many of us.

The pandemic amplifies cybersecurity concerns for CPAs.

Business continuity plans should be used constantly, not just when the crisis is at its peak, says the New York Fed’s head of financial services.

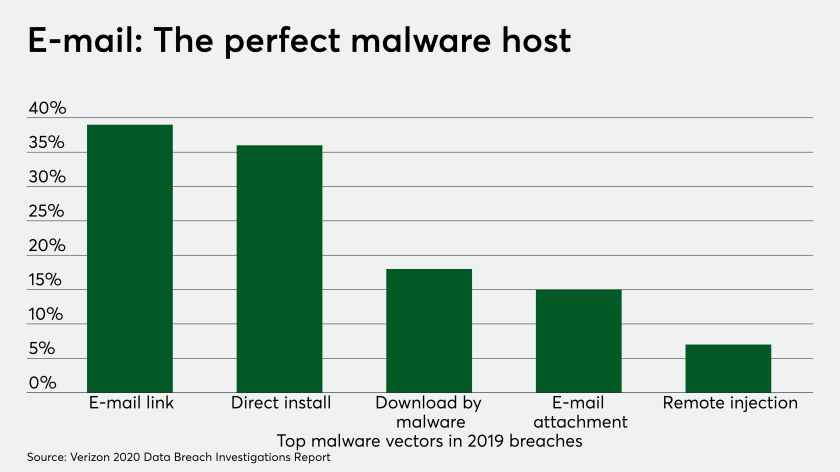

In a new twist on an old scam, cybercriminals have tried to get thousands of people to surrender their Wells bank account information by sending authentic-looking emails containing malicious links that lead to a fake website bearing the company's name.

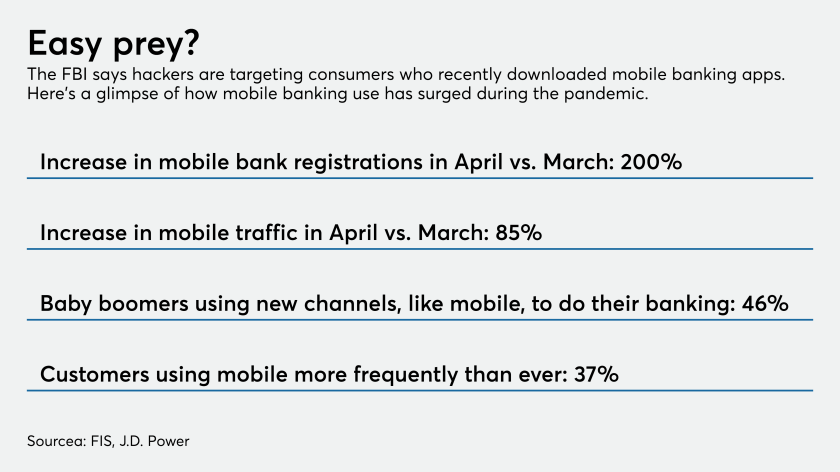

Mobile banking use has swelled since the pandemic hit, and law enforcement officials expect hackers to target the credentials of digital novices. The FBI stressed the importance of two-factor authentication and ensuring consumers know how to spot fake apps that carry malware.

Fraudsters are licking their chops at the prospect of businesses and financial services extending remote working because of the coronavirus pandemic.

Even before the coronavirus outbreak, cybercriminals were shifting their attention away from point-of-sale terminals — but the retail industry still absorbs the most attacks seeking to compromise databases or networks.

The popular videoconferencing service has been beset by security issues, and some banks have banned employees from using it. Are they overreacting?

Compliance attorneys for large wealth managers outline which questions are critical in light of the substantial regulatory requirements.

Financial institutions need to alert customers about emails or websites that pretend to offer important COVID-19 information but instead could end up stealing their account numbers or logins.