The Internal Revenue Service’s Criminal Investigation unit has been initiating fewer investigations of abusive tax return preparers this past year, while also recommending fewer prosecutions, and seeing fewer indictments and prison sentences this year, according to a new report. However, the IRS CI division managed to identify $2.3 billion in other types of tax fraud schemes in the past year despite the challenges posed by the COVID-19 pandemic.

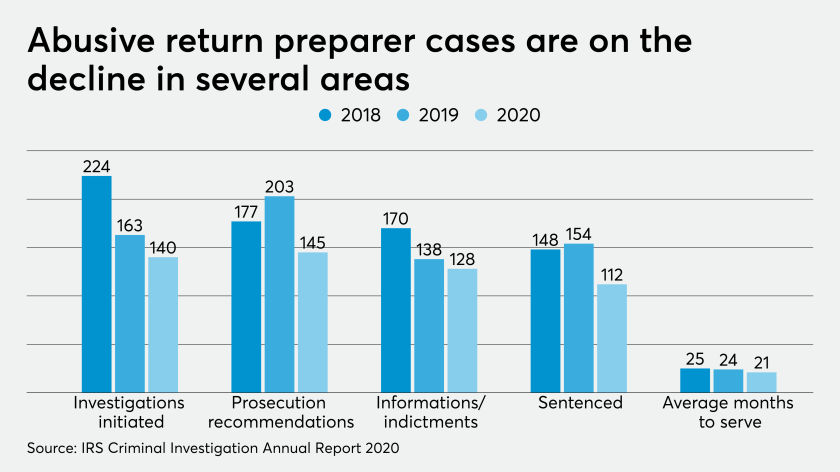

The report indicated that 140 investigations were initiated by IRS CI’s abusive return preparer program in the fiscal year ending Sept. 30, 2020, compared to 163 in fiscal year 2019 and 224 in fiscal 2018. Prosecution recommendations declined to 145 this year from 203 last year. Indictments and informations slipped to 128 this year from 138 last year and 170 in fiscal year 2018. The number of abusive return preparers sentenced fell to 112 in fiscal year 2020 compared to 154 in fiscal 2019. The average number of months of prison sentences for abusive preparers dipped to 21 months in fiscal year 2020, compared to 24 months in fiscal 2019 and 25 in fiscal 2018. The only metric for abusive return preparers where there was an uptick was in the incarceration rate, which increased to 80 percent in fiscal year 2020 from 78 percent in both fiscal 2019 and 2018.

“We have a significant return preparer program,” said IRS Criminal Investigation chief Jim Lee during a conference call Monday with reporters, in response to a question from Accounting Today. “When I talk to my special agents in charge around the country ... I’m stressing that they need to work the best and most significant investigations.”

He noted that the decline of 23 investigations this past year comes down to about one per field office and could be due to the training of new agents. The number of CI special agents increased by 1 percent in fiscal year 2020 to offset planned retirements.

“Some of that will have to do with new special agents in training because while they’re in training they’re not working cases, so some of that can be directly attributable to the number of agents we have,” said Lee. “We have a significant relationship with the IRS revolving around abusive return preparers, whether they’re individuals or businesses, so you might see a small downtick there, but what I would suggest is that our quality of cases is higher.”

As for the decline in prosecution recommendations and indictments, he pointed out that the IRS depends on the Justice Department to bring those cases, which have declined in part as a result of the COVID-19 pandemic this year. “Keep in mind that when we refer a case for prosecution, we investigate the case and refer it,” said Lee. “We make a recommendation for prosecution, but we need the Department of Justice to actually prosecute the case, and during the last half of the year, it’s been challenging because you had courts closed and you had grand juries that were not running, so some of that probably has to do with the pandemic. But overall, I don’t look at any one program. I look at them overall, and overall our tax program is strong.”

Despite the declines on the tax preparer enforcement side, the IRS CI report cited other achievements this year, despite the pandemic dominating much of the fiscal year, including the identification of over $10 billion in tax fraud and other financial crimes. Some of the main focuses this past fiscal year have included COVID-19 related fraud, cybercrimes (with an emphasis on virtual and cryptocurrencies), traditional tax investigations, international tax enforcement, employment tax, tax refund fraud and tax-related identity theft.

In response to COVID-19 related crimes, CI special agents adapted their investigative techniques this year to take on cases involving fraudulent claims for Economic Impact Payments, Paycheck Protection Program loans and refundable payroll tax credits from the CARES Act.

Frank Pignanelli is the executive director of the National Association of Industrial Bankers.

“Our mission and our highest priority continue to be enforcing our country’s tax laws,” said Lee. “The 2020 annual report highlights this. Specifically, on the key takeaways, it talks about how 73.1 percent of our time was spent on tax-related crimes, and this is significant.”

In fiscal year 2020, the IRS CI unit initiated 1,598 cases. CI also continued to increase its use of data analytics and strengthened its international partnerships to help identify the most impactful cases. One important partnership again this past year was the Joint Chiefs of Global Tax Enforcement (J5), an international committee composed of tax enforcement agencies from five different countries. In FY 2020 alone, they shared more information about cryptocurrency, tax crimes and related areas of enforcement than in the previous 10 years combined. CI also saw the first guilty pleas for a case brought under the J5 umbrella.

Enforcement is happening at the local level as well. Last Friday, the IRS announced it had busted an apparel company owner in New York City who allegedly diverted $4.4 million to third parties to pay for personal expenses for himself and his family. “When we talk about tax evasion, the reason why we’re in this job is to take care of the taxpayer and make sure that we protect the Treasury,” said IRS Criminal Investigation deputy chief Jim Robnett, who also spoke during the press conference call. “This is the kind of greed that we often see in cases that make them go from a civil matter to a criminal matter. That’s really what we’re in the business of investigating: those allegations that point to people doing things that are unlawful intentionally.”

As the sole federal law enforcement agency with jurisdiction over federal tax crimes, the CI division boasts a 90.4 percent conviction rate, one of the highest in federal law enforcement.

"The special agents and professional staff who make up Criminal Investigation continue to perform at an incredibly high-level year after year," said IRS Commissioner Chuck Rettig in a statement. "Even in the face of a global pandemic, the CI workforce initiated nearly 1,600 investigations and identified $2.3 billion in tax fraud schemes. This is no small feat during a challenging year, and their work is critical to protecting taxpayers and the integrity of our tax system."