The share of borrowers seeking payment relief on loans skyrocketed as COVID-19 concerns mounted, a recent survey by the Mortgage Bankers Association shows.

Between March 2 and April 1, the amount of loans with forbearance requests increased to 2.66% from 0.25%. This marks a more than tenfold growth in requests every two weeks, with a 1,270% increase between March 2 and March 16 and a 1,896% jump between March 16 and March 30.

Hold times in servicer call centers also grew dramatically — from 2 minutes to 17.5 minutes — over the course of a few weeks in March. Abandonment rates increased to 25% from 5%, the report found.

The largest surge in forbearance requests was for the government loans packaged into the securitizations that Ginnie Mae insures, rising from 0.19% to 4.25% over the period analyzed.

Ginnie Mae has promised to provide some support for mortgage servicers that need to advance principal and interest payments from loans to bondholders while borrowers are not paying, but it's unclear how extensive that government intervention will be, and the MBA has sought broader public aid for the industry.

Small-business employment and hours worked grew a bit in September, especially in the Northeast and within the construction industry, according to the latest monthly report from payroll giant Paychex.

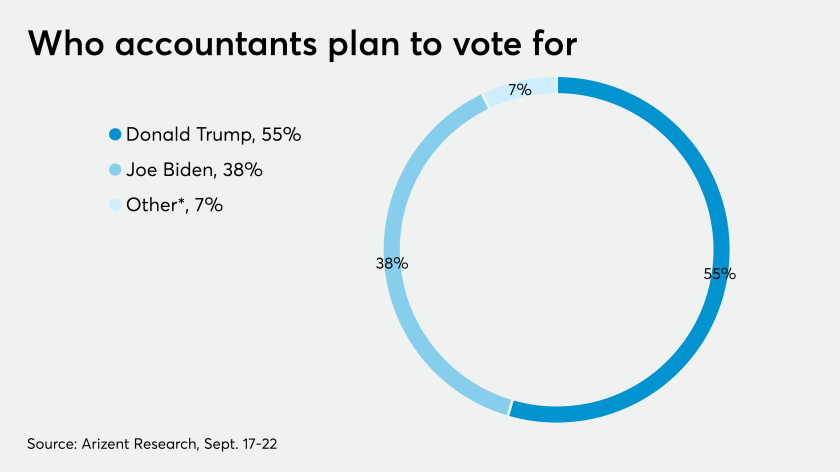

Regardless of their voting intentions, they overwhelmingly expect things to improve after Nov. 3.

The shutdown in March forced O&G firms to confront the inefficiencies of their financial processes.

"It is expected that requests will continue to skyrocket at an unsustainable pace in the coming weeks, putting insurmountable cash-flow constraints on many servicers," said Mike Fratantoni, senior vice president and chief economist at the MBA.

The constraints will be particularly hard on independent mortgage bankers that lack a source of cash from deposits. As of April 1, the percentage of loans in forbearance in IMBs' servicing portfolios was 3.45%. That request rate is 2.24% for banks and 2.73% for all loans.

The association's survey included data from more than 22 million loans in the first-mortgage market.

Providers of government-related loans must provide up to six to 12 months of forbearance without penalty if borrowers state they have coronavirus-related hardships, but consumers can still be considered liable for paying the full amount due in the future if they put payments on hold.