New York’s Department of Financial Services has issued an emergency regulation requiring state-regulated financial institutions to offer consumers relief on mortgage payments and certain fees if they demonstrate financial hardship resulting from the coronavirus pandemic.

The emergency regulation, issued late Tuesday, requires financial institutions to give mortgage borrowers forbearance of at least 90 days if they apply for assistance due to job loss or other issues brought on by the economic fallout from the pandemic. It also requires those financial institutions to waive ATM fees and late payment fees on credit cards for the same reason.

The order Democratic Gov. Andrew Cuomo issued an executive order on Saturday allowing the state’s Department of Financial Services to issue the emergency regulation.

The White House is signaling to Congress that President Donald Trump could reject a new coronavirus aid bill if it doesn’t include a payroll tax cut, adding a new complication to already contentious negotiations between Republicans and Democrats on the next round of stimulus.

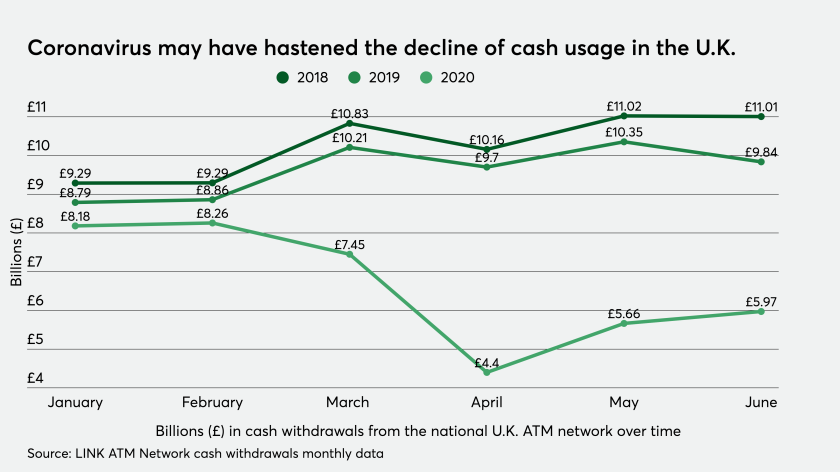

The coronavirus pandemic has cast a shadow over the use of cash, which is often perceived as dirty because it frequently changes hands and is almost never washed.

The growth in remittance providers' digital customer sign-ups accelerated as the U.S. went into a nationwide lockdown in the middle of March, and has continued through the summer despite store reopenings that could pull customers back to their old habits of paying in person.

“Thanks to Governor Cuomo, DFS is further empowered to step up for New Yorkers during the COVID-19 pandemic,” Superintendent of Financial Services Linda A. Lacewell said in a statement. “This emergency regulation provides a measure of much needed financial relief to New York residents with New York State mortgages on homes in New York State."

According to a DFS official familiar with the matter, the regulation will be in place for at least 30 days, but can be renewed if the governor extends the executive order.

The emergency regulation only applies to banks and credit unions already regulated by the agency. The largest state-chartered banks in New York are the $311.8 billion-asset Bank of New York Mellon, the $229 billion-asset Goldman Sachs Bank USA, the $119.4 billion-asset M&T Bank., $53.6 billion-asset New York Community Bancorp and the $50.6 billion-asset Signature Bank.

Cuomo has moved aggressively on a number of fronts aimed at containing the coronavirus outbreak in the state and providing relief to New Yorkers affected by it. Those actions have also included closing schools and restaurants to better comply with public health experts’ recommendations for containing the spread of the virus.

As of Tuesday evening, the Centers for Disease Control and Prevention reported that the U.S. had over 44,000 cases of coronavirus, including over 544 deaths. On Monday, New York confirmed that it had over 20,000 cases of the novel coronavirus.