Pressure is building on the Consumer Financial Protection Bureau to take more aggressive steps to directly benefit consumers who are hurting financially from the COVID-19 pandemic.

The bureau has joined other regulators in encouraging financial institutions to work with struggling borrowers and other consumers with financial services needs, but critics say the agency's response has been tepid at best.

They point to the lack of specific guidance protecting consumers in the mortgage servicing process, restricting debt collectors from contacting consumers during the crisis, or requiring credit reporting agencies to factor in pandemic-related hardships on credit reports.

“In this time of national emergency, the CFPB needs to be thinking hard about what consumers need right now,” said Diane Thompson, of counsel at the National Consumer Law Center and a former CFPB deputy assistant director of regulations.

Industry lawyers are also speaking up, saying mortgage servicers need better direction from the agency on how to deal with the flood of incoming calls from borrowers with forbearance requests and on how servicers can prepare for a potential wave of defaults.

Attorneys representing financial firms said they are reviewing prior CFPB alerts on how to respond to consumers during natural disasters like hurricanes and trying to cobble together guidance for servicing during the pandemic. It also is increasingly likely the bureau will extend beyond next year an exemption from the Qualified Mortgage rule for loans backed by Fannie Mae and Freddie Mac.

But industry representatives say they need more concrete guidance.

"It's somewhat frustrating," said one lawyer who did not want to be identified. "It would be nice if the CFPB provided some better advice on the institutions' responsibilities given their need to reduce head count in servicing call centers."

Some observers suggest the agency's focus to date has been mostly on relaxing regulatory requirements on the margins while not deviating from a schedule of finalizing rules that are part of the CFPB's broader deregulatory agenda.

“They haven’t indicated any willingness to significantly slow down rulemaking,” Thompson said.

The agency's most immediate agenda item is finishing its payday lending rule — which rescinds underwriting requirements imposed by former Obama-appointed CFPB Director Richard Cordray — by an April deadline.

“They have a limited time to get [the payday rule] done and they really can’t wait too long,” said Alan Kaplinsky, a partner at Ballard Spahr. “I don’t think they are going to put anything off because of COVID-19.”

The bureau is still on track to finish that rule and is also expected to issue a separate rulemaking reexamining the so-called payment provision that seeks to limit how often a lender can access a consumer’s checking account, sources familiar with the matter said.

"I don’t think anything is on hold,” Kaplinsky said.

In her public remarks, CFPB Director Kathy Kraninger has referred to the COVID-19 pandemic as a public health crisis with financial repercussions.

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

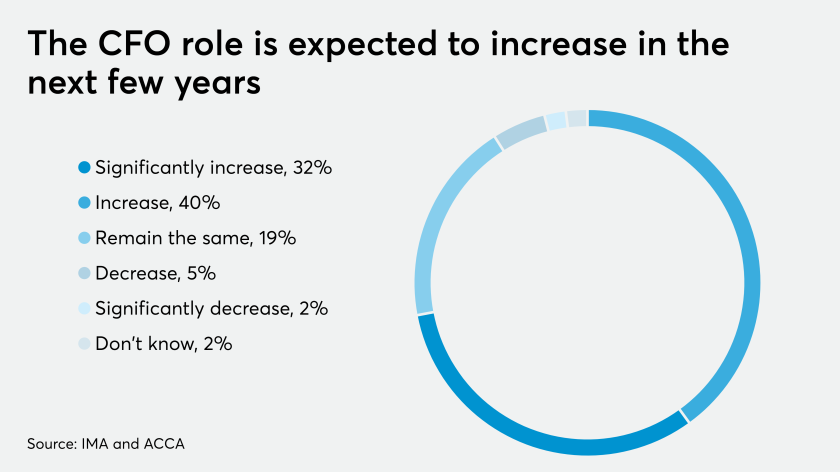

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

"I recommend that consumers who may be facing financial difficulty contact their financial institutions to discuss their specific circumstances," Kraninger said in remarks last week at a meeting of the Financial Stability Oversight Council. "As a backstop, the CFPB stands ready to help consumers resolve issues with their financial services providers through our consumer complaint system."

The agency has issued statements along with the Federal Reserve, Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency encouraging all banks and financial firms to help borrowers and customers. That includes a statement last week urging banks and credit unions to consider offering small-dollar loans.

The agency's most specific public action to date in response to the coronavirus outbreak is giving financial firms some relief from upcoming reporting requirements. The CFPB is postponing quarterly reporting under the Home Mortgage Disclosure Act, which helps identify discrimination in mortgage lending. The CFPB also has temporarily suspended some reporting for credit card and prepaid accounts under the Truth in Lending Act and other regulations.

In the coming weeks, Kraninger is expected to further loosen some disclosure and timing requirements for mortgage servicers and provide guidance on credit reporting in response to industry demands, sources familiar with her thinking said.

But consumer dvocates say a reprieve from some reporting requirements undermines the transparency and reliability of consumer data at a time when the CFPB needs data more than ever.

"Letting the information in the prepaid accounts database get stale is especially troublesome as people who do not have bank accounts may be looking for options to be able to get money electronically and the database provides transparency into that market," said Lauren Saunders, an associate director at the National Consumer Law Center. "Halting reporting also gives potential room to increase fees in less transparent ways."

The CFPB launched a dedicated page for COVID-19 resources but advocates say it contains mostly reissued blog posts on steps consumers can take if they are targeted by a scammer or cannot pay their bills. On Friday, the bureau issued a request for information on a task force charged with updating consumer credit laws that some said was yet another indication that Kraninger is moving forward with a deregulatory agenda unheeded by the crisis.

"We're not seeing anything affirmative coming out of the CFPB," said Saunders. "We're not seeing any particular attention paid to people struggling with debt. We're seeing the CFPB giving advice that consumers are on their own and should talk to their banks.”

By contrast, consumers will get some added protections under the $2 trillion stimulus package passed by lawmakers last week. The bill provides for up to 180 days of forbearance and prohibits foreclosures for 60 days for borrowers of federally-backed loans. Multifamily borrowers will receive 90 days forbearance. The legislation also states that approved loan modifications cannot result in negative information being added to a borrower's credit report.

Yet industry observers said it would still be helpful for the CFPB to provide guidance on the appropriate response to an expected spike in loan defaults.

“It will be hard for [servicers] to deal with an avalanche of defaults and foreclosures and debt collectors are going to be all the more aggressive and harassing because people will owe more debt and it will be harder for them to pay,” said Cordray, the former CFPB director.

Because of the massive disruptions to the mortgage market, the CFPB is expected to further extend the Qualified Mortgage rule that gave a special exemption to Fannie Mae and Freddie Mac known as the "QM patch," which expires in January 2021. Last year, the CFPB had planned to eliminate the patch and replace a 43% debt-to-income limit for QM loans.

In the past few weeks, Kraninger has been in discussions on how and when to further extend the patch to avoid further disruptions in the mortgage market, sources said.

Fitch Ratings gave a "negative" outlook last week on mortgage servicers, citing elevated loan delinquencies, higher staffing costs, and increasing requirements to advance principal and interest on behalf of defaulted borrowers.

Fitch said such stresses “increase systemic risk across the mortgage servicing spectrum.” Since the mortgage crisis, banks have relied on nonbank servicers to handle delinquent loans.

Some advocates suggest the CFPB should be doing more to aid consumers by providing guidance on servicing requirements, including establishing a single point of contact.

Mortgage delinquency rates are expected to jump to 25%, Thompson said, voicing concerns that borrowers will be forced into foreclosure in the absence of tougher forbearance rules.

“There are going to be people who do not get a forbearance, who don’t know how to ask for it or they can’t get through to their servicer,” said Thompson. "This will hit bigger and faster and they will have fewer resources to deal with a bigger, sharper shock."

Thompson said a policy announced last week by Ginnie Mae to help mortgage services advance principal and interest appears focused on providing relief to bond holders.

She said servicers need to extend forbearance for up to six months, remove duplicative applications so borrowers can reapply for loss mitigation, and clarify what is a reasonable time frame for completing applications.

“Why are we privileging bond investors over homeowners who are out of jobs?” said Thompson. “I don’t think the bond holders are going to end up homeless on the street.”