Distressed consumers are bombarding the Consumer Financial Protection Bureau with complaints that mortgage servicers are refusing to provide deferrals for skipped payments, or are forcing homeowners into forbearance plans they didn’t ask for.

Complaints to the CFPB hit a record 42,774 in April, up 15% from March — the highest monthly tally since the complaint database was launched in 2011. Though most of them related to credit reporting and repair services, as is typically the case, more than one in five complaints mentioning the coronavirus were about mortgages.

Trends in complaints often are a harbinger of the bureau's future enforcement and supervisory actions. Many of the complaints indicate there is widespread confusion about the coronavirus relief law that gives borrowers with federally backed mortgages forbearance for 180 days and a further 180-day extension if needed.

Consumers alleged in complaints to the CFPB that servicers are not abiding by the law.

“They are attempting to scam people into terms that are not compliant with the CARES Act that was passed by the federal government,” wrote one borrower, referring to the Coronavirus Aid, Relief and Economic Security Act. “They are attempting to push loan modifications as well as threatening to report negative information to credit bureaus during a global pandemic.”

Some said that servicers have demanded they repay skipped payments in one lump sum once stay-at-home orders are lifted.

“I requested a forbearance on my mortgage due to my roommate losing her job due to COVID-19, but they only offered me one option — pay three months of deferred payments in a balloon payment,” wrote one homeowner. “I cannot pay a balloon payment and wish to have the missed payments attached to the end of the loan. I thought that is what the law says. Please help!”

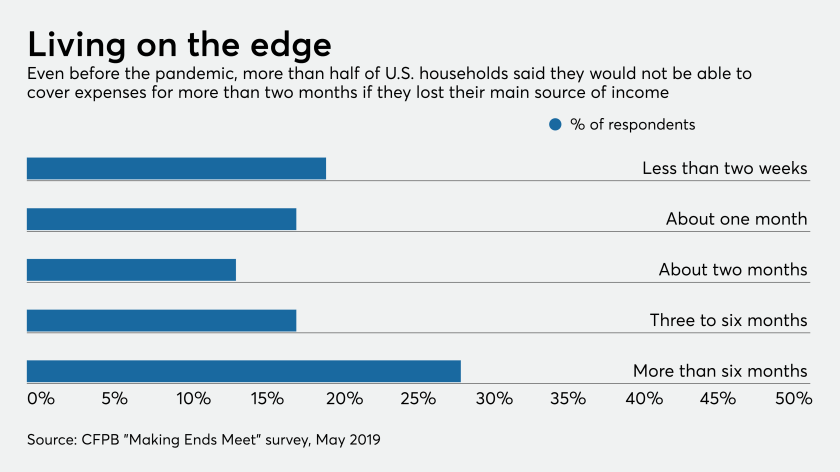

Even before the coronavirus led to massive job losses, many consumers were struggling to pay their mortgages. Roughly 52% of households said they would not be able to cover expenses for more than two months if they lost their main source of income, the CFPB found.

A majority of middle-market CFOs are predicting an economic recovery and revenue increases for their companies in 2021, according to a new survey by BDO USA.

Tax-refund delays and stimulus-payment hiccups could spill into the upcoming tax season as the Internal Revenue Service continues to face challenges related to the coronavirus pandemic and as Congress considers yet another round of direct payments.

With the filing season upon us, a raft of brand new challenges await ahead of the April 15 deadline.

As government officials, lawmakers and policymakers encourage struggling homeowners to request forbearances, there remains a big gap in the relief provided. Roughly 30% of home loans are not backed by government agencies such as Fannie Mae, Freddie Mac, the Federal Housing Administration and a few smaller agencies.

Borrowers may be unaware that the relief bill does not apply to private-label loans that are pooled into residential mortgage-backed securities. In some cases, the documents governing private-label loans may not allow for forbearances or may depend on whether an investor chooses to provide it.

“We are seeing some people being helped if their loans are government-backed, but 30% of loans are not, and that is a huge amount,” said Kathleen Engel, a research professor at Suffolk University Law School and former member of the CFPB’s consumer advisory board. “The fallout of having even a portion of the 30% of loans defaulting and going into foreclosure could result in a housing market collapse and even more demand on rental housing.”

Mortgage servicers often are third parties that collect principal, interest, taxes and insurance payments from borrowers and pass those payment on to investors for a fee. Servicers of private-label, nonagency loans could face increased scrutiny if they do not provide forbearance relief on similar terms as government-backed mortgages, according to mortgage experts at the Milken Institute.

Those experts — Ted Tozer, a former president of Ginnie Mae, Michael Stegman, a former housing policy adviser in the Obama administration, and Eric Kaplan, a former managing partner at Ranieri Strategies — are calling for private-label investors to provide forbearance relief.

"Failure of the industry to meet the challenge at this moment of greatest need might just be enough for regulators and policymakers to decide that [private-label securities are] not ready to reassume a meaningful role in the future housing finance system," the experts said in a recent report.

A portion of private-label loans also are held in portfolio by the largest banks.

Yet banks are receiving high marks for responding quickly to the pandemic by allowing borrowers to request forbearance with just a few clicks on their websites. Moreover, banks generally are abiding by the relief bill in allowing borrowers to defer payments by moving them to the end of the loan or extending a loan’s term. The borrower is not considered delinquent and is not expected to pay back the deferred payments on a repayment plan.

One servicer that came under frequent attack by a number of consumers is Freedom Mortgage, a large nonbank servicer in Mount Laurel, N.J. Some homeowners complained that Freedom and other servicers put them in forbearance plans they never requested.

“I was not late nor delinquent in my mortgage payments,” wrote one homeowner in a CFPB complaint. “I stated I did NOT want to be on a forbearance plan. I received a letter from Freedom Mortgage stating I was approved for a 3 months forbearance plan, and while on this plan my property would be subjected to one or more inspections, any payment I sent would be held in a suspense account and applied only after all fees related to the forbearance plan had been settled.”

Freedom CEO Stan Middleman said there have been a lot of misunderstandings about mortgage payment options.

“These are difficult times, and while forbearance can be helpful to many, when the forbearance period ends, the missed payments must be repaid,” Middleman said. “There are a variety of ways to address the missed payments, and the options vary depending on the type of government-backed loan the customer received. We are doing our best to educate customers to understand the various government requirements and rules and the various options they may have to address any missed payment.”

When a consumer submits a complaint to the CFPB, the bureau forwards the complaint to the company, which has 15 days to acknowledge the complaint and up to 60 days to respond.

Studies also show that not all servicers are providing readily accessible information about forbearance.

Many servicers’ websites provided “incomplete, inconsistent, dated, and unclear guidance to borrowers related to their forbearance options,” according to an April study by the Department of Housing and Urban Development’s Office of Inspector General, which reviewed 30 top servicers’ websites.

Ruhi Maker, a senior staff attorney at the Empire Justice Center, who has spent 20 years helping borrowers facing foreclosure, said mortgage servicers need to provide loss-mitigation options to borrowers who already have loan modifications and face further stress from reduced income or job losses.

“The CFPB needs to make sure that mortgage servicers are putting people into forbearance regardless of whether they were already in loan mods,” Maker said. “If a borrower has additional loss or reduction in income, they need to be remodified by the servicer.”

Some advocates praised CFPB Director Kathy Kraninger for posting information on the CFPB’s website that explains what options are available for borrowers. Kraninger shared details of consumer complaints related to the coronavirus pandemic at a joint advisory board meeting on May 1.

“I think the CFPB has been doing a decent job putting things on the website about people’s options, but not enough people go to the CFPB for information,” Engel said. “I would love to see the CFPB buying announcement time on Netflix and Amazon Prime Video where they reach people who don’t know what their rights are and don’t have access to the information they need.”

Roughly 3.8 million homeowners are now in forbearance plans, which means servicers cannot charge borrowers additional fees, penalties or interest. Though new requests for forbearances have slowed, the Mortgage Bankers Association has been sounding the alarm about the impact of so many borrowers being unable to pay their mortgages.

“The housing market is in uncharted waters right now,” said Joel Kan, an associate vice president of economic and industry forecasting at the association. “The early impact of this deterioration on the mortgage market has already been felt by rapidly increasing rates of loans in forbearance.”