A month after completing a sector-reshaping deal, Advisor Group faces a credit downgrade — another signal of the severe potential wealth management fallout from the coronavirus pandemic.

Moody’s Investor Services dropped its corporate family rating for the $2.7 billion in debt issued by Advisor Group Holdings to “B3” from “B2” and changed the firm’s outlook to “negative” from “stable,” the agency said March 19. The firm had received confirmation of its “B2” rating in January, after a review related to Advisor Group’s $1.3-billion deal to buy Ladenburg Thalmann.

The “immediate effect” to profitability stemming from the Fed’s move to cut the federal funds rate to between 0% and 0.25% on March 15 prompted Moody’s to downgrade Advisor Group within the high-risk issuer category, Assistant Vice President Fadi Abdel Massih said in Moody’s report. The lower rating came with sobering words that could resonate throughout the industry.

“The economic, operational and other consequences of the ongoing coronavirus pandemic are profound, and the magnitude and duration of these consequences remains fluid and uncertain,” Massih said. “Similar to most of its peers, these matters present a fundamental credit challenge to Advisor Group.”

Representatives for Advisor Group didn’t immediately respond to requests for comment.

The single-family house on Forestview Avenue in Euclid, Ohio, a suburb of Cleveland, shows no signs of farming activity. The only things growing on the one-eighth-acre plot are trees, shrubs and grass.

The institute released the pair of reports as companies increasingly rely on their CFOs and accounting departments to help them survive beyond the coronavirus pandemic.

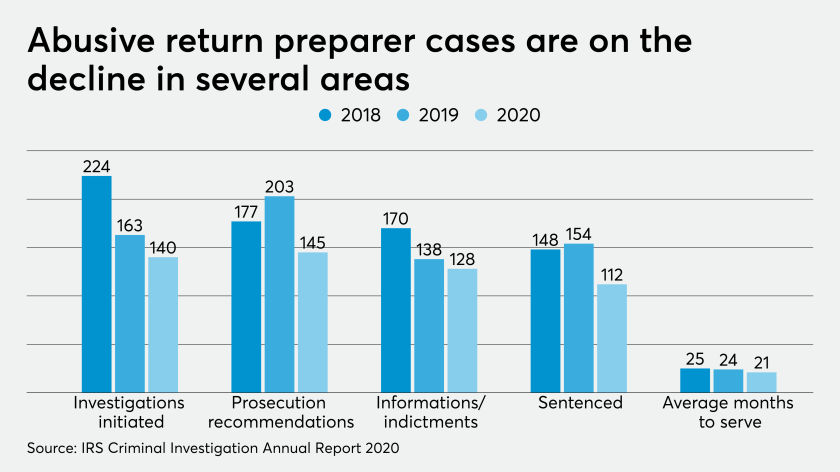

The Internal Revenue Service’s Criminal Investigation unit has been initiating fewer investigations of abusive tax return preparers this past year, while also recommending fewer prosecutions, and seeing fewer indictments and prison sentences this year.

The Phoenix-based network of nine independent broker-dealers with some 11,500 advisors grew to its current size on Feb. 14 by completing the acquisition of Ladenburg’s five firms. In the only larger M&A deal announced in the IBD space last year, private equity firm Reverence Capital Partners bought 75% of Advisor Group for a reported price of more than $2 billion.

Advisor Group isn’t alone in grappling with its high leverage: PE capital has fueled record volume of M&A deals in wealth management for the past six years in a row. Two days earlier, Moody’s shifted the outlook for the parent firm of rival IBD network Cetera Financial Group to negative from stable but affirmed its B3 corporate family rating.

The two firms took similar paths in recent years, as shown by near-identical phrasing of the description offered in Moody’s report on its rating action. Both enjoyed “macroeconomic tailwinds” from rising interest rates and equity values for much of the past three years while making acquisitions that Moody’s says have delayed their efforts to pay down their debt.

Advisor Group’s Ladenburg deal gave it notable “scale in the consolidating [IBD] space” by adding some 4,400 advisors with $180 billion in client assets, Massih noted. However, the new giant IBD network now finds itself hampered by lower cash sweep revenues due to vanishing interest rates and smaller advisory fees connected to the falling equity values.

“The full and timely achievement of the extensive planned post-acquisition synergies will be more difficult for Advisor Group to achieve in the challenging operating environment that currently exists, pertaining to the coronavirus pandemic,” Massih said.

Adjusted debt-to-EBITDA above 7.5x, more debt-financed acquisitions and a failure to carry out the synergies from combining the two businesses could cause another downgrade. The factors that could lead to a stable outlook include reducing Advisor Group’s leverage below 6.5x, significant expansion of its business and expense slashing to offset lost revenue.

In addition, the negative outlook for Advisor Group means that an upgrade is “unlikely in the near future,” Massih said.