Four of the five largest banks in the U.S. have agreed to let California residents skip mortgage payments for 90 days if they have lost their jobs or are struggling financially due to the coronavirus pandemic, Gov. Gavin Newsom said Wednesday.

JPMorgan Chase, Wells Fargo, Citigroup and U.S. Bancorp, along with about 200 state-chartered banks and credit unions, voluntarily agreed to waive mortgage payments for California residents who are having trouble paying bills because of the COVID-19 outbreak, Newsom said. Bank of America has also agreed to waive payments, but only for 30 days, Newsom said.

The banks and the credit unions also agreed to a 60-day moratorium on foreclosures.

“It is significant that we have some consistency, that we don’t have a patchwork one bank to another,” Newsom, a Democrat, said at a press conference. “We wanted to engage our nation’s largest banks and see if we could create some continuity, some consistency across their ranks.”

Newsom also said that he was still in conversations with those financial institutions to secure similar relief on ATM fees and overdraft charges and expects to make an announcement about that soon. He added that the credit scores of borrowers who apply for mortgage relief will not be negatively affected.

The announcement is the latest move by a state governor to secure relief on mortgage payments for borrowers who are financially impacted by the ongoing pandemic.

On Tuesday, New York’s Department of Financial Services issued an emergency regulation requiring state-chartered banks and credit unions to offer struggling New Yorkers similar relief on mortgage payments, ATM fees and credit card late payment fees. Democratic Gov. Andrew Cuomo issued an executive order on Saturday allowing the state’s Department of Financial Services to take action.

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

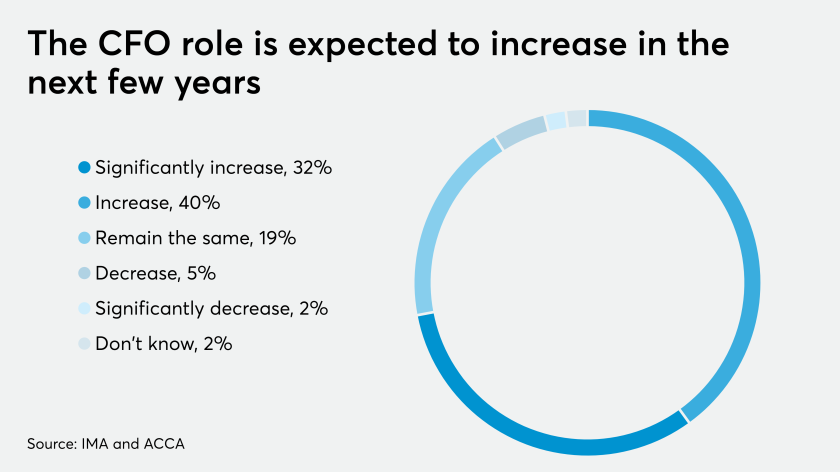

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

In an email to American Banker, a spokeswoman for JPMorgan Chase said, “We support Governor Newsom in his calls for financial institutions to offer customer relief during this extraordinarily challenging time. In fact, we have already been providing relief to customers across the country who have said they’re struggling financially due to coronavirus — just as we’ve done before during hurricanes, wildfires, government shutdowns, or other moments that cause economic stress for our customers.”

In making the announcement, Newsom acknowledged that the state of California does not have regulatory oversight of the four big banks that agreed to 90-day mortgage waivers — all have national charters — but praised those banks for “their sensitivity to their customers.”

Of Bank of America, he said, “I hope they will reconsider and join those other banks that are willing to do the right thing by at least extending that commitment to their customers for 90 days.”

In an email to American Banker, Bank of America said it is allowing customers nationwide, not just in California, to defer mortgage payments on a monthly basis “until the crisis is over.” A spokesperson said that means payments could be waived for 90 days or even longer, depending on how long the crisis lasts.

Bank of America said it has also agreed to pause all foreclosures, evictions and repossessions.

This story has been updated to include comments from Bank of America. Allissa Kline contributed to this story.