Banks seem to have held credit losses in check in the third quarter, but experts say it's far too early for them to declare victory given the stubbornness of the coronavirus pandemic.

Some companies, including Zions Bancorp. and Synovus Financial, reported an increase in net charge-offs from the second to the third quarters and identified potential weak spots, such as retail and hospitality. Others, like Comerica and Regions Financial, actually saw credit losses decline.

But none of those lenders — which reported quarterly results this week — had a charge-off ratio of higher than 0.80%. The means they are still in pretty safe territory, according to Chris Marinac, director of research at Janney Montgomery Scott.

“We’re seeing some write-offs now — we’re definitely not seeing all write-offs," Marinac said. "The anticipation is that there still is going to be a healthy amount of charge-offs that occur in the fourth quarter, first quarter, second quarter next year. That’s the bad news.”

But the good news, he said, is that "banks have reserved for it in advance, and while they’ll probably keep building reserves, it certainly feels like the pace is going to be slower.”

Indeed, banks continued to strengthen reserves in the third quarter and cautioned that they still anticipate at least some further credit deterioration in the quarters ahead.

Regions, in Birmingham, Ala., charged off $113 million in the third quarter, compared with $182 million in the second, bringing net charge-offs down to 0.50% of total loans from 0.80%. The improvement stemmed from the fact that the company had charged off energy credits in the second quarter that had problems predating the COVID-19 outbreak. The $145 billion-asset company set aside $113 million for credit losses, compared with a provision of $882 million in the prior quarter.

Chief Financial Officer David Turner said Regions still needs those loan-loss reserves, warning that consumers could be particularly vulnerable in quarters to come.

“The consumer’s had a lot of stimulus to support them,” he said in an interview after Regions released its quarterly results Tuesday. “There’s a risk that losses increase on the consumer in ‘21. That didn’t happen this quarter. Consumers even got better in the third quarter. That was a piece of our improvement.”

The Institute of Internal Auditors is giving corporate America only a modestly better grade on governance in 2020 compared to 2019, and any improvement is probably due to the coronavirus pandemic.

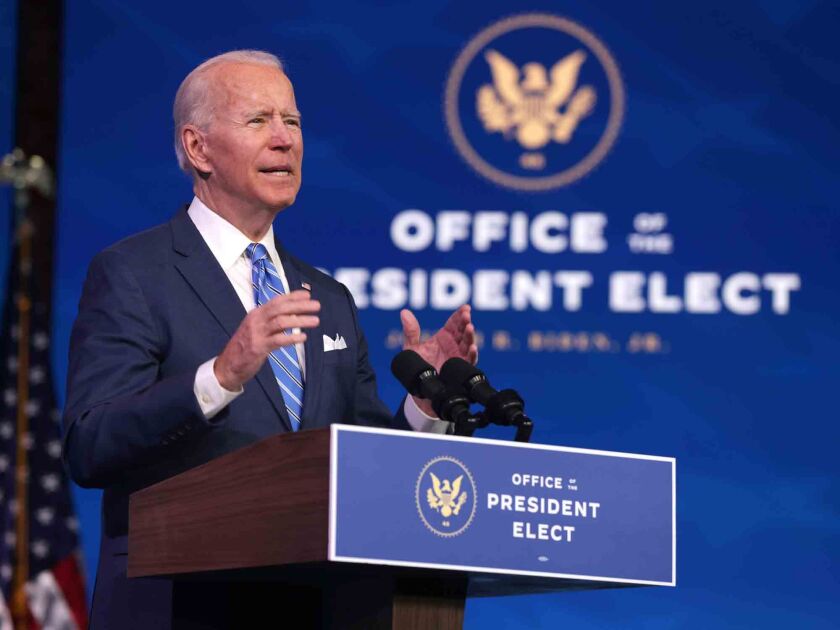

President-elect Joe Biden’s $1.9 trillion COVID-19 relief plan is designed to both pump money into the economy and contain the coronavirus pandemic.

President-elect Joe Biden’s $1.9 trillion economic relief proposal serves as the opening salvo in a legislative battle that could be prolonged by the go-big price tag and the inclusion of initiatives opposed by many Republicans.

Zions, which is based in Salt Lake City, charged off $52 million in loans and leases during the third quarter, compared with $31 million in the second quarter. Executives attributed the rise in net charge-offs mainly to the energy and retail sectors.

The $75 billion-asset company scaled back its loan-loss provision to $55 million from $168 million in the prior quarter. On a conference call Monday, executives said they expect charge-offs to peak next year, but they declined to say when the company may be able to release any reserves.

The $84 billion-asset Comerica, of Dallas, said charge-offs dipped from $57 million in the second quarter to $33 million in the third quarter. Executives identified energy lending as their biggest concern and said oil prices need to rise in order to see any real recovery in that sector.

Synovus executives said during a conference call Tuesday that they feel as though the $665 million loan-loss allowance at Sept. 30 should be sufficient to help ride out any credit issues. The $53 billion-asset company recorded a $43.4 million provision in the third quarter.

Hotel loans remain a concern, accounting for more than 80% of the $731 million in balances Synovus reclassified as criticized in the third quarter. The move reflects a sharp decline in revenue for those borrowers — about 8% of the hotel book was in deferral on Sept. 30 — but executives said they were hopeful that low loan-to-value ratios and strong debt service would limit charge-offs.

Net charge-offs rose by 18% from a quarter earlier to $28.5 million.

Executives said during the call that overall charge-offs could increase at a faster rate during the first or second quarter of 2021, though factors such as additional federal stimulus and the availability of a COVID-19 vaccine could have an impact.

Citizens Financial Group in Providence, R.I., saw net charge-offs rise to $219 million from $147 million, largely driven by two credits to mall real estate investment trusts. Executives said they expect charge-offs to remain relatively stable in the quarters to come, and the $180 billion-asset Citizens could start releasing reserves as soon as the fourth quarter.

Banks’ charge-offs and provisions reported in the third quarter largely reflect widespread reopenings and lifting of lockdowns that began in June, said David Russell, vice president of market intelligence at the online brokerage firm TradeStation.

Russell said he’s particularly concerned about evictions, as protections for renters begin to sunset. A wave of evictions could ultimately have devastating impacts for commercial real estate, retail and even state and municipal governments, and that could eventually show up on banks’ balance sheets.

“At a certain point in time, this question of people who have lost their jobs, who can’t pay the rent — in one way or another that has to come to a head,” he said. “That, to me, is the broad and systemic risk.”

Allissa Kline, Jon Prior and Paul Davis contributed to this article.