As financial hardships mount with the COVID-19 outbreak, Fannie Mae and Freddie Mac released their plans for mortgage borrowers impacted by the pandemic.

Under the Federal Housing Finance Agency's guidance, both government-sponsored enterprises are suspending all foreclosures and evictions for at least 60 days until May 17 for the mortgages they back, effective immediately.

"We are doing all we can to help those adversely impacted by the coronavirus, including by immediately suspending foreclosure sales and evictions during this challenging time," Donna Corley, executive vice president and head of Freddie Mac's single-family business, said in a press release.

"These eviction and foreclosure stoppages are just one part of the comprehensive assistance we're providing borrowers to help protect our communities. We are also expanding relief available through our well-known forbearance programs, allowing us to reach the majority of affected borrowers as expeditiously as possible."

Additionally, those impacted are eligible to enter forbearance plans that can reduce or suspend their mortgage payments for up to 12 months. Assessments of penalties or late fees against borrowers will be waived, which also applies to homeowners already in forbearance. After the forbearance moratorium lifts, servicers need to reduce monthly payments as necessary or modify loans where needed. Finally, all credit bureau reporting of past due payments is suspended during this time.

Among the pandemic-related issues covered are how to handle the Paycheck Protection Program and other stimulus efforts.

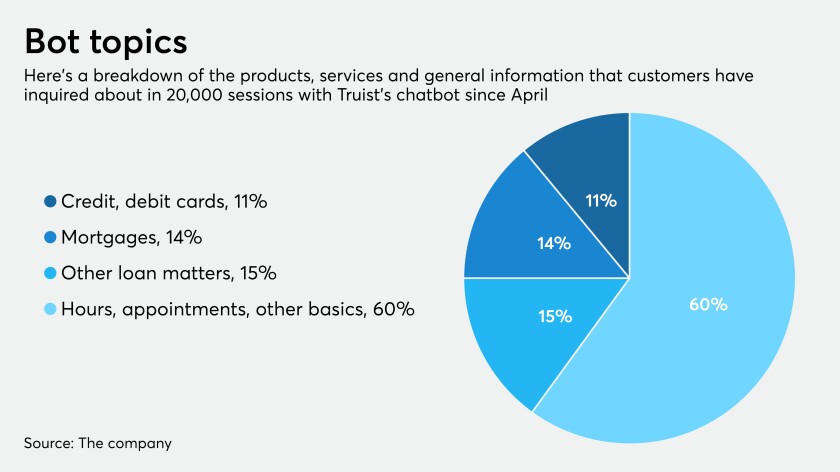

Built to respond to borrowers' questions about mortgage deferrals, the bot created by Salesforce is evolving and in the future could conduct transactions, handle a wide range of queries or help with emergencies.

A public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

"Our thoughts are with everyone who may be impacted by COVID-19 and we urge you to stay safe and well during these unprecedented times," Malloy Evans, senior vice president and single-family chief credit officer at Fannie Mae, said in a press release. "Fannie Mae, along with our lending and servicing partners, is committed to ensuring assistance is available to homeowners in need. We encourage residents whose employment or income are impacted by COVID-19 to seek available assistance as soon as possible."

Those affected by the national coronavirus emergency should request mortgage assistance by contacting their servicer.

The National Consumer Law Center praised the GSEs' plans to help homeowners remain in their homes and to protect their credit scores. However, more steps still need to be taken.

"We welcome these important first steps toward preventing homeowners from losing their homes during this pandemic, however the agencies should ensure that their policies provide accessible and fair procedures for payment relief," Alys Cohen, an attorney at NCLC, said in a press release.

"States also have a role and should also halt foreclosures and evictions. And the private-label mortgage market should follow with a moratorium and also ensure that homeowners are offered affordable payment options in the aftermath of the pandemic. Throughout this process, mortgage companies need to ensure access for homeowners whose primary language is not English."