Employers were forced to make difficult decisions regarding compensation to protect their businesses and employees from the financial fallout of COVID-19.

Sixty-five percent of U.S. employees said their pay stayed the same or decreased in 2020, according to a report by Elements Global Services, an HR consulting firm. Employees who made less said they took a paycut rather than lose their job. More than half have not seen their pay return to pre-pandemic levels.

Seventy-three percent of employees say that finances are their top source of stress, according to the Employee Benefit Research Institute. Financial stress can lead to absenteeism, poor work performance and more serious mental health issues like anxiety and depression.

“Your employees are spending time during working hours on personal finances because they’re stressed,” says Mike Nannini, head of client management, business development and industry engagement at UBS. “Anything you can do to put their minds at ease and help them take control of their situation is going to boost productivity and morale.”

Read more: 5 companies tackling employee financial wellness

For employers, boosting pay might be the key to retaining a workforce eager for new job opportunities: 34% said they would consider leaving their current job for just a 10% raise, the Elements Global Services survey found.

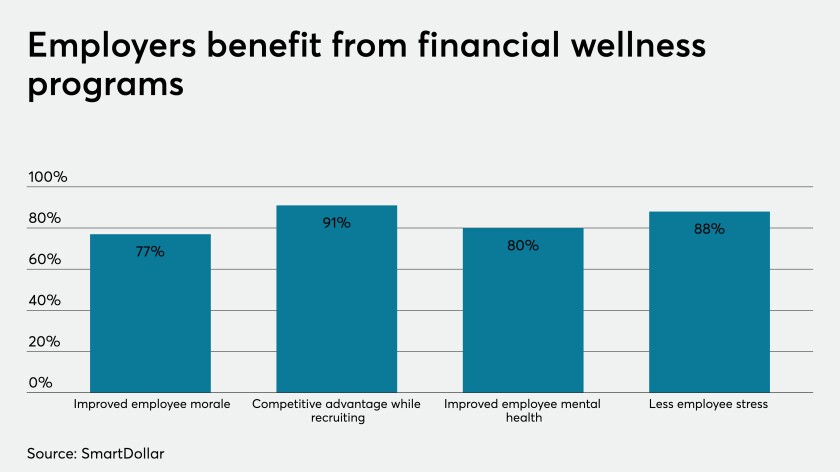

Employers need to consider offering more robust employee benefits and work perks if they want to attract and retain top talent. Benefits that address financial stress are the number one priority for employers looking to expand what they offer employees, according to SmartDollar, a financial wellness program.

“What’s more expensive for your business: the price of adding financial wellness to your benefits package or the price of a team that’s struggling with money?” says Brian Hamilton, senior vice president of SmartDollar. “When you can get positive results for both employees and the business, that’s return on investment.”

Read more: Employers fail without financial wellness benefits

Ninety percent of employers say that financial wellness benefits have positively impacted their workforce, SmartDollar found. Early wage access, financial education and student loan repayment have become popular ways to help employees get on solid financial ground.

With widespread vaccinations underway, employers and employees are optimistic about their financial future. Eighty percent of employees expect to make more or the same amount of money in 2021, according to the Elements Global Services survey. Almost half said any extra money they did make would go to savings.

As employers and employees continue to weather the fallout of the pandemic, financial wellness benefits can provide a solid foundation and keep employees motivated and engaged.

“When you provide a financial wellness benefit that actually works, your employees stop bringing their money baggage through your company’s front door,” Hamilton says. “Your employee benefits package just isn’t complete without financial wellness.”