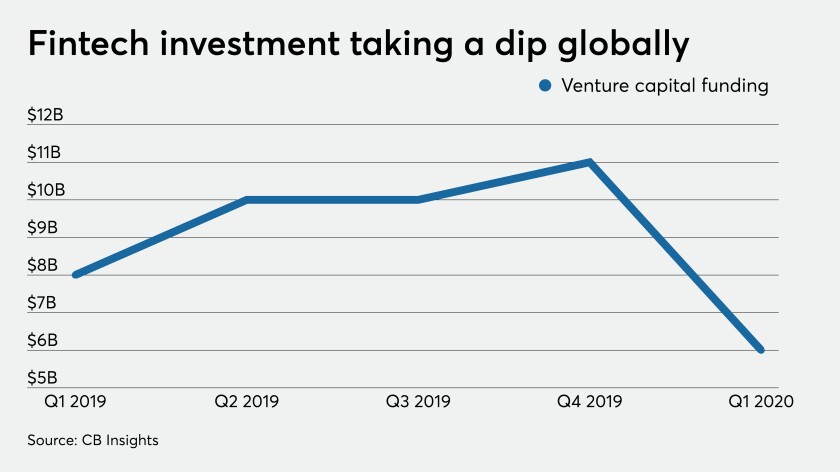

The pace of venture capital investment in fintechs, like many aspects of the economy, has slowed this year — but the demand for digital finance at a time of social distancing, and other factors, are expected to buoy the numbers in coming months.

Globally, venture capital firms invested $6 billion in fintech companies in the first quarter, down 45% from the fourth quarter and 25% less than in the first quarter of 2019, according to the data analysis firm CB Insights.

In the U.S., there was a slight uptick: to $3.7 billion in the first quarter from $3.6 billion in the year-earlier period, according to the research company Crunchbase, which tracked more than 12,000 startups for a recent report.

Gene Teare, a data expert for Crunchbase, said fintechs should be relatively optimistic about the funding prospects for the rest of the year because the results could have been a lot worse.

“We haven't seen a substantial pullback yet within the U.S. fundings to startups" even though the markets went wobbly in the early part of March, she said.

There has definitely been activity early in the second quarter.

The payments company Stripe got $600 million on April 16 from the venture capital firms Andreessen Horowitz, General Catalyst, GV and Sequoia Capital; Stripe is benefitting from the coronavirus-inspired trend of paying without contact.

And the California stock trading app Robinhood is said to be raising $250 million as consumers stick to digital, do-it-yourself investing, according to news reports.

Stripe’s announcement shows “there are still great market opportunities and venture investors didn't want to miss out,” Teare said.

However, venture capitalists may become a little more selective, Teare said.

By incentivizing businesses to rehire employees laid off or furloughed due to COVID-19, states will generate a faster economic recovery and provide valuable assistance for companies to get back on their feet.

The Internal Revenue Service and the Treasury Department provided guidance to employers requiring them to report the amount of qualified sick and family leave wages they have paid to their employees under the Families First Coronavirus Response Act on Form W-2.

The Financial Accounting Standards Board released a proposed accounting standards update to help insurance companies adversely affected by the COVID-19 pandemic by giving them an extra year to implement the long-duration insurance accounting standard.

“VCs are ... focused on making sure that their portfolio companies are getting the support and the insight to make the necessary changes to their business models and what they're doing going forward,” she said. “But I'm also hearing from venture investors from seed all the way through that this is an opportunity and they don't want to miss out on the opportunity to invest in some strong or promising companies.”

Brad Leimer, co-founder of Unconventional Ventures and adviser to startups and funds like Gauss Ventures, had a similar take.

“Like most areas of the economy during this crisis, venture capital firms have taken a pause to reassess their strategies going forward,” he said. “While we may see some firms pull back term sheets — this has already happened outside of fintech — or reduce their capital invested within a particular round, I foresee that they will continue to look for startups with solid business models and upward success to disrupt portions of the financial services market.”

Those include startups addressing the financial needs of gig economy workers, older workers or retirees and small businesses, Leimer said. He predicted strong levels of fintech investment to continue during the rest of 2020.

“This is an opportunity for VCs to create as much of an impact through fintech as we’ve seen over the past decade — likely even more so because the economic need is there — and banks have proven to not be able to meet all of those needs,” Leimer said.

Zoom pitches, consumers flocking to fintech

Jon Zanoff, founder of Empire Startups and until recently managing director of Techstars, said the shift away from face-to-face meetings forced by the pandemic has not deterred dealmakers.

“Most early-stage investors are open to, and are taking, more company pitches than ever before thanks to the limited friction of a Zoom-first model,” he said. “The billion-dollar question is whether or not more pitches translates to more capital deployed. Very few deals are done without spending time in person in front of a whiteboard, and unless this was done prior to the epidemic, the companies funded via Zoom-only will be a small minority.”

Zanoff also said that consumers are reevaluating their financial providers, which presents an opportunity for fintechs like Novo, a digital bank for small businesses, which has grown over the past few months.

He expects the wealth-tech sector to outperform the markets as consumers “gut-rebalance their portfolios and advisers struggle to scale to the demands of new customers."

Zanoff also expects strong performance for fintechs that provide technology that helps financial institutions deal with time-intensive tasks like compliance with anti-money-laundering rules and fraud detection.

Warning to fintech execs

Still, CB Insights' report warned fintech executives about the adjustments they may have to make.

“Investors are currently liquidating assets to fortify their cash positions,” the report stated. “Fintech companies should be following suit, as raising funding in the current market will likely prove exceedingly difficult — and expensive. A flight to cash will mean that fintech companies will have to tighten their belts and focus more on profitability and positive cash flow than growth at all costs. This represents a marked shift from the past decade, which saw companies raise massive amounts of capital without showing profitability.”

The analysts suggested that investors will be more judicious with their investments and terms.

“This will make for a more difficult funding landscape for earlier-stage fintech companies, who will have to compete with better capitalized and larger firms for a smaller pie of venture funding,” the report said. A sustained economic slowdown would reduce consumer and business spending more than what has already occurred.

“Ultimately, in a frozen economy, fintech companies will have serious financial challenges ahead if they are unable to reduce costs or rely on their balance sheets to get them through this difficult period,” the report said.

Venture capital firms are all rattled by the economic conditions caused by the pandemic, Teare acknowledged. Some startups are starting to struggle and have laid people off.

“Venture capitalists do not see themselves as charities for their portfolio companies,” Teare said. “They will be assessing which companies will pass and which are going to fail. Good venture investors will support those companies to get an outcome, to either get acquired or to help people at those companies who are let go get rehired.”

Venture capitalists will continue to invest in companies that are struggling as long as they think they are viable over the long haul, Teare said.

“There will be a lot of cutting,” she said. “And for a lot of investors that creates more space for companies who do pull through to do well.”

But still, Teare sees this as different from the recessions in 2001 and 2007-9. At the end of the last recession, she said, venture capital firms took a break, sat on their money and waited to see what would happen.

“There was the sense that we don't know where we are,” Teare said. “It’s very different this time around. I don't get a sense from the investors that I speak to that they want to sit and wait and see what happens. I think they're more aggressive. And I think part of it could be because there's a sense that the economy might come back more quickly. I do think bigger investors like Andreessen see opportunities. It'll be interesting to see next quarter what really comes out. We haven't seen a big reset.”