As lenders scale up on their remote capabilities in response to the pandemic, the software companies that service them see exponential growth.

As social distancing related to the coronavirus complicates work for appraisers, real estate agents and construction lenders, professionals turn to technology and, in some cases, ask consumers to pitch in.

Mortgage technology efforts have historically been behind the curve, but some recent responses to the coronavirus highlight instances where it rises to the occasion.

Mortgage industry technology providers are adjusting their processes to allow for originations to keep flowing through the system as the nation combats the coronavirus.

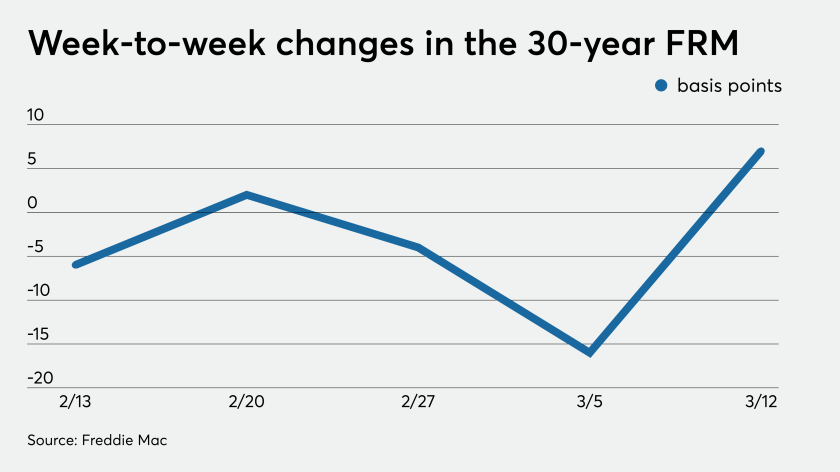

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

Fears stemming from the coronavirus have resulted in lower mortgage rates and more business for now, but if the situation deteriorates further, consumers could decide to put off buying a home.