- 3 Min Read

Lenders and government guarantors can use loan technology to bring immediate relief to business owners, former OCC official Jo Ann Barefoot says.

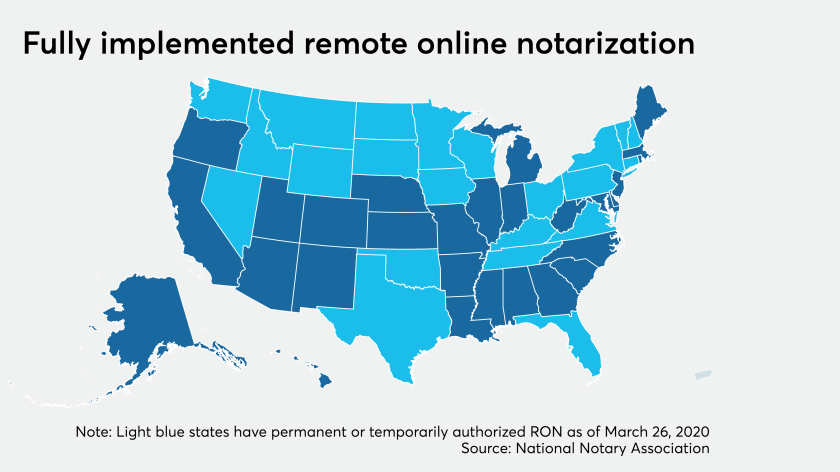

2 Min ReadAs the world practices social distancing to counteract spreading the virus further, it forces lenders to move as close as possible to an all-digital model, as quickly as possible.

4 Min ReadThe U.S. government will shortly funnel trillions of dollars into the economy to soften the coronavirus’ impact on a variety of industries and small businesses. Payment companies that are also lenders will soon find out if it’s enough to save the market.

2 Min ReadOnline lenders can help the agency distribute loans faster as it gets set to deploy emergency funding to small businesses.

3 Min ReadNo online lenders are approved for the agency's traditional programs, but they could make loans under the COVID-19 stimulus package if they get special approval.

3 Min ReadPayments technology is a relative bright spot as coronavirus’ economic fears hit venture capital, since an emergency can be a catalyst for early-stage innovation designed to ease digital commerce.

4 Min ReadMany borrowers will suffer unless the program, the central bank's latest response to the coronavirus pandemic, includes consumer loans issued by fintechs.

4 Min ReadOnline platforms and apps can be utilized to quickly support small businesses and consumers facing unexpected financial hardship.

5 Min ReadPayments firm announces leadership changes; the bank will place restrictions on fossil fuel lending while adding to sustainable projects.

1 Min ReadAppraisals are viewed as a choke point in the mortgage process. As the ranks of appraisers dwindle and technology advances, a new, AI-driven approach may not be far off.