The Consumer Financial Protection Bureau and Federal Housing Finance Agency announced a plan to share mortgage servicing data as borrowers seek loan workout options during the coronavirus emergency.

The Borrower Protection Program initiative announced Wednesday enables the CFPB to share complaint information about servicers and analytical tools with the FHFA using a secure electronic interface. The FHFA will make loss mitigation data, related to loan forbearance and modifications, available to the CFPB.

CFPB Director Kathy Kraninger and FHFA Director Mark Calabria said the information-sharing program would help both agencies protect borrowers during the pandemic crisis. Yet the joint press release offered little detail on how the information shared between the two agencies would be used to protect borrowers.

“Through the partnership being announced today, the Bureau will share our insights with FHFA and ensure we get their data on how mortgage servicers are working with their customers during this critical time and going forward,” Kraninger said in the jointrelease. “Help for consumers is always here at the CFPB through our complaints process. In addition to working with your lender to get an answer for you, we analyze the information to better educate consumers, provide clear rules for financial institutions, and hold companies accountable.”

Calabria said "protecting and helping homeowners during this national crisis is my top priority."

"No one should be worried about losing their home,” he said. “Borrowers are entitled to accurate information about their forbearance options. This partnership with CFPB ensures FHFA can address misconceptions stemming from consumer complaints by working with Fannie and Freddie servicers.”

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

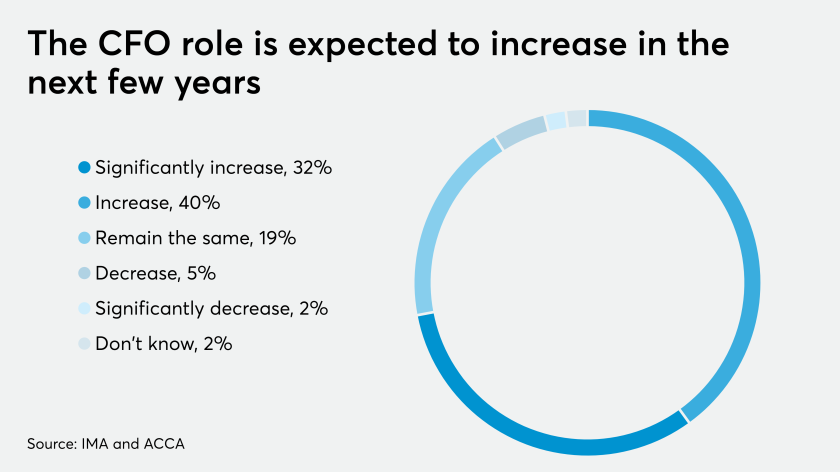

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

Both agencies have been criticized for their response to the pandemic.

Kraninger has been faulted for failing to provide more guidance to mortgage servicers, not restricting debt collectors from contacting consumers during the crisis and for allowing voluntary reporting of pandemic-related hardships to the credit bureaus.

Meanwhile, Calabria has been blamed for the lack of a government-backed liquidity plan to aid nonbank servicers.