Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

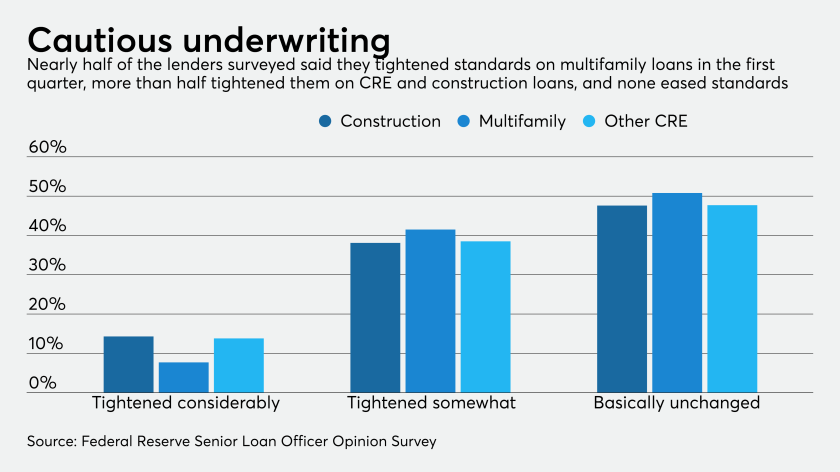

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

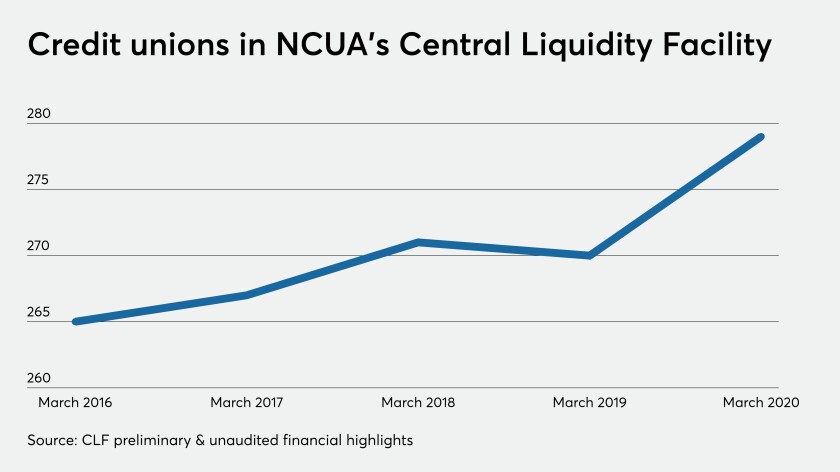

A credit union-specific liquidity backstop is far less popular than other options such as the Federal Reserve's discount window. The National Credit Union Administration wants to change that.

The policy move will allow small institutions participating in the Paycheck Protection Program to pledge business loans as collateral to obtain advances.

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

The Borrower Protection Program enables the two agencies to exchange information about loss mitigation efforts and consumer complaints regarding specific servicers.

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

The government is cushioning the impact of the coronavirus on consumers, but independent mortgage bankers need funding to deal with increased levels of servicing advances because of forbearances.

Treasury Secretary Steven Mnuchin reiterated Thursday that he wants U.S. financial markets to remain open even as the coronavirus fuels wild volatility, while adding that he's focused on helping mortgage firms expected to be hit hard by the pandemic’s spreading economic pain.

A number of proposals have been floated for debt payment holidays and other types of moratoria, but such approaches offer solutions that are worse than the problems.