The alternative lending company Upgrade, led by LendingClub founder Renaud Laplanche, has rolled out a contactless card at a time when consumers and retail employees are doing all they can to avoid physical contact.

The card, which can be added to some popular mobile wallets, is meant to help customers avoid having to hand cards to cashiers or touch point-of-sale terminals that might have droplets of novel coronavirus droplets on them.

Laplanche's team at the 3-year-old company planned to get to these two projects eventually, but the pandemic moved up the timetable given the need. The World Health Organization has encouraged people to use digital payments as much as possible.

“We decided to accelerate the development, and the teams have been working close to 24/7 to get it done as quickly as possible,” Laplanche said.

Upgrade, which is based in San Francisco and has an operations center in Phoenix and technology centers in Chicago and Montreal, launched its credit card in October with partner Sutton Bank.

It is actually a hybrid between a credit card and a loan. Customers make purchases with the card on a website or in a store the way they would with a regular credit card. But instead of indefinitely making minimum monthly payments, they pick a time period of 12 to 60 months within which they repay the purchase in installments. They can pay off the entire balance at any time.

The product in some ways resembles the point-of-sale loans offered by fintech companies like Affirm, Afterpay, Klarna and Sezzle. But rather than issuing individual loans, the Upgrade card lumps all of a customer’s payments into one monthly sum.

Upgrade also offers personal loans from Cross River Bank, Pentagon Federal Credit Union and Blue Ridge Bank. It has extended about $2 billion of credit through these loans.

The Internal Revenue Service is temporarily allowing the use of digital e-signatures on some forms that can’t be filed electronically.

Even though everyone is using Zoom, it’s amazing how few people have actually spent time learning how to use it effectively. There’s no excuse for that.

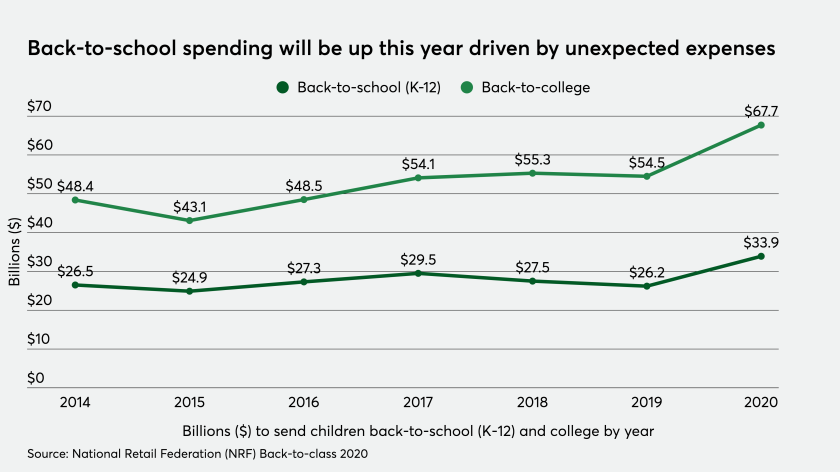

One thing that many parents are finding unusual this year is the amount of money being spent on school supplies during the coronavirus crisis — it’s actually going up.

The Upgrade card’s interest rate ranges from 6.49% to 29.99%, based on the risk profiles of customers. Affirm similarly charges 0% to 30%; Klarna charges 19.99%. Afterpay and Sezzle do not charge interest but assess fees for missed payments.

At the end of March, Upgrade cardholders had received $500 million in credit.

For people who pay off their credit card bill every month, Upgrade does not offer much advantage. Users tend to be people who buy expensive items and carry balances.

“Last quarter we saw a lot of home furniture, electronics, small home-renovation projects, the type of thing that might cost several thousand dollars,” Laplanche said.

Being required to pay back the debt within a certain period of time can help people avoid some interest.

The contactless card Upgrade is issuing this week, like any contactless card, has near-field communication technology built in that can reach a device up to four centimeters away. So the user can wave it over a store terminal or subway turnstile rather than swipe or insert the card, which saves the cardholder from having to touch a machine that others might have contaminated. The cardholder never has to hand the card to a cashier and risk virus transmission.

Upgrade has also received approval from Apple and Google to include its card in their mobile wallets. As a result, users can now buy things by opening Apple Pay or Google Pay and waving their phone over a payment terminal, or tapping those options on a website.

Upgrade has a mainstream customer base. The average customer is 42 years old and has a credit score of just over 700. The average income is around $90,000.

This quarter, two things have changed about the way Upgrade cardholders use the card. For one, they are using it more on online, less in stores. Where previously about 30% of transactions were online, now more than 50% are.

The other change is people are buying a lot of home office equipment like printers and scanners.

“You could see people getting ready to work from home,” Laplanche said.