The relief bill includes an extension of the 45Q tax credit, which gives companies a tax break for capturing carbon..

The shutdown in March forced O&G firms to confront the inefficiencies of their financial processes.

The Dallas bank set aside less in the second quarter for credit losses than analysts expected. Executives cited action in Texas and California to reverse reopenings and said they're still committed to the oil and gas business.

In response to the coronavirus, the Internal Revenue Service and the Treasury are giving renewable energy companies more time to develop projects using sources such as wind and geothermal.

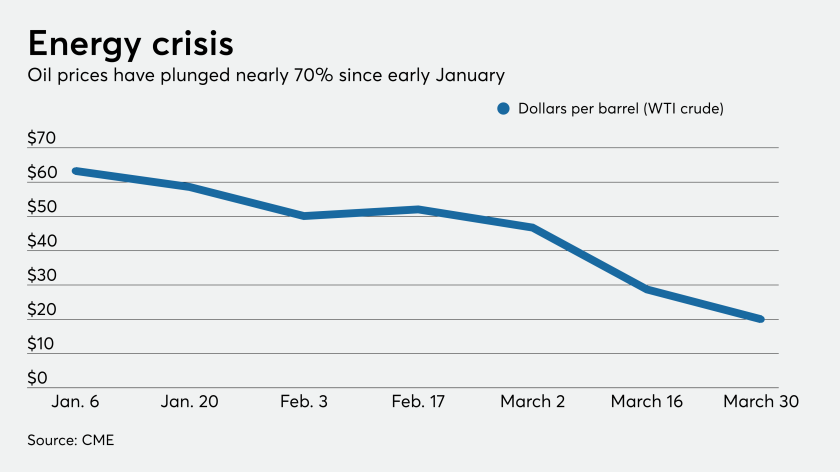

As oil prices collapsed in the fallout from the coronavirus, Singapore-based Hin Leong's foundations crumbled.

Rather than selling off assets at a steep discount, the Dallas company is considering taking equity positions in energy firms struggling to make loan payments in the wake of collapsing prices.

A Florida utility continues to pursue a lawsuit against a public power agency with a stake in the Plant Vogtle project.

Fitch Ratings placed Alaska's AA-minus issuer default rating on Rating Watch Negative.

Weak demand for oil and gas, brought on by the economic fallout of the coronavirus outbreak, has raised concerns of energy firms missing loan payments or even going bankrupt. Here’s how banks and regulators are trying to get ahead of potential problems.

Gov. John Bel Edwards kicked off Louisiana's legislative session by asking lawmakers to share accurate details about the coronavirus with constituents.