In a new twist on an old scam, cybercriminals have tried to get thousands of people to surrender their Wells bank account information by sending authentic-looking emails containing malicious links that lead to a fake website bearing the company's name.

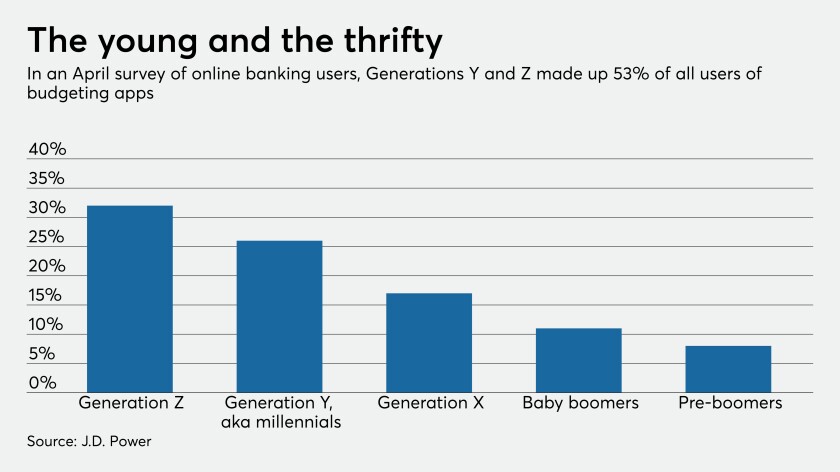

With money flow suddenly stifled for millions of customers, demand for money management tools has skyrocketed.

Peoples Bank in Arkansas and Main Street Bank in Massachusetts are getting smarter about spotting suspicious transactions tied to unemployment benefit fraud as well as warning customers what to watch out for.

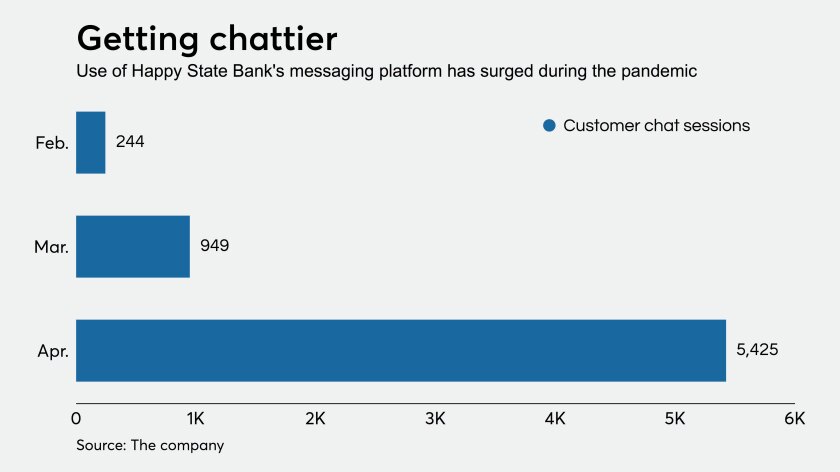

The success of Isbank's Maxi service is a lesson for all banks: Chatbots, with the right training, can provide the kind of human touch customers need in times like these.

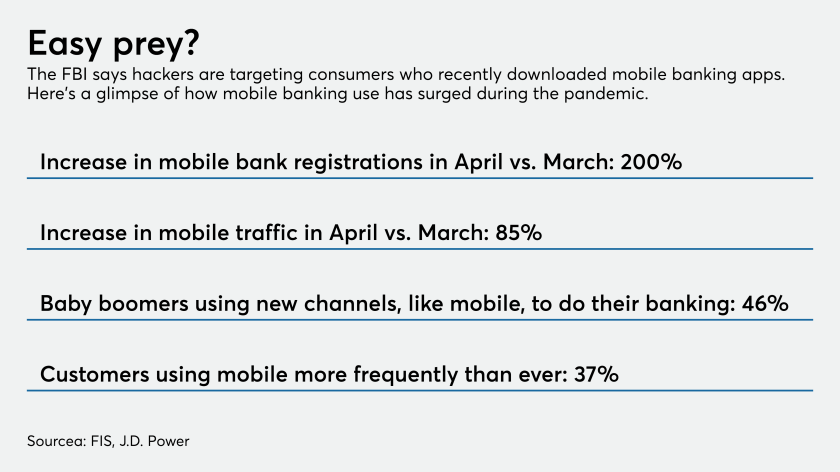

Mobile banking use has swelled since the pandemic hit, and law enforcement officials expect hackers to target the credentials of digital novices. The FBI stressed the importance of two-factor authentication and ensuring consumers know how to spot fake apps that carry malware.

After initially processing the loans manually, the Minnesota bank turned to "low code" software to build the electronic forms and workflows needed to approve loan applications. The result: a more than fivefold increase in the number of loans it could process in a day.

The Texas bank is leaning on solutions from Lightico and MANTL to quickly set up accounts and handle loans when customers can’t sign documents in person because of the coronavirus emergency.

U.S. Bancorp, Wells Fargo, WSFS and others were already deeply engaged in digital transformations before the coronavirus crisis led them to pivot — quickly.

Financial institutions have been monitoring workers' productivity at home with tracking software and webcams. Now they're mulling whether to mandate contact-tracing apps, COVID-19 testing and other practices that could raise further privacy issues.