WASHINGTON— The Federal Reserve said Thursday it will limit shareholder payouts by big banks and will also require them to reassess their long-term capital plans.

The actions are necessary in anticipation of more economic fallout from the coronavirus pandemic, the Fed said after it released the results of its annual stress tests.

The central bank will require big banks to suspend share repurchases during the third quarter of this year and limit dividend distributions to the levels banks paid out in the second quarter. Those dividend distributions could also be limited further, the Fed said, depending on each individual bank’s earnings results.

“For the first time in the ten years we have been doing stress testing, we are exercising the option that has always been in our capital framework of requiring all large banks to reassess their capital needs and resubmit their capital plans to the Federal Reserve later this year,” Fed Vice Chairman for Supervision Randal Quarles said in a statement. “If the circumstances warrant, we will not hesitate to take additional policy actions to support the U.S. economy and banking system.”

Many big banks had already halted share buybacks this spring. A handful of small and midsize banks reduced their dividends after COVID-19 was declared a global pandemic by the World Health Organization on March 11, but none of the larger banks have cut their payments. The investment firm Keefe, Bruyette & Woods issued a forecast in May that dividend payouts as a percentage of earnings among the largest banks would peak in the second quarter and then settle back in the latter half of the year.

The Fed took action after conducting “sensitivity analyses” of the 34 banks — each with more than $100 billion of assets — that it reviewed for capital adequacy as part of its annual stress tests.

In a departure from previous years, the Fed did not publish how individual firms fared under the Comprehensive Capital Analysis and Review, or CCAR, examinations, but instead disclosed how the biggest banks would perform under the typical “severely adverse” scenario as a whole, as well as how banks would react to the additional COVID-19-related analyses.

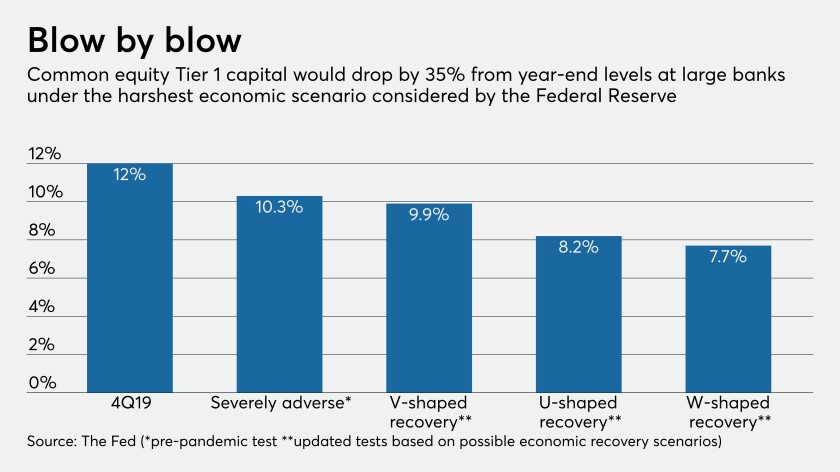

Those analyses tested banks against three hypothetical economic models of recovery from the pandemic: a “V-shaped” economic recovery, a “U-shaped” recovery and a “W-shaped” recovery. Each of those scenarios made different assumptions in unemployment rates, gross domestic product output and Treasury rates. Those were the only economic indicators, although they stressed some other elements of the bank data.

In aggregate, all 34 banks tested maintained the minimum capital requirements under each of the scenarios tested — although “several would approach minimum capital levels,” the Fed said in the statement.

The Fed found that aggregate capital ratios for the 34 banks as a whole declined from 12% in the fourth quarter of 2019 to between 9.5% and 7.7% under the hypothetical coronavirus-related scenarios it tested firms against.

Under the V-shaped scenario — which models a quick economic rebound — banks would stay “well above” their minimum capital requirements, but under the other two scenarios, several of the banks would come extremely close to the 4.5% minimum common equity Tier 1 capital requirement. The Fed declined to specify which banks approached that minimum or how many of the 34 tested fell below the aggregate average, but a senior Fed official said that roughly a quarter of the banks tested approached that minimum threshold under the most severe W-shaped recovery scenario.

The analyses did not factor in any additional government support — such as continued enhanced unemployment benefits — or planned capital distributions in their analysis. But the agency said in its statement that the results show “that firms have sufficient capital to withstand a short-lived deep recession.”

Despite not factoring in planned capital distributions in the sensitivity analyses, senior Fed officials said they did not believe banks continuing to pay dividends would push bank capital below the minimum common equity Tier 1 threshold, noting that most capital distributions come in the form of share repurchases, which the Fed is suspending, and that banks wouldn’t be allowed to increase their dividend payments.

But a second wave of the pandemic could delay economic recovery, and would have “significant negative effects on many banks’ capital levels,” the agency said.

Federal Reserve Gov. Lael Brainard said in a statement accompanying the release that while she agrees with the agency’s move to limit stock repurchases and dividend payouts, even more dramatic actions were likely warranted.

“This is a time for large banks to preserve capital, so they can be a source of strength in a robust recovery,” she said. “I do not support giving the green light for large banks to deplete capital, which raises the risk they will need to tighten credit or rebuild capital during the recovery.”

Freezing all large banks’ shareholder distributions would allow those banks to further retain capital against what may be more ominous macroeconomic fallout from the pandemic, Brainard said, and would do so in a uniform way.

“Temporarily halting shareholder payouts at large banks due to the COVID-19 shock would create a level playing field and allow all banks to preserve capital without suffering a competitive disadvantage relative to their peers,” Brainard said.

“Instead, the vote allows distributions to continue to be paid out, despite the material change in financial conditions.”

The information was published Thursday as part of the Fed’s annual Dodd-Frank Act stress tests and CCAR examinations, in which banks are required to submit data from their balance sheets as of the end of the fourth quarter. The Fed typically tests those balance sheets against baseline and severely adverse scenarios.

Usually, the results of the CCAR stress test determine how bank capital would fare in a sharp economic downturn and are used to dictate a firm’s planned capital distributions for the year.

But in light of the pandemic, the Fed said it would use the results of the sensitivity analyses to partly determine its stance on dividend payments. While some former regulators had called for the Fed to ban dividend payments and share repurchases entirely, the central bank is not going that far just yet, although could in the future depending on how COVID-19 evolves.

Leaders of the European Central Bank and the Bank of England’s Prudential Regulation Authority have already called on their member banks to suspend dividend payments because of the COVID pandemic and the need to retain capital. European banks pay out dividends once a year, while U.S. banks pay out dividends on a quarterly basis.

The Fed said banks will also need to resubmit their capital plans later this year to better respond to more current stresses on the economy, and the agency will conduct additional analyses each quarter in order to determine if firms’ updated plans are adequate.

While those sensitivity analyses were run based on the same data banks had to submit for the regular stress tests, the Fed changed some elements of that data in order to more closely resemble the current financial position of the industry, including stress on borrowers in certain sectors and increased pressure on commercial real estate.

But the sensitivity analyses will not affect a bank’s capital requirements for the upcoming year. Instead, banks will have to comply with a stress capital buffer requirement based on the Fed’s original stress tests.

That buffer, which was finalized in March independent of the pandemic to replace the capital conservation buffer, calculates a bank’s stress capital buffer as the difference between a bank’s starting and projected capital ratios under the “severely adverse” stress test scenario, and factors in a bank's common stock dividends as a percentage of risk-weighted assets.

The Fed did not publish the stress capital buffer requirements Thursday, to allow for banks to make changes to their original capital distribution plans. But banks will be able to disclose their stress capital buffer requirements and planned capital distributions on Monday after the market closes, if they choose to do so.

The Fed will then release the final capital plans before the stress capital buffer requirement is set to take effect in the fourth quarter.

In another break from precedent, the Fed released the results of its other stress test, the Dodd-Frank Act Stress Test, or DFAST, on the same day as the CCAR results.

DFAST and CCAR differ in one important respect, which is that while CCAR tests a bank’s balance sheet against a hypothetical severely adverse scenario with a bank’s own capital distribution plan, DFAST tests the balance sheet against a generic capital distribution plan. A bank’s performance in the DFAST examination also do not confer any penalties or restrictions, unlike CCAR.

The DFAST results did not include the sensitivity analysis from this year’s CCAR examination. But under the severely adverse scenario, banks’ aggregate minimum common equity Tier 1 capital ratio fell from 12% in the fourth quarter to a minimum of 9.9%, well above the required minimum.