After wrapping up a much-delayed general obligation refunding that may have offered the first notable forward delivery since the COVID-19-driven market disruption in March, Wisconsin is teeing up a long-stalled taxable transportation revenue bond advance refunding.

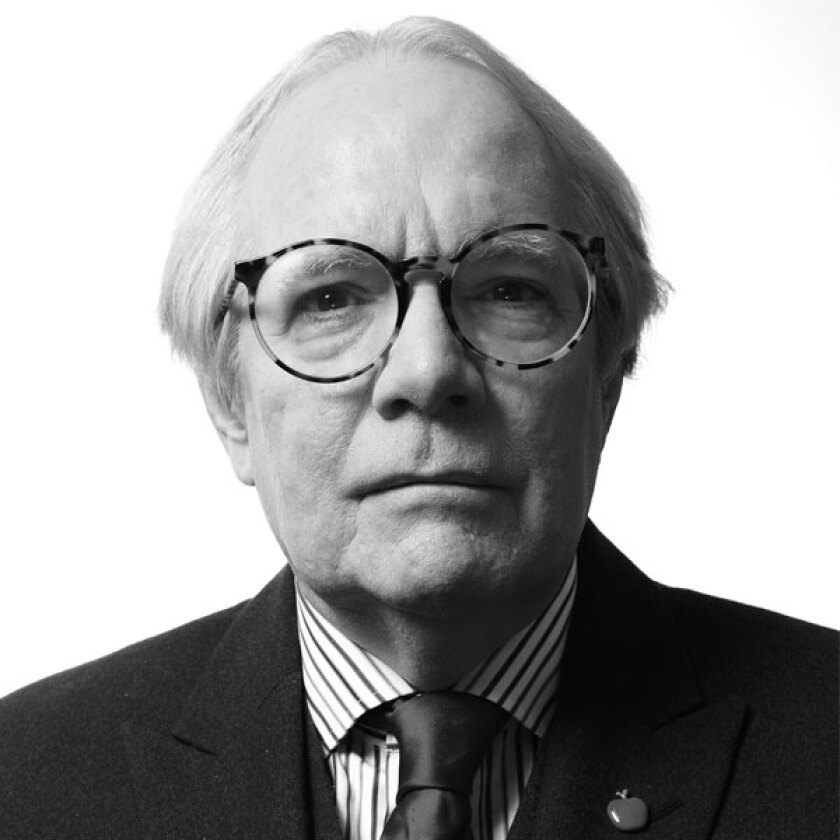

The forward delivery's success helps support market participants’ perceptions that the market has returned to a more “normal” state, albeit a fragile one, given the uncertain trajectory of the disease and its impact on market sectors, said Wisconsin Capital Finance Director Dave Erdman.

“We believe we ended up at or even better than pre-COVID-19” rates, Erdman said.

The state sold nearly $300 million including $164 million of taxable paper and $134 million of tax-exempt forward delivery bonds on Wednesday.

Rising jitters over the pandemic’s short- and longer-term economic impact — that rocked the market with record outflows in March driving rates up — had calmed enough to prompt the state to jump into the market in April with a top-rated $80 million new money state revolving deal. It returned early this month with a competitive new money $214 million GO sale.

But two advance refundings the state and its finance team had planned earlier in the year, based on strong taxable investor interest and attractive rates and spreads, remained on hold as spreads widened shrinking savings.

The delay gave the state time to reconsider the structure, with the GO candidates under consideration nearing a date where they could be forward delivered to meet a May 2021 call date. Erdman said a revised offering statement gave the state the option, but there was some hesitancy based on the lack of forward deliveries in the market amid concerns over the pandemic’s course.

“Pricing bonds out to a forward date? We weren’t sure about the investor reception,” Erdman said.

The state’s finance team made the decision to go ahead with the split structure the weekend ahead of the sale, given the market’s growing steadiness and where rates and spreads were, Erdman said. That steadiness was underscored by weeks-long inflows, the helping hand from the Federal Reserve with its money market and liquidity facility programs, and federal relief that’s helped sectors cope with COVID-19-related costs.

The steadiness is especially true for higher-grade credits, with market participants expressing more worries over a bifurcated market, so Wisconsin benefited on that front.

The state also wrestled with continuing to wait, given the possibility of congressional moves to restore advance refundings, but with rates low, spreads in check and looming uncertainty over federal elections and the pandemic’s course, Erdman said, the decision was to go ahead.

Erdman said spreads came in better than expected and the bonds were tightened by 10 basis points in repricing, as the deal was 10 times over-subscribed. That came after the original pricing was five bps tighter than the pre-marketing scale. The deal achieved more than 10% in present value savings.

“Forward deliveries are now back too. We are back to a market we had pre-COVID-19, but I think the muni market is a little fragile. We are not out of the pandemic’s shadow,” Erdman said. “One thing I think the market has learned from COVID is to be nimble.”

JPMorgan ran the books with Ramirez & Co. Inc. serving as co-senior manager. Acacia Financial Group Inc. advised the state. The GO issue was rated AA-plus by Kroll Bond Rating Agency, Aa1 by Moody’s Investors Service, and AA by S&P Global Ratings.

If the market remains on firm ground, the state anticipates selling its taxable $200 million transportation refunding issue in early to mid-July.

The Federal Reserve’s Main Street Lending Program is meant to be a lifeline for midsize businesses, but two weeks after its unveiling, those firms and their lenders remain on edge about what strings will be attached.

The president said he envisions infrastructure as “a big part” of the next round of emergency legislation.

The new federal COVID-19 relief package probably won’t be the last boost the U.S. economy will get, economists say.

Erdman said he’s watching closely for developments in Congress on advance refundings, so sale plans could change depending on developments there or if the market shifts. House Democrats’ pending infrastructure package, which includes a surface transportation bill, would reinstate tax-exempt advance refundings that were eliminated in the 2017 federal tax overhaul.

The transportation bonds carry AA-plus ratings from Fitch Ratings and S&P and a Aa2 from Moody’s. The state has about $1.7 billion outstanding.

"The rating reflects our assessment of the transportation revenue bonds, specifically a very strong statewide economic base of 5.8 million people generating the pledged revenues, our view that nationwide and Wisconsin registration fees and other registration-related program income have historically demonstrated very low volatility, and very strong maximum annual debt service coverage of 3.17x on the senior transportation bonds, using fiscal 2019 program revenue," said S&P analyst Carol Spain.

The bonds are secured by a first claim on vehicle registration fees and registration-related fees, including title transaction fees, registration and title counter service fees, and personalized license plate issuance and renewal fees.

Fitch said it expects declines in vehicle registrations due to coronavirus containment measures well in excess of a cyclical decline but that coverage can withstand a big hit. Under Fitch's assumption of a 34% annualized decline, the structure maintains satisfactory debt service coverage and revenues rebound. Pledged revenues totaled $707 million in fiscal 2019 providing 3.2 times MADs coverage for $222 million.