Bank bill-payment sites have become less relevant over the last decade as more people go to billers’ websites to pay directly or use billers' mobile apps — often at the last minute. But the COVID-19 pandemic could flip the script on the $4.6 trillion bill-payment sector.

Recent research from BillGO, whose API-based consumer bill payment platform is delivered through banks and fintechs, suggests consumers using scattered bill-payment methods are primed to centralize the task through modern, real-time solutions.

“Before COVID, consumers assembled their own systems for paying bills but now they've got more financial pressure and angst because they don't know if they have enough money to pay the same bills,” said Russ Chacon, BillGO’s senior vice president of product strategy.

It might be tough to sell a bank-centered bill-payment solution to consumers who recall the slow, clunky legacy bank bill-payment sites from 20 years ago.

The percentage of bills paid through banks’ sites has declined to 22% in 2020 from 38% in 2010, according to a new research report Aite Group conducted with BillGO.

Meanwhile, the percentage of bills consumers pay directly through billers’ own websites has increased over the same time period to 76% this year from 62% a decade ago, Aite said.

Those figures only underscore the problems consumers face in trying to wrangle their bills now, with more people working in the gig economy and living paycheck to paycheck, according to Mary Anne Keegan, BillGO’s chief marketing officer.

Timing has become a top priority for cash-strapped consumers, she said.

Democrats on the House Ways and Means Oversight Subcommittee want the agency to reverse the automated revocation of status for tens of thousands of nonprofits.

Banks have managed to steer around trouble spots in energy, hotel and mall-related credits. But fears of further deterioration, an eviction wave or more job losses are keeping lenders circumspect.

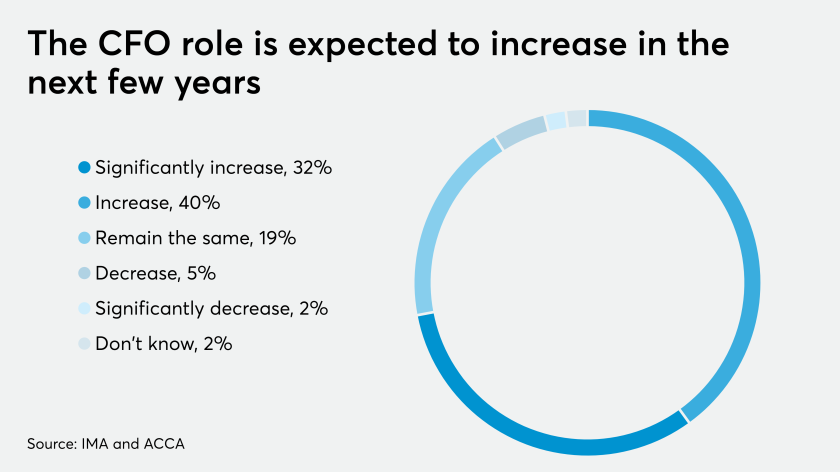

Finance executives are likely to hold onto their greater responsibilities once the pandemic subsides.

“When a consumer is looking to pay a bill — especially during the pandemic — they want confirmation when they hit ‘send’ that the money was received, which is not something you can get from most legacy bank bill pay sites,” Keegan said.

Fifty-six percent of all U.S. consumers have struggled to pay their bills since coronavirus hit because of unemployment and higher expenses, according to Aite’s survey of more than 3,000 consumers during the second quarter.

Bills most likely to go unpaid in the pandemic are student loans (34%), cable TV and internet (26%) and retail credit cards (21%), according to Aite. More than 40% of consumers also said they stopped making charitable donations during the pandemic.

BillGO, which launched five years ago in Fort Collins, Colo., provides a consumer dashboard displaying which bills are due, with options to pay from any payment instrument including a checking account, credit card or digital wallet, with assurance of clearing through BillGO with the adjusted bank account balance.

Huntington Bank is in the process of adopting BillGO’s solution, while two other undisclosed institutions have signed up to add BillGO to consumer online accounts, BillGO said. Last year Texas-based USAA invested an undisclosed amount in the firm.

"Our customers have made it clear they want a modernized bill pay solution," said Steve Steinour, chairman and CEO of Huntington Bank, which operates 920 offices in states surrounding its Columbus, Ohio, headquarters.

One of BillGO’s goals is to give consumers the same kind of payments control corporations have, said Russ Chacon, BillGO’s senior vice president of product strategy.

“Just like a corporation paying a supplier, BillGO lets consumers control the timing and best payment instrument to use for paying bills to maximize financial control or rewards, for whatever goals they have,” Chacon said.

Other providers have tried for years to improve banks’ bill-payment services, with mixed results.

BillGO already swallowed one such contender in 2018, when it purchased the bill payment app Prism. The Prism consumer experience is now integrated into BillGO’s bill pay platform.

Mastercard separately has been piloting Mastercard Bill Pay Exchange, an initiative to connect diverse participants in the bill payment ecosystem including Payrailz, Avidia Bank, ConEd and others.

BillGO doesn’t rule out partnering with Mastercard on Bill Pay Exchange, said Chacon.

“Mastercard Bill Pay Exchange is a messaging network and one of the services out there for real-time bill payments with confirmation that we’d love to see as part of the BillGO network someday,” Chacon said.

Among the 15.5 billion bills paid in the last year, about half, or 7 billion, traveled via ACH, Aite said. The other half were divided roughly equally among credit cards (2.6 billion), debit cards (2.5 billion) and checks (2.3 billion), according to Aite.

Early Warning Service has said its Zelle P2P app is driving a growing share of bill payments. But Zelle and Venmo don’t register in measurements of broad payment volume, according to Aite’s research director David Albertazzi, who conducted the study for BillGO.

“It’s still very early for P2P services to represent a significant portion of payments, though we are seeing a slight increase in usage in bill- pay categories such as charitable donations or rent payments,” Albertazzi said.

And bill payment isn’t a zero-sum game, he noted.

“The bill-payment pie is getting bigger, whether you look at biller- direct sites or bank bill pay,” Albertazzi said.