Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

Consumer sentiment for home buying stayed near its record high behind low mortgage rates and a strong job market, though the declining stock markets and COVID-19 concerns may change that soon, according to Fannie Mae.

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

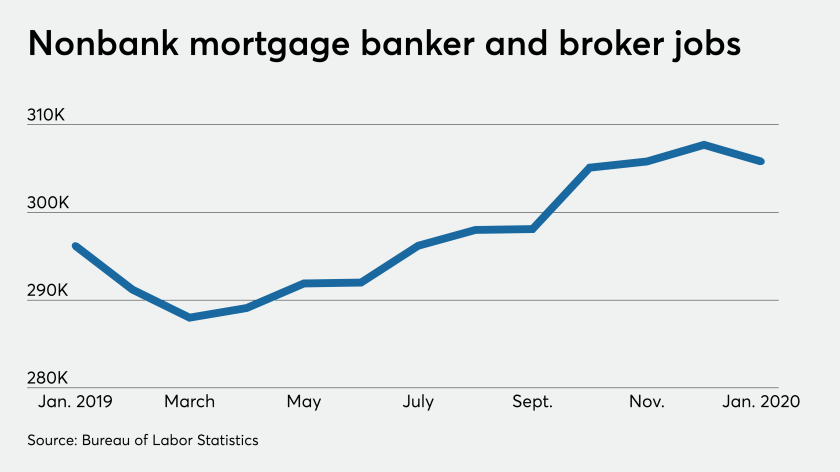

Nonbank mortgage employment fell in January, but could subsequently surge as lenders seek to capture business while rates are low, the job outlook is favorable, and the coronavirus is contained.

Capacity constraints among mortgage lenders are leading to wider spreads between mortgages and the 10-year Treasury yield even after it remained below 1% for an extended period this week.

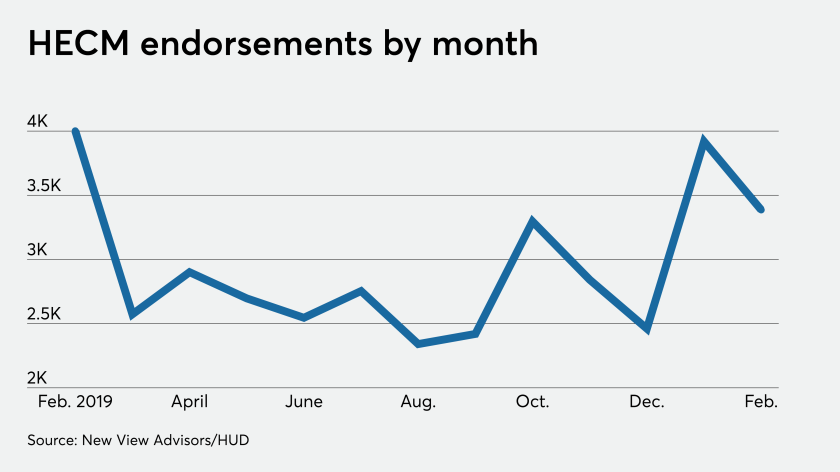

Endorsements of Home Equity Conversion Mortgages fell nearly 14% on a consecutive-month basis in February after a January surge, but stayed relatively strong compared to average levels last year.

Mortgage rates hit their lowest point since Freddie Mac began tracking this data in 1971, as the 10-year Treasury yield fell below 1% after the Federal Open Market Committee's surprise short-term rate cut.

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

While home price appreciation has lost some momentum, tight inventory and low rates could drive housing values further upward this spring if the coronavirus remains contained, according to CoreLogic.

Canada's housing market is poised for a hot spring — with lower mortgage rates likely to offset any major drag from the coronavirus.