The temporary foreclosure moratorium on loans backed by HUD, Fannie Mae and Freddie Mac comes after lawmakers and housing advocates had pushed for steps to avoid consumers getting booted from their homes.

A national moratorium would be costly to lenders and servicers, but proponents say it's needed to help cushion the economic blow of the pandemic.

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

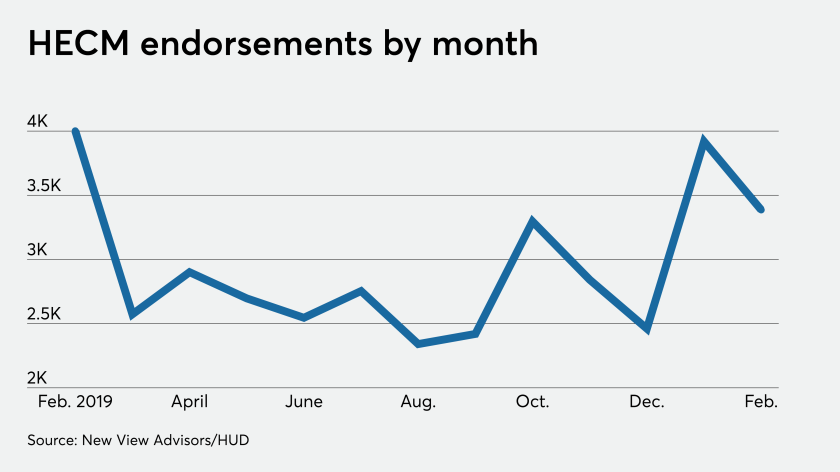

Endorsements of Home Equity Conversion Mortgages fell nearly 14% on a consecutive-month basis in February after a January surge, but stayed relatively strong compared to average levels last year.

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

Mortgage application volume rose last week, but with the 10-year Treasury yield tanking in recent days, growth in refinancings for the current period is quite likely, according to the Mortgage Bankers Association.