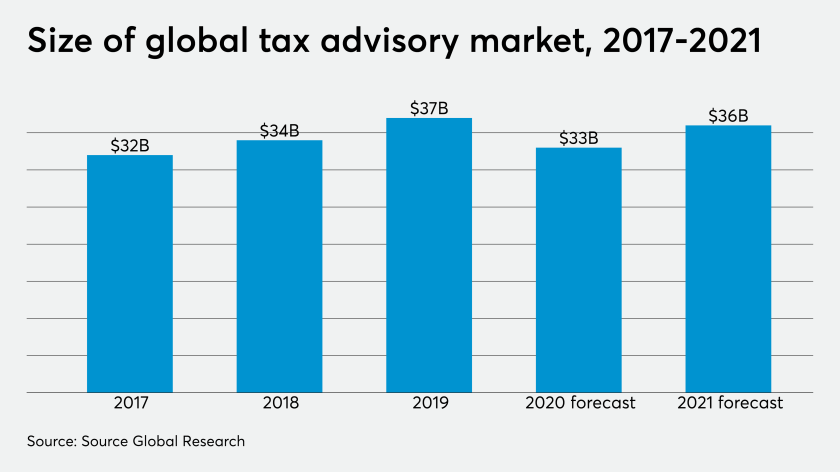

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

The report, from Source Global Research, estimates that revenues contracted over 9 percent in 2020 due to the pandemic. Some parts of the world fared better than others. In the U.S., the $16.3 billion market for tax advisory services grew 7 percent in 2019, but in 2020 the report estimated a decline of 13 percent. The U.K. market contracted even more, by 21 percent. On the other hand, Australia saw 4 percent growth.

With more than 25 years of experience in the insurance and technology industries, George Robertson provides a seasoned perspective on emerging technological trends and their impact on insurance professionals and clients. As a former board member of the Independent Insurance Agents & Brokers of America (IIABA) Agency Council for Technology, he has played a key role in tracking strategic developments that shape consumer expectations and business opportunities.

George also served as co-chair of the Cyber Workgroup, where he helped develop The Cyber Guide for Insurance Agents, a resource designed to assist agents with cyber regulation compliance and safeguard both agencies and their customers. With expertise in cyber insurance, insurtech, artificial intelligence, and agency automation, he delivers valuable insights that drive innovation and progress within the insurance industry. He can be reached at grobertson@ncinsquote.com.

Date: Monday, September 29, 2025

Gail McGiffin is the Managing Director and Global Insurance Advisory Lead at EPAM, where she helps insurers deliver large-scale transformation programs focused on growth, efficiency and digital innovation. With over 35 years of experience in insurance leadership, she specializes in underwriting modernization, data-driven platforms and operational efficiencies.

Before joining EPAM, Ms. McGiffin was the Chief Information and Operations Officer and board member at Vantage Group Holdings Ltd., where she led technology and operations. She previously served as Global Insurance Underwriting Lead and Partner/Principal at EY, Chief Information Officer and a member of the board of directors at ProSight Specialty Insurance and Managing Partner at Accenture, where she established and led the Global Underwriting Practice. Ms. McGiffin began her career at Chubb, holding leadership roles in underwriting and product innovation.

Despite the slump, demand for tax advisory services has held up better than many other areas of the overall professional services market. The global management consulting market shrank 13 percent to $21 billion. The report predicts the global tax advisory market will recover soon, with a growth rate of 7 percent anticipated.

The COVID-19 pandemic has reshaped the tax advisory market, stalling M&A activity and international tax work. M&A-driven tax work declined 21 percent last year, reducing total revenues from $1.6 billion to $1.3 billion. In contrast, compliance-related tax management fared comparatively well last year, even though clients initially tried to do more of their work in-house, with only a 5 percent contraction in revenues tied to efforts to shore up cash reserves by taking advantage of tax deferrals and other government support schemes.

“The pandemic has radically reshaped priorities, with many different concerns all vying for space at the top of the corporate agenda,” said Source Global Research managing director Fiona Czerniawska in a statement Monday. “Finance and tax functions are having to balance the demands of tax compliance with the ability to respond to new and unprecedented risks. That balancing act saw attempts to reduce reliance on external support early in the crisis, only for demand to recover as clients recognized that they lacked the capacity and/or capability to carry out compliance work by themselves.”

Some tax firms report greater demand for their services. “We’re seeing lots of requests for compliance services, which is driven by the fact that many clients just weren’t prepared for this,” said Ryan LLC chairman and CEO Brint Ryan in a statement.

When it comes to clients in different sectors of the economy, tax advisory work in the energy sector declined 23 percent, in the manufacturing industry by 10 percent, in the services sector by 18 percent, and in the technology, media and telecommunications sector by 18 percent. However, much of the decline in that sector seems to be due to media clients, and the high-tech and telecom industries experienced significant growth of 22 percent and 16 percent respectively. Tax advisory work in the insurance industry grew 4 percent. The pharmaceutical and health care sectors saw growth in tax advisory work of 19 percent and 4 percent, respectively. Regulation is becoming an increasingly significant issue in all of those industries and sectors, and is making itself felt through increasing demand for compliance-related support.

For those tax advisory firms that do win work, fee rates are coming under increasing pressure, which will present even more of a challenge throughout this year. Only 3 percent of the clients surveyed in March 2020, before the pandemic had truly taken hold, anticipated that fee rates would fall across the industry; however, by September, that had risen to over 60 percent. While the pandemic itself is undoubtedly the main driver of this pressure on fees, it’s also a consequence both of the growing demand for compliance work which, while complex, isn’t an expensive, highly specialized service, and clients’ belief that a wider range of tax services have been similarly commodified.

The market is expected to recover this year, with growth likely to be focused in specific areas. The continuing pressure on organizations’ own in-house tax functions will probably contribute to growth in compliance-related work. The Source report found that once the crisis is over, the area of tax where clients are most likely to increase their use of outside support is compliance (70 percent of those surveyed predicted they would increase the use of third parties for doing this work). There’s also likely to be a resurgence in M&A-related tax work, as many of those surveyed anticipate the prolonged crisis will lead to an increase in restructuring and transactions.

“We anticipate a higher uptick [in tax work associated with M&A] because the pandemic has caused executives around the world to reflect on what it is they’re trying to achieve within their business,” said Lisa Stott, global lead for tax advisory services at Deloitte, in a statement. “They’re reflecting on whether they have the right strategies, and how to introduce resilience into their business so they can cope more effectively if anything like this happens again. Therefore, a lot of clients are already making decisions about divestments, expansions and acquisitions to make their supply chains more resilient.”