In mid-February, the S&P 500 reached its highest point in a decade-long bull market run. In the following weeks a pandemic unlike any seen in generations has led to an unprecedented pullback in the markets and an even more drastic change to the way most Americans live.

While no one would wish for times like these, it is during these very moments that advisors can provide clients with the greatest value, keeping them focused and taking advantage of opportunities that may not otherwise be clear. Advisors should not ignore obvious investment strategies such as capital-loss harvesting and rebalancing, but there are a variety of other tactics that can, and perhaps should, be considered as well.

To that end, here are 10 conversations to have with clients during these difficult times.

No. 1: Revisit “Am I on track?”

No one enjoys seeing their hard-earned savings evaporate before their eyes, but as painful as it is, the bigger pain point is often a forced change to a previously agreed-on plan.

For younger families that might be the difference between being able to pay for two years of a child’s college education instead of four years. For those close to retirement it might mean working an additional year or two beyond the existing target. And for those already in retirement it may mean an adjustment to discretionary spending. Other clients may have accumulated a buffer significant enough to withstand a substantial market pullback.

One of the most impactful things advisors can do right now is reassess clients’ plans and help them answer the all-important question, “Am I on track?”

Of course, a single advisor may be responsible for 100 or more client relationships, so a prioritization plan is needed. Planners should consider prioritizing clients who have historically expressed greater concern during market pullbacks, as well as those who are close to significant goal-based events such as retirement, funding a child’s college education, etc.

No. 2: Adjust budgets

For those clients whose plans are materially impacted by the current crisis, there are two key functions an advisor can play.

First, planners can help clients adjust spending in effective and realistic ways. For instance, many individuals believe the best way to mitigate a market pullback is to substantially reduce spending — say, by 25% or more — until the market recovers. The reality is that such cuts are not only very painful, but are often not as effective in managing long-term safe withdrawal rates as other less severe, more sustainable changes.

Advisors looking to guide clients through a belt-tightening should encourage them to consider much smaller — e.g., 3% — but permanent changes to annual spending. There is ample evidence to suggest that such cuts are actually far more effective in dealing with market pullbacks than shorter, bigger spending curbs.

Second, advisors can serve as a sounding board. Whether a client is 85 or 35, pulling spending levels back can be difficult — particularly when spouses disagree on what should be cut. Advisors can help clients remain focused on the things most important to them and to serve as impartial arbiters.

No. 3: Make 2020 Roth conversions

The timing of a Roth IRA conversion is primarily a tax consideration, but once the decision to make a conversion has been made, leveraging the timing can add a valuable boost.

Market dips can present a particularly opportune moment. For those who believe that there is much more pain to come — or at least are reasonably fearful of the possibility — there are a couple of potential options to consider.

The passage of the act extends the IRA contribution deadline and waives RMDs for 2020. Here’s what else financial advisors need to know.

One is to engage in some Roth conversion cost-averaging. Instead of making one large conversion now, spread the conversion throughout the year in smaller increments. For example, instead of converting $100,000 at once, do four Roth conversions of $25,000 each month for the next four months.

A riskier option, but one that potentially comes with a higher upside, is to use the 60-day rollover window to try and recreate the recharacterization option that was eliminated by the major tax legislation passed in December 2017, effective for 2018.

As advisors will recall, prior to 2018 Roth IRA conversions could be recharacterized — i.e., undone — until October 15 of the year after conversion. Congress eliminated that option though, resulting in a situation where taxpayers are now stuck with their Roth conversions, for better or worse. Or are they?

Some clients can have what amounts to a short window of opportunity to decide whether they want to keep a conversion or not. It’s not particularly complicated, but as noted above, it does come with a fair amount of risk, as it raises both potential once-per-year rollover, same-property-rule and 60-day rollover concerns. But for those willing to take the leap, here’s how it works:

First, take an in-kind distribution of IRA investments, and put them in a taxable account. Next decide whether or not to keep the conversion. If you decide to keep it, complete it by transferring the assets in-kind to a Roth IRA before the end of the 60-day rollover window. If you decide to forgo the conversion, complete a regular rollover by transferring the assets in-kind to a traditional IRA, thereby artificially recharacterizing the conversion before the end of the 60-day rollover window.

No. 4: Assess the emergency reserve

An emergency fund typically consists of at least three to six months of expenses in cash or liquid cash alternatives. The U.S. is only about one month into the COVID-19 crisis, but there’s no telling how long it will take until either the virus runs its course or an effective therapy or vaccine is found, allowing life to return to some semblance of normalcy.

While the emergency spending package passed by the Senate may blunt some of the typical effects, several analysts have projected the unemployment rate to rise to 30% or higher in the near future, which would be higher than peak unemployment during even the Great Depression, and more than three times the peak unemployment during the 2008 crisis.

Given this uncertainty, advisors should consider helping clients establish next-in-line sources of cash to use after the emergency reserve runs dry.

One logical place to turn once cash assets have been exhausted is taxable brokerage accounts. Using assets inside such accounts to fund living expenses has several advantages, including that it’s quick, simple and, depending on the assets liquidated — as well as whether there are existing carry-forward losses to offset any gains — there may not be any tax consequences.

On the flip side though, using taxable brokerage assets may require selling positions at depreciated values. Furthermore, long-held positions may still have a significant gain, even after the market pullback, resulting in capital gains tax being owed.

For those who lack other adequate options but who wish to avoid liquidating substantially depressed taxable investments, a securities-based loan may be worth a look. Such loans are offered by certain custodians, using the securities held within their accounts as collateral. Interest rates are generally lower than the margin rates offered by the same institutions, while dollars available in loan form will vary based on the types of securities held within the account. Typically, if a loan is available it will be for at least 50% of the market value of the account’s underlying securities.

Of course many individuals don’t have substantial savings in taxable accounts because they have accumulated most of their non-emergency-fund savings in tax-favored accounts such as IRAs, 401(k)s and other employer-sponsored retirement plans. For these individuals it’s worth investigating whether the plan offers a loan provision.

Meanwhile, IRA owners and participants in plans without loan features may wish to simply take a distribution of retirement assets. Distributions of pre-tax assets will still be taxable, but up to $100,000 should be available without a penalty now that the coronavirus relief bill has passed.

The best source of capital for other clients could be derived from what may be their single largest asset, their home. There are a variety of ways in which homeowners might unlock home equity. Spurred on by research, including that conducted by Wade Pfau, some planners have encouraged eligible clients to secure line-of-credit–style reverse mortgages to help mitigate sequence-of-return risk and avoid selling assets during significant drops.

Can a home equity line of credit offer clients a bridge loan for troubled times? Says one, “I’m going to call those people and rehire them.”

Those who have secured such mortgages should consider drawing on some of their available loan proceeds, potentially with the mindset of paying the loan down with proceeds of the sale of other investments once asset prices have rebounded.

For others who either don’t qualify for a reverse mortgage or simply don’t want one, a HELOC presents another potential option. However, given today’s low interest rates and the last decade’s relatively strong housing market, an even more attractive option may be to use a cash-out mortgage. While rates for such mortgages are generally higher than their conventional counterparts, they can give homeowners access to potentially large amounts of cash at a fixed rate for typically as long as 30 years, whereas most HELOCs are issued with variable interest rates.

No. 5: Reduce flexible payments

Many individuals’ cash flows are impacted by the current coronavirus crisis. Meanwhile, other clients may be fortunate enough to be relatively unaffected in this regard, yet the moment warrants caution, especially where defensive actions can be taken with little to no downside or additional cost.

To that end, advisors can help clients understand the types of payments that can or should be considered for reduction. In particular:

Unforeseen circumstances sometimes get in the way — and for some clients, that time may be now.

Federal student loan payments: In March, the Department of Education announced that the interest rate on all federally provided student loans will automatically drop to 0% for a period of at least 60 days, pending further guidance. Borrowers are also empowered to suspend payments for at least two months, pending further guidance. Notably, the reduction is automatic, but the loan payments will only stop if a forbearance is requested — or, in some cases, if the borrower is late on payments. Thus, individuals who wish to stop payments generally must take proactive measures to do so. Borrowers can call 1-800-4-FED-AID or visit their loan servicer’s website to make the change.

Mortgage payments: In some states, New York among them, a mortgage “holiday” may be available to clients who have seen disruptions in income due to the COVID-19 crisis. While the exact terms will vary between jurisdictions, the general idea of such a provision is to automatically allow impacted borrowers to defer payments without incurring additional costs and/or impacting their credit scores. In states where such relief is not available, mortgage companies may work with borrowers to defer certain payments without incurring late fees or other additional charges. Notably, ongoing mortgage payments may represent the single largest monthly expense for many clients, so any relief could make a substantial difference.

Credit card payments: Perhaps surprisingly, many credit card companies have offered cardholders varying degrees of relief during the COVID-19 crisis. The potential relief offered by some companies includes reduced or delayed monthly payments, reduced interest rates and abated late and other fees. The available relief is rapidly changing, so clients should be encouraged to reach out to their individual credit card companies, or to visit applicable companies’ COVID-19 relief pages.

No. 6: Replace refunded 529 plan funds via rollover

While the extent of the COVID-19 epidemic has led many higher education institutions to transition from in-person courses to remote learning, some classes have simply been canceled, leading to the institution refunding all or a portion of previously paid amounts. In other situations students may have chosen to temporarily leave school to the same effect, receiving tuition refunds.

Where tuition and/or other qualifying educational expenses that are now being refunded were paid with 529 plan funds, strong consideration should be given to replacing such funds into a 529 plan. As a result of legislation enacted in 2015 — and as further explained by the IRS in Notice 2018-58 — individuals receiving such refunds can roll them back into the student’s 529 plan within 60 days of receipt. Refunds rolled back into a 529 plan also do not count toward the plan’s contribution limit.

Unforeseen circumstances sometimes get in the way — and for some clients, that time may be now.

Absent the completion of such a rollover, the taxable portion of the refund would be includable in income, and potentially subject to penalties. To make matters worse, although the IRS has stated it intends to release regulations to simplify this calculation, no such regulations are available to date.

Thus, for the time being it would appear that the refunded amount would have to be treated as a proportionate amount of basis and earnings as the 529 plan distribution that was used to pay the expenses in the first place. This can get tricky where multiple payments to a single institution, and for a single academic period, were made via multiple 529 plan distributions that spanned multiple calendar years, resulting in different basis-to-earnings ratios.

Sound complicated? The fix is simple: Encourage clients to complete the 529 plan rollover within 60 days of receiving the refund. Done.

Unforeseen circumstances sometimes get in the way — and for some clients, that time may be now.

No. 7: Use a QHFD to fund HSAs

It is generally best to reserve amounts in retirement accounts for their intended purpose. But unforeseen circumstances sometimes get in the way — and for some clients, that time may be now.

For clients with cashflow problems who must pay medical bills or can’t otherwise fund HSAs, a partial solution would be to use the little-known qualified HSA funding distribution, or QHFD. Quite literally a once-in-a-lifetime option — given an individual can only make one during their lifetime — a QHFD allows a client to move money directly from an IRA to an HSA. The amount that can be transferred is limited to the maximum HSA contribution that the individual is eligible to make during a given year.

For 2020 the maximum HSA contribution is $3,550 for individuals with self-only coverage and $7,100 for individuals with family coverage. Individuals 55 and older by the end of the year may contribute an additional $1,000 catch-up contribution.

For those who would otherwise be unable to make their 2020 HSA contributions but who have available IRA dollars, there are two reasons why a QHFD should be strongly considered. First, if funds are tight enough that the HSA contribution can’t be made, it likely means that if/when medical costs arise, there won’t be a good source of funds from which to pay them. Furthermore, being HSA-eligible means an individual has a high-deductible health plan, meaning at least initially, insurance will be of no help either.

The Institute of Internal Auditors is giving corporate America only a modestly better grade on governance in 2020 compared to 2019, and any improvement is probably due to the coronavirus pandemic.

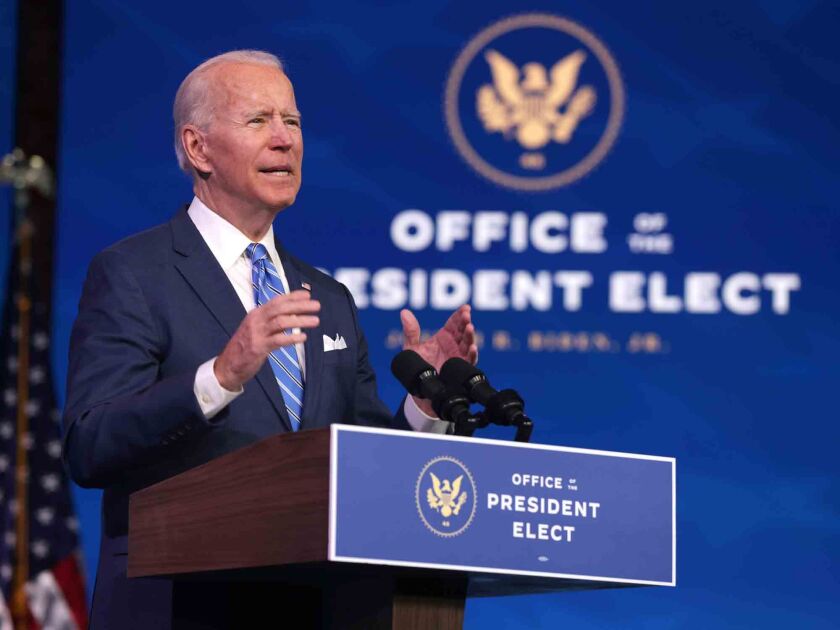

President-elect Joe Biden’s $1.9 trillion COVID-19 relief plan is designed to both pump money into the economy and contain the coronavirus pandemic.

President-elect Joe Biden’s $1.9 trillion economic relief proposal serves as the opening salvo in a legislative battle that could be prolonged by the go-big price tag and the inclusion of initiatives opposed by many Republicans.

Certainly a distribution from an IRA could be used to pay such an expense, but that distribution would be taxable and potentially subject to a 10% penalty as well. Note that the 10% exception for medical expenses only exempts expenses in excess of 7.5% of AGI for 2020. By contrast, making a QHFD first and then taking a distribution from the HSA to pay the same expense would be both tax- and penalty-free.

Second, even for those who do not have imminent expenses, if there aren’t enough available funds to cover making a full HSA contribution, then the QHFD should be strongly considered. Notably, HSAs are generally higher on the hierarchy of tax-preferenced accounts for most individuals. Thus, if the choice is to have dollars in a traditional IRA or to have the same dollars in an HSA account, it generally pays to have those dollars live inside the HSA.

No. 8: Reduce/pause contributions to employee retirement plans

Many small businesses have been particularly impacted by the pandemic. Lockdown and/or social distancing policies have resulted in business revenues falling dramatically or, in other cases, being eliminated. Many proprietors are doing everything they can to keep their businesses afloat and to retain as many employees for as long as possible.

Those goals may be advanced by eliminating and/or reducing normally required retirement plan contributions. Many small business owners have incorporated either nonelective or matching safe harbor provisions into their 401(k) plans to allow themselves and other highly compensated individuals to contribute the maximum amount of salary into the plan annually, without worrying about testing.

While such contributions are generally not a choice on the part of the owner, if the plan’s safe harbor notice includes language that allows the employer to reduce or eliminate the safe harbor — which is generally a good practice in times such as this — then the safe harbor contributions can be suspended or reduced. Additionally, IRC Section 412(c)(2)(A) allows a company to suspend such contributions even if such language was not included in the safe harbor notice when the company is operating under an economic loss for the year, which clearly may be the case.

Clients who would consider making such changes should speak with a TPA, as the plan will need to be amended. Other procedural requirements must also be fulfilled, such as providing notice to employees of the change — which can’t actually go into effect until at least 30 days after employees have received the notice — and giving employees an opportunity to change their own salary deferral elections.

It should be noted though that by making such a change, the plan is no longer operating with a safe harbor, and thus would be subject to annual testing.

Employers using SIMPLE IRAs may also wish to revisit their employer contributions. However, changes cannot be adjusted mid-year. Rather, they can only be adjusted prospectively for future years.

Employers with SIMPLE IRA plans who are struggling may nevertheless want to look out to 2021 to recover some losses by reducing SIMPLE IRA matching contributions. While contributions are generally required to be matched up to 3% of an employee’s salary, the 3% rate can be reduced to as low as 1% in up to two out of five years.

No. 9: Fix the previously unfixable

While gross returns matter, at the end of the day what really counts is after-tax returns. How much money did the client make that they could actually spend? Generating tax-efficient returns can be bolstered in any number of ways, such as maximizing tried-and-true strategies like tax-loss harvesting, or simply by using tax-efficient investments in the first place.

But another significant and often overlooked way to generate additional tax alpha is by properly locating the right assets in the right type of account. If a client has assets in a traditional IRA, a Roth IRA and in a taxable account, where are the bonds? Where does the stock go? REITs?

As a general rule of thumb it makes sense to locate your highest long-term expected-return assets in a Roth account, where they can grow tax-free. But what if your client’s highest long-term expected return asset consists of growth stock, which they’ve been holding inside a taxable brokerage account?

Though it might make sense in a vacuum to house those assets in a Roth account, the cost of making a corrective change may have been too significant to merit making the change at all. But owing to the recent market pullback, that may no longer be an obstacle. Advisors who have wanted to reposition clients’ assets and adjust the location plan should review accounts as quickly as possible to determine if such a move is now desirable.

It’s worth noting that with such huge market swings, the difference of a single day’s performance may dictate whether such changes make sense — i.e., the window to capitalize may be limited.

As such, advisors should identify clients for whom they’d like to make such changes and, if such shifts don’t make sense yet, identify the potential market levels where such analysis should be revisited, as they could arrive sooner than expected.

No. 10: Will changes be needed in proxies, wills and advance directives?

Estate planning is often the last item to be checked off clients’ lists, as contemplating one’s demise is often quite difficult. In other situations clients may not feel that they need an estate plan because either they don’t think they have enough saved or because most or all of their assets will pass outside of probate.

Of course, estate planning covers more than just the financial bases. A critical element is planning for what has traditionally been viewed as end-of-life care. For individuals who have not yet engaged in this planning, the current crisis may be just the kick in the pants they need. And while face-to-face meetings with an attorney may not currently be possible, most of the estate planning process — save for the actual signing and/or notarization of documents — can be addressed virtually or over the phone.

For individuals who have not yet engaged in this planning, the current crisis may be just the kick in the pants they need.

Even clients who have existing healthcare proxies, living wills and advance directives may wish to reconsider some of the terms or language therein. For example, some clients may have named an individual who lives far away as a healthcare proxy because they assumed that if the situation merited it, that person would come. Travel restrictions may make that difficult, if not impossible, so it may be wise to name an alternate person to fulfill that role, even if only as a back-up.

Other issues that advisors may wish to discuss with clients include the terms by which they would like to be kept alive. COVID-19 is a respiratory disease that attacks the lungs, and while most cases are not severe, those which lead to hospitalization often necessitate the use of a ventilator to ensure blood remains adequately oxygenated.

If a client’s living will or healthcare directive provides that the client should not be kept alive via artificial means, this would potentially preclude the use of a ventilator — even if recovery were still possible, or even likely, with its use. Given the increased likelihood that such a measure may ultimately be needed, advisors should encourage clients with existing directives to review them to ensure they accurately reflect their wishes.

For example, a directive may say, “No means of artificial life support should be used,” but given the current climate a client may want to amend it along the lines of, “No means of artificial life support should be used once doctors have determined that a return of normal brain function is unlikely.”

Finally, once clients are satisfied that their legal documents read as desired and reflect their wishes, advisors can store copies of the documents and help facilitate discussions with clients’ healthcare agents and/or other persons relevant to their planning.

With any luck, the COVID-19 virus will peter out on its own, or the combination of science and social distancing will allow us to arrive at the same result. It’s all but certain we will get through this crisis. Less certain, however, is when.

Meantime, advisors can continue to do what they do best: Help clients keep things in perspective. Encourage them to avoid making emotionally driven decisions. Use the current situation to their advantage as best as possible.

In short, control what we can control. The rest usually falls into place.

Jeffrey Levine, CPA/PFS, CFP, MSA, a Financial Planning contributing writer, is the lead financial planning nerd at Kitces.com, and director of advanced planning for Buckingham Wealth Partners.