FHFA Director Mark Calabria said the health crisis will complicate the release of a proposal establishing new capital requirements for Fannie Mae and Freddie Mac.

A national moratorium would be costly to lenders and servicers, but proponents say it's needed to help cushion the economic blow of the pandemic.

Houston-area home sales experienced another double-digit gain in February as buyers came out in droves to take advantage of low mortgage rates.

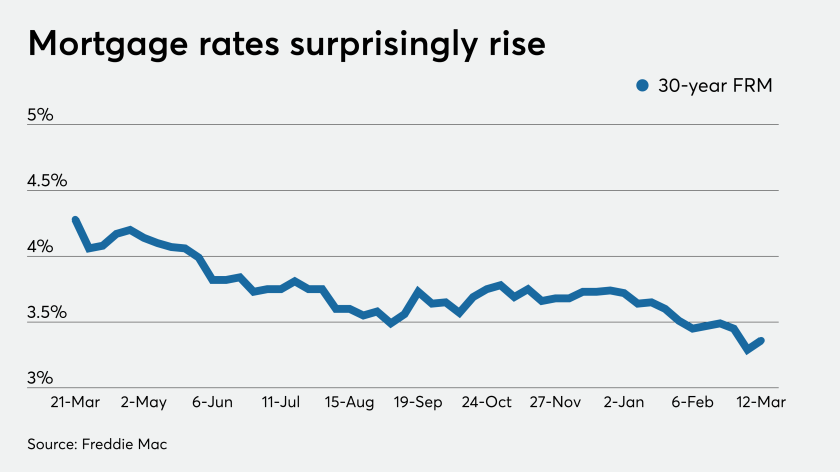

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

Capacity constraints among mortgage lenders are leading to wider spreads between mortgages and the 10-year Treasury yield even after it remained below 1% for an extended period this week.

Mortgage rates hit their lowest point since Freddie Mac began tracking this data in 1971, as the 10-year Treasury yield fell below 1% after the Federal Open Market Committee's surprise short-term rate cut.

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

As officials prepare plans for the government-sponsored enterprises' exit from conservatorship, there's no shortage of speculation about what those plans might look like and how they might affect the mortgage industry.

![“We are delaying the opening of ... [the] comment period until we have some certainty on what the current overall situation is,” said FHFA Director Mark Calabria.](https://arizent.brightspotcdn.com/dims4/default/1bf0ad9/2147483647/strip/true/crop/4182x2787+0+0/resize/840x560!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F24%2F4f%2F09d186a142899167373b7d4166b7%2Fcalabria-mark-bl-031820.jpg)