For many U.S. cities and counties, the high number of walk-in payments and checks typically received for services, permits and fees has been aggravating but acceptable — until coronavirus struck.

As many as 30% of consumers — often seniors or unbanked residents — prefer to make local government payments in person, according to CityBase, a Chicago-based fintech that helps government agencies upgrade their payments technology. About 40% of these in-person payments are made in cash, CityBase said.

“Many government agencies are used to operating around in-person payments and there are a lot of entrenched protocols and procedures that need to be re-engineered to introduce digital payments,” said Liz Fischer, CityBase’s chief customer officer.

Coronavirus has disrupted these longstanding patterns. “Behavior around paying bills is migrating in many directions, and COVID-19 has really sped up the rate of change,” Fischer said.

Since many cities closed their offices beginning in March to protect employees and cashiers from COVID-19, there has been a rapid acceleration of digital payments adoption that was unlikely to happen without the pandemic, according to Fischer.

Just as retailers have seen a sharp shift away from cash to contactless payments, some cities have seen growth rates of nearly 100% where consumers switched their habits almost overnight. Where previously residents would make in-person payments to a human cashier, they now use CityBase’s secure kiosks that can accept cash, checks or card payments, Fischer said.

The kiosks themselves are being built outside or built into the wall of the offices, allowing them to accept payments outside of business hours, Fischer noted. Many of these options were available before coronavirus, and consumers used them as a faster alternative to waiting in line, she said.

Employee Benefit News' March/April issue explores how workplaces are navigating pandemic challenges and making plans to return to the office.

The Internal Revenue Service released information on how employees now have until the end of the year to repay any payroll taxes they deferred from last year.

CPA firms will be in a great position to help their small business clients with the latest round of the Paycheck Protection Program, according to Barry Melancon.

The shift in behavior is saving money for cities and counties by reducing the number of human cashiers needed to handle the hundreds of in-person payments, which typically account for up to 30% of all payments, Fischer said.

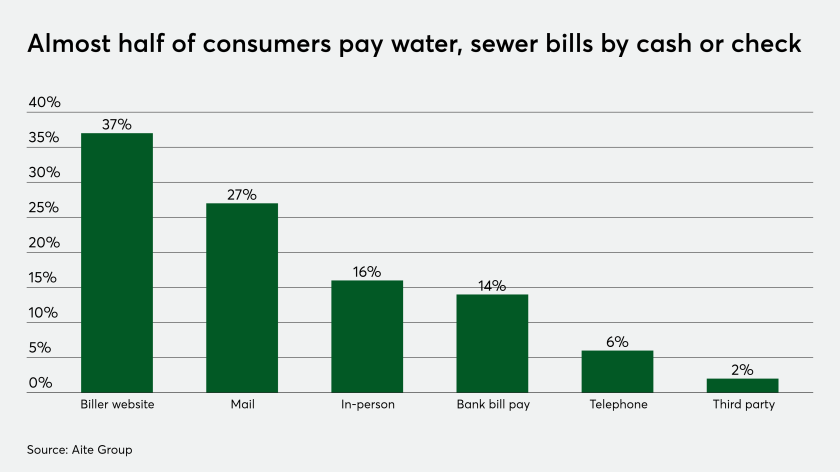

In a survey of 3,000 U.S. consumers Aite Group conducted this year for consumer banking bill site provider BillGO, Aite Group found that 16% of consumers' one-time water and sewer payments typically are made in person, and 33% of those are in cash.

Since its launch in 2013, CityBase has worked with dozens of cities and counties to upgrade payment-acceptance systems to be more secure and rely less on employees to accept cash, Fischer said.

Payments technology for public organizations is a booming niche for a variety of payment specialists and fintechs. CityBase works with eight out of the top 20 U.S. cities, including San Francisco and Indianapolis.

Many cities’ payments-acceptance systems consist of fragmented approaches that evolved over decades, with funds coming through different channels.

CityBase replaces legacy approaches with a streamlined system for accepting online payments across many city departments for everything from one-time fees to recurring service payments.

In many cases, CityBase replaces an arrangement with a local merchant acquirer that has been in place for decades.

“The act of making a payment to local city or government [agencies] is one of the most frequent consumer interactions, and it’s a way to usher in new technology in a core operational function across the whole organization,” Fischer said.

For many cities, coronavirus forced an expansion of online payment options for services and permits, freeing up city personnel to perform other tasks.

In most cases, CityBase’s digital platform enables real-time confirmation of payments, which is critical for continuation of utilities and other services.

“Switching to digital payments brings a lot of improvements for both residents and staff,” Fischer said.