The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

The various programs put into effect following the financial crisis made that possible, including the capital standards established by the government-sponsored enterprises through the Private Mortgage Insurer Eligibility Requirements.

"While we recognize that an impending recession rightfully causes concern for companies with credit risk, our position remains that this time is different than 2008 because of both stronger mortgage underwriting quality, more enhanced risk distribution methods, and robust retained capital buffers," according to KBW analysts Bose George, Thomas McJoynt-Griffith and Eric Hagan. "To demonstrate this, we applied an accelerated highly stressed scenario to the insured portfolios to assess the impact on losses and capital levels. We conclude that even a sharp deterioration in delinquencies would be an earnings event, not a book value event, for the industry."

In the aftermath of the Great Recession, three of the then seven mortgage insurers were forced into run-off because they lacked the capital to pay claims from the increased number of foreclosures.

Even in situations where mortgage insurers grant borrowers forbearances, they must treat the missed payment as a new notice of default. Although many of those borrowers will cure, a certain percentage will eventually end up in foreclosure, triggering a claim. If the Federal Reserve does establish a servicer advance facility, KBW expects lenders to use some of the funds to keep MI premiums current.

The Internal Revenue Service is extending until June 30, 2021 the period in which it will accept digitally signed and emailed documents due to the COVID-19 pandemic.

EAPs, yoga and meditation classes and access to free therapy are all ways to help your employees combat stress and anxiety from the on-going pandemic.

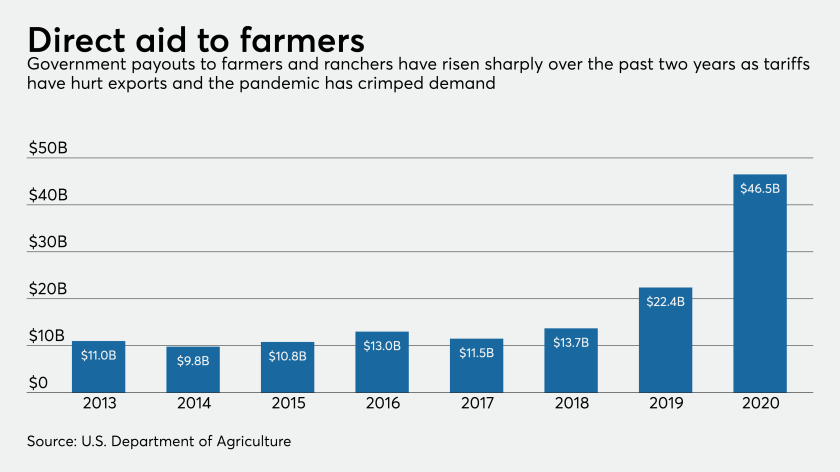

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

KBW ran accelerated stress scenarios on the portfolios of the four companies it follows: MGIC, Radian, National MI and Essent.

"We conclude that the coronavirus is likely to be treated like other natural disasters from a capital standpoint," the KBW analysts said. "If FHFA were to apply a 0.30x adjustment factor (same as that used for loans in FEMA disaster-declared areas), then the MIs would generally still have extra capital."

In the stressed scenario, Essent would have the largest excess over its current PMIERs capital, of $616 million. MGIC would have a $159 million excess and Radian, a $59 million excess. National MI, however, would have a shortage of $86 million.

On March 20, NMI Holdings, National MI's parent, announced it was able to amend its senior secured revolving credit facility.

The revolving capacity increased to $100 million from $85 million, the maturity date pushed out to Feb. 22, 2023 from May 24, 2021, lenders were added and interest reduced for both drawn borrowings and undrawn funds.

"We had been working on this amendment for some time — well before the escalation of virus concerns and the related financial market impact," Adam Pollitzer, NMI Holdings executive vice president and chief financial officer, said in an email. This was not in any way driven by a near-term capital need; we simply chose to maintain the momentum we had established with lenders over the last several weeks and complete this transaction. It is a pure positive that our bank group remains supportive and received their internal approvals for the transaction even while so much was happening across the public health and financial landscape."

NMI first established this facility in 2018 and has never made a draw. It will "continue to view it as 'dry powder,'" Pollitzer said. In light of recent events, we were pleased to achieve all of our objectives and further enhance our financial flexibility."

But because of COVID-19, Radian Group suspended its share repurchase program, which cost of $226 million in the first quarter, it said in a press release. The company has $680 million in liquidity, which takes into account the share repurchase activity and a $200 million surplus note investment into Radian Guaranty, its MI subsidiary. There was an inflow of $465 million, primarily a return of capital from Radian Reinsurance.