With the catastrophic circumstances of the COVID-19 pandemic, necessity acts as the mother of invention in the mortgage industry. As the world practices social distancing to counteract spreading the virus further, it forces lenders to move as close as possible to an all-digital model, as quickly as possible.

Performing remote online notarizations stands as a major part of that model. On March 18, Sens. Kevin Cramer, R-N.D., and Mark Warner, D-Va., introduced the Securing and Enabling Commerce Using Remote and Electronic Notarization Act of 2020, permitting the immediate use of remote online notarization across the U.S.

"Americans shouldn't have to risk their health or safety to execute important financial or legal documents, especially when they could do so from the safety of their own home," Cramer said after the bill was announced. "The SECURE Notarization Act brings the notary process into the 21st century, allowing people to securely complete documents while still following recommended health and social practices amid the coronavirus pandemic."

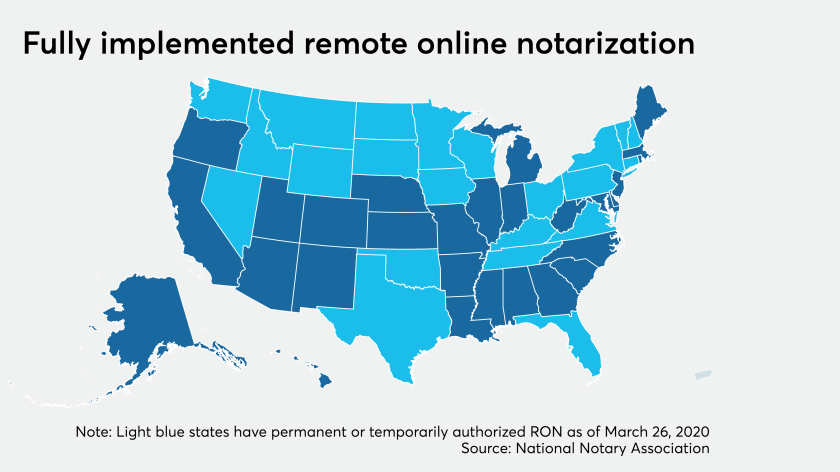

Before the act, remote notarization ability varied by state. Only 13 states — Florida, Idaho, Kentucky, Minnesota, Montana, Nevada, Ohio, Oklahoma, North Dakota, South Dakota, Tennessee, Texas and Virginia — had fully implemented RON laws, according to the National Notary Association. As of March 26, an additional nine — Connecticut, Iowa, New Hampshire, New York, Pennsylvania, Vermont, Washington, Wisconsin and Wyoming — put temporary authorizations in place.

President-elect Joe Biden will seek a deal with Republicans on another round of COVID-19 relief, rather than attempting to ram a package through without their support, according to two people familiar with the matter.

The work-from-home phenomenon has triggered a fresh frustration for U.S. corporations: Americans are blowing the whistle on their employers like never before.

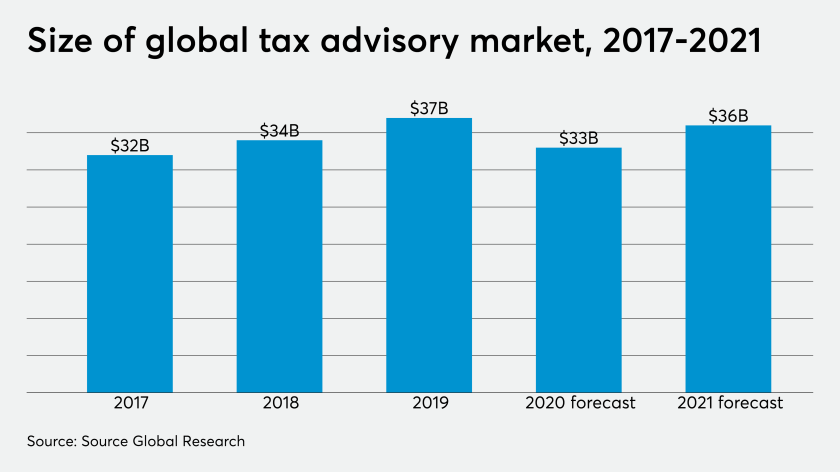

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

Infamous for lagging technologically, the current times puts a spotlight on the mortgage industry to embrace remote systems. Those companies at the front of the digital curve have more of an advantage now than ever before. If borrowers can execute closings and verify their information completely electronically, lending business can carry on through the crisis and handle the increased activity of low interest rates.

"From a process standpoint, the industry's been talking about a digital verification tools for years. Those lenders that have adopted and that are adopting can certainly handle more volume than those that haven't," Andy Sheehan, president and chief operating officer of Finicity, said in an interview. "I can say with confidence that lenders who engage consumers digitally reduce their time to get through the loan process by using next generation solutions. They're able to take on more business faster because they can handle that business more efficiently."

To expedite the mass accessibility to digital notarizations and totally remote closings, lenders and tech vendors are coming together to keep the system moving. A recent example of this came when Evolve Mortgage Services teamed with Pavaso to enable a fully electronic eClosing that supports RON.

"The integrated solution delivers an online, paperless initial e-disclosure and e-closing experience that can be directly implemented by mortgage lenders and title agents," the press release said. "Or, it can be outsourced to an established relationship with a signing agency. The combined solution allows borrowers to electronically execute all of their mortgage loan documents from the safety and comfort of their homes. State-certified e-notaries can remotely acknowledge consumers' signatures via Pavaso's RON, and lenders can securely and confidently close their mortgage loans."