BOK Financial in Tulsa, Okla., says it has found a growth opportunity in the chaotic senior housing market, as investors are offloading these suddenly risky facilities.

The company reported $2.5 billion in senior housing loans in the third quarter, up about 4%, or $100 million, from the previous three months. The increase came at a time when senior homes became hot spots for the spread of COVID-19 and many facilities were shuttered.

Real estate investment trusts that have been buying up these facilities in bulk as a bet on the needs of an aging U.S. population suddenly became sellers, and BOK has stepped in to finance the deals, Stacy Kymes, executive vice president of corporate banking at BOK, told analysts Wednesday.

“What we’ve seen in growth in the near term has been some of the large REITS that have struggled may divest of certain property sets,” Kymes said. “So, we have some clients who are the operators of those properties, and maybe they sold it to the REIT many years ago, they continue to operate them, they know the health dynamics of that facility, so they’re very comfortable purchasing that facility out of the REIT.”

Private buyers of senior housing facilities have taken up 58% of all transactions in 2020, up from 45% last year and less than one-third of the market in 2016, according to data from the real estate firm CBRE.

BOK got a boost to its health care unit, which covers senior housing loans, from its 2018 acquisition of CoBiz Financial in Denver. Kymes said that team has continued to exceed expectations in a tough year for commercial lending.

But the move to expand senior housing loans comes with risk, especially as new cases of COVID-19 are picking up in the U.S. Moody’s Investors Service warned back in April that senior housing occupancy was declining over health concerns and that costs to operators were going up.

"U.S. health care REITs will feel the effects of the coronavirus outbreak most acutely in their senior housing operating portfolios, with safety concerns already lowering the number of move-ins and raising staffing and supply costs," Moody’s Senior Credit Officer Lori Marks said in a report at the time.

President-elect Joe Biden will seek a deal with Republicans on another round of COVID-19 relief, rather than attempting to ram a package through without their support, according to two people familiar with the matter.

The work-from-home phenomenon has triggered a fresh frustration for U.S. corporations: Americans are blowing the whistle on their employers like never before.

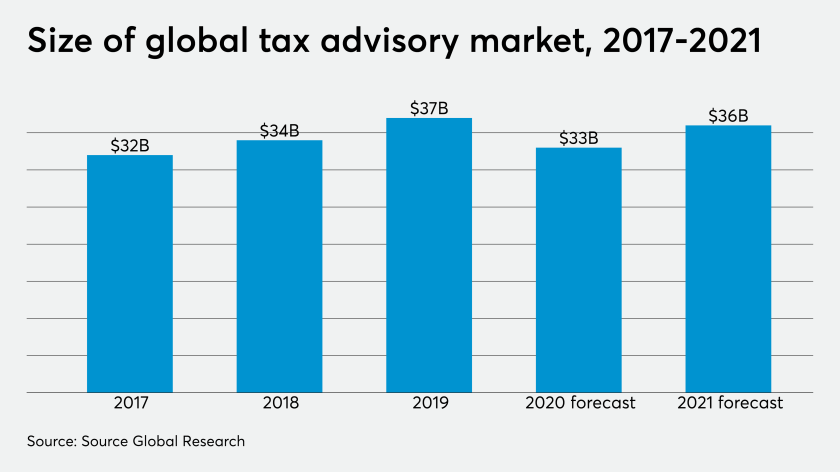

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

One of the largest senior housing REITs, Welltower, reported a 24.5% year-over-year decline in net operating income from its facilities in the second quarter. The firm had to offload two large portfolios of senior housing properties this year, totaling $1.3 billion.

“The toll from COVID on our business has been and will continue to be pronounced,” Welltower CEO Tom DeRosa said on an August call with analysts.

Financing loans for buyers on the other side of those deals could be a needed spark for loan growth at BOK. The $46 billion-asset company reported $154 million in net income for the third quarter, but while that was more than double the profits from three months prior, fees made up nearly half of all revenue.

BOK’s net interest income declined 2.6% from a year earlier, to $271 million in the third quarter, according to financial results it released Wednesday. Its period-end loans of $23.8 billion fell 1.5% from the second quarter.

The company’s bread-and-butter energy business reported that lending deals remain difficult to find as borrowers are continuing to pay down debt, leaving niche markets like health care to try to pick up the slack.

Financing acquisitions now could lead to more business with nursing home buyers later, BOK said.

Senior housing "created some opportunities for growth from us with existing clients with existing properties that they operate,” Kymes said. “Once we get through the pandemic that will continue to be a strong growth opportunity for growth for us.”