Treasury Secretary Steven Mnuchin reiterated Thursday that he wants U.S. financial markets to remain open even as the coronavirus fuels wild volatility, while adding that he's focused on helping mortgage firms expected to be hit hard by the pandemic’s spreading economic pain.

Detroit-based mortgage giant Quicken Loans could be facing a cash crunch in coming weeks and possibly need temporary emergency federal assistance if lots of borrowers stop making payments on their home mortgages during the coronavirus pandemic, according to a news report.

Mortgage companies that borrow heavily to keep their operations running may face financial pressure from coronavirus-related market volatility as it affects the valuations of collateral securing their financing.

Mortgage lenders could benefit from the surge in refinancing due to widening market spreads, and that could help offset damage to servicing rights portfolio valuations, according to Keefe, Bruyette & Woods.

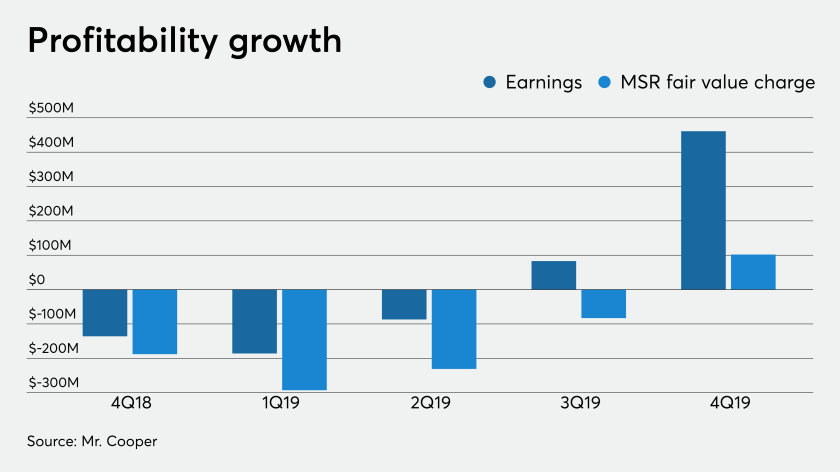

Mr. Cooper Group reported fourth-quarter net income of $461 million, aided by the recovery of its deferred tax asset and a positive mark-to-market on its servicing portfolio.