- 4 Min Read

Consumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

2 Min ReadNearly everything fell during the difficult first quarter: net income, advisory assets, IRA assets, and advisor headcount.

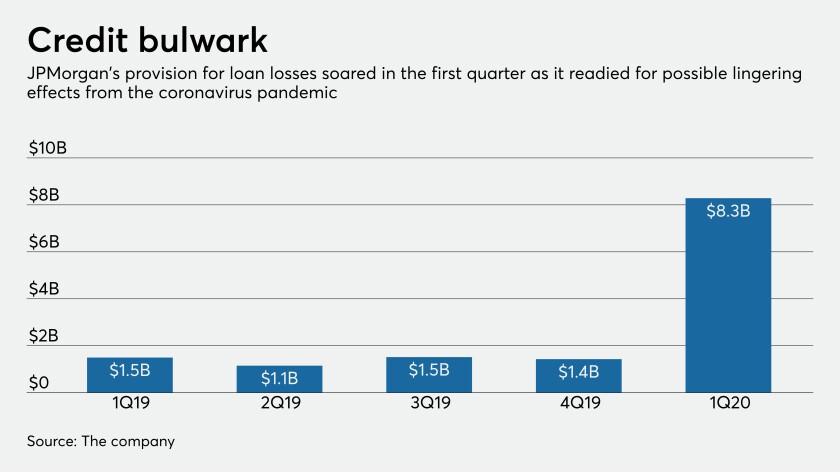

4 Min ReadThough hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

9 Min ReadIt was less than three months ago, though it seems like a lifetime. Mastercard CEO Ajay Banga welcomed progress in the trade dispute between the U.S. and China, but with a caveat. The good news wouldn't last if the coronavirus became a pandemic.

8 Min ReadRatings agencies predict major losses for all of the largest BDs, prompting firms to reassess strategies in uncertain times.

3 Min ReadThe impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

3 Min ReadBankers will be pressed on upcoming earnings calls to forecast how the coronavirus pandemic — and the government's response — will shape credit quality, margins and fee income.

2 Min ReadMoody’s lowered the giant IBD network’s credit rating with sobering words that could resonate across wealth management.

4 Min ReadMoody’s affirmed the company’s “B3” rating but signalled the potential wide-reaching impact of the pandemic across wealth management.

2 Min ReadCompanies in the mortgage business were already focused on processing a lot of loans and generating efficiencies before the latest uptick in business hit.