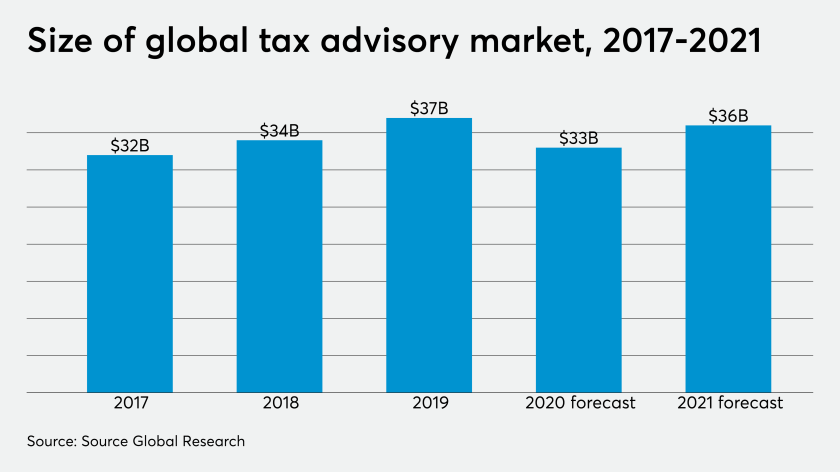

Tax advisory firms took a projected $3 billion hit on their revenues around the world last year because of the coronavirus pandemic, according to a new report.

The report, from Source Global Research, estimates that revenues contracted over 9 percent in 2020 due to the pandemic. Some parts of the world fared better than others. In the U.S., the $16.3 billion market for tax advisory services grew 7 percent in 2019, but in 2020 the report estimated a decline of 13 percent. The U.K. market contracted even more, by 21 percent. On the other hand, Australia saw 4 percent growth.

Rathi Murthy is the Chief Technology Officer at Varo Bank, the first nationally chartered all-digital consumer bank in the United States. In this role, she leads the company's end-to-end technology strategy, overseeing the design and development of secure, scalable, and AI-powered digital banking platforms. Her leadership is instrumental in advancing Varo's mission to build inclusive, accessible, and real-time financial solutions for millions of consumers.

A seasoned technology executive, Rathi brings over 25 years of experience leading innovation and digital transformation at some of the world's most recognized technology and financial services companies. Prior to joining Varo, she served as Chief Technology Officer and President of Expedia Product & Technology at Expedia Group, where she modernized the company's global travel infrastructure, integrating AI-driven personalization, modular architecture, and advanced cloud capabilities across its family of brands.

Earlier, she held executive leadership roles at Verizon Media and Gap Inc., where she led enterprise cloud migrations, e-commerce platform evolution, and large-scale product delivery initiatives across global markets.

Rathi also served as Senior Vice President and Chief Information Officer of Enterprise Growth at American Express, where she was responsible for the technology strategy and operations of the Serve platform and a suite of prepaid products including Bluebird.

Rathi's early career includes engineering leadership roles at eBay, Yahoo!, Sun Microsystems, and WebMD, where she consistently delivered improvements in platform stability, operational agility, and customer experience.

In addition to her executive work, Murthy is a board member at PagerDuty, Inc., a leader in digital operations management, and serves as an External Expert Advisor to the University of San Francisco's Board of Trustees Committee on Information Technology Strategy. She is also a regular speaker at industry events and leadership forums, offering thought leadership on topics such as fintech innovation, integrating AI, platform transformation, and executive technology leadership.

Guy Baker, CFP, Ph.D., is the founder of Wealth Teams Alliance in Irvine, California.

He is a member of the Forbes 250 Top Financial Security Professionals list and is author of "Maximize the RedZone," a guide for business owners, as well as "The Great Wealth Erosion," "Manage Markets, Not Stocks" and "Investment Alchemy." He received the 2019 John Newton Russell Memorial Award for lifetime achievement in insurance.

Despite the slump, demand for tax advisory services has held up better than many other areas of the overall professional services market. The global management consulting market shrank 13 percent to $21 billion. The report predicts the global tax advisory market will recover soon, with a growth rate of 7 percent anticipated.

The COVID-19 pandemic has reshaped the tax advisory market, stalling M&A activity and international tax work. M&A-driven tax work declined 21 percent last year, reducing total revenues from $1.6 billion to $1.3 billion. In contrast, compliance-related tax management fared comparatively well last year, even though clients initially tried to do more of their work in-house, with only a 5 percent contraction in revenues tied to efforts to shore up cash reserves by taking advantage of tax deferrals and other government support schemes.

“The pandemic has radically reshaped priorities, with many different concerns all vying for space at the top of the corporate agenda,” said Source Global Research managing director Fiona Czerniawska in a statement Monday. “Finance and tax functions are having to balance the demands of tax compliance with the ability to respond to new and unprecedented risks. That balancing act saw attempts to reduce reliance on external support early in the crisis, only for demand to recover as clients recognized that they lacked the capacity and/or capability to carry out compliance work by themselves.”

Some tax firms report greater demand for their services. “We’re seeing lots of requests for compliance services, which is driven by the fact that many clients just weren’t prepared for this,” said Ryan LLC chairman and CEO Brint Ryan in a statement.

When it comes to clients in different sectors of the economy, tax advisory work in the energy sector declined 23 percent, in the manufacturing industry by 10 percent, in the services sector by 18 percent, and in the technology, media and telecommunications sector by 18 percent. However, much of the decline in that sector seems to be due to media clients, and the high-tech and telecom industries experienced significant growth of 22 percent and 16 percent respectively. Tax advisory work in the insurance industry grew 4 percent. The pharmaceutical and health care sectors saw growth in tax advisory work of 19 percent and 4 percent, respectively. Regulation is becoming an increasingly significant issue in all of those industries and sectors, and is making itself felt through increasing demand for compliance-related support.

For those tax advisory firms that do win work, fee rates are coming under increasing pressure, which will present even more of a challenge throughout this year. Only 3 percent of the clients surveyed in March 2020, before the pandemic had truly taken hold, anticipated that fee rates would fall across the industry; however, by September, that had risen to over 60 percent. While the pandemic itself is undoubtedly the main driver of this pressure on fees, it’s also a consequence both of the growing demand for compliance work which, while complex, isn’t an expensive, highly specialized service, and clients’ belief that a wider range of tax services have been similarly commodified.

The market is expected to recover this year, with growth likely to be focused in specific areas. The continuing pressure on organizations’ own in-house tax functions will probably contribute to growth in compliance-related work. The Source report found that once the crisis is over, the area of tax where clients are most likely to increase their use of outside support is compliance (70 percent of those surveyed predicted they would increase the use of third parties for doing this work). There’s also likely to be a resurgence in M&A-related tax work, as many of those surveyed anticipate the prolonged crisis will lead to an increase in restructuring and transactions.

“We anticipate a higher uptick [in tax work associated with M&A] because the pandemic has caused executives around the world to reflect on what it is they’re trying to achieve within their business,” said Lisa Stott, global lead for tax advisory services at Deloitte, in a statement. “They’re reflecting on whether they have the right strategies, and how to introduce resilience into their business so they can cope more effectively if anything like this happens again. Therefore, a lot of clients are already making decisions about divestments, expansions and acquisitions to make their supply chains more resilient.”