In the middle of a public health and economic crisis, a so-called flight to safety sounds like a great idea.

That's what happened in the last financial crisis, experts say. And even as the coronavirus has already prompted annuity issuers to alter their products following the Fed's interest rate cut last month, annuities are still coming off their best year for sales since 2008.

Fixed annuities, fixed-index products and structured annuities — which hadn't even hit the marketplace that year — could prove attractive to advisors and clients in 2020 as low interest rates slash the yields on CDs and bonds, according to experts. In some cases, the annuities could present returns three times as high as 10-year treasuries that have fallen below 1%.

These conditions make it a good time to discuss whether annuities might fit a client’s goals, says Sheryl J. Moore, CEO of research firm Wink. The suspended sales of certain annuities, lower-ceilinged rates on other products and further adjustments to the shelf in response to the macroeconomic factors could be spooking some planners, according to Moore.

“There's a sense of impending doom for a lot of advisors,” she says. “The great thing is that, once we get through this, we're probably going to get record sales.”

The U.S. Small Business Administration and the Treasury Department relaunched the Paycheck Protection Program on Monday to new borrowers, prioritizing loans from community lenders.

Growth in small business jobs and wages declined last month as a result of the novel coronavirus pandemic, according to payroll giant Paychex.

The economic fallout from the coronavirus pandemic is continuing.

She and Michael Robinson, co-founder of The Blueprint Insurance Services, recall that flight to safety that happened in the wake of the financial crisis a dozen years ago. Index annuities with lifetime income riders could play a critical role in the current one, Robinson says.

“Every insurance carrier across the board has lowered rates in conjunction with what's happening in the marketplace,” he says. “The true actual concrete ability of the client solution has not changed, and that goes across the board for all clients using this solution: it's the upside potential with limited downside risk.”

Fixed account payouts between 2.30% and 2.85% look compelling at a time when 10-year treasury rates are around 0.70%, agrees David Lau, CEO of DPL Financial Partners. To the fee-only insurance network’s founder, the situation displays how much portfolios have changed in recent decades.

Cash that’s “basically earning zero” these days would have been delivering far higher yields to clients some 15 or 30 years earlier, according to Lau.

“Sometimes you unfortunately need an event to cause people to pay attention, and I think this really highlighted the risks that are in portfolios, along with the benefits that annuities can provide,” Lau says. “The amount of risk being put into portfolios is just far greater than it has been in the past just because interest rates are so low.”

Low interest rates had hurt annuity sales before the pandemic ushered in a new recession. Fixed annuity sales tumbled 18% year-over-year in the fourth quarter to $30.8 billion, and total sales slipped by 8% to $57.6 billion, according to the LIMRA Secure Retirement Institute.

Still, fixed products and FIAs set records in sales in 2019, with fixed annuity contracts rising by 5% from the previous year to $139.8 billion and FIAs up 6% to $73.5 billion. Total sales expanded by 3% to $241.7 billion — the largest value of contracts sold since 2008.

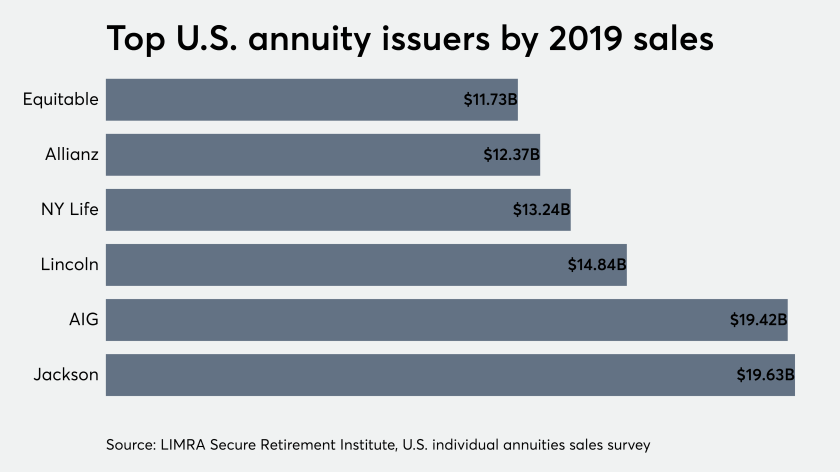

In terms of issuers, Jackson National Life Insurance regained its position as the No. 1 seller after losing the top spot to AIG in 2018. After Jackson ($19.6 billion) and AIG ($19.4 billion), Lincoln Financial Group ($14.8 billion), New York Life Insurance ($13.2 billion) and Allianz Life ($12.4 billion) rounded out the rest of the top five issuers in 2019, the institute’s figures show.

The list may look the same in the coming year as the macro environment reaps changes across the product shelf. In addition to striking their rates, issuers are also reducing the premium bonuses offered with certain products and tweaking payouts on their guaranteed lifetime withdrawal benefits, according to Moore.

Organizations and firms are donating N95 masks, providing resources at no cost and taking steps to protect employees and practices nationwide from the spreading pandemic.

If the economic fallout from the pandemic lasts longer, issuers could also begin altering the commission structure of their products, she says. Still, advisors may find it useful to compare CDs to annuities at this time.

“It's kind of a perfect storm that's resulting in some really undesirable rates right now,” says Moore. “These products are about risk transfer rather than rate return...They're still competitive, it's just the current market environment is not good for anybody.”

It’s of the “utmost urgency” that advisors reach out to their clients, according to Robinson, whose firm provides outsourced insurance services to RIAs. Annuities could offer “yield in a safe fiduciary manner” under the correct circumstances, he says.

“With insurance, especially on the annuity side, it's all about a bond alternative, but it's also about protection,” Robinson says. “And third, it's about income for life. Those are the three variables you're looking at.”

FIAs weren’t yet as popular after the last recession as they are today, according to Lau, who cites a “big spike” in variable annuity sales after the 2008 crisis. Structured VAs, also known as buffered or registered index-linked annuities, can also provide downside protection. DPL is currently offering its fee-only annuity services free to all RIAs until June 1.

“There's just so much more activity around annuities,” he says. “You've got to be prepared to talk about them, because your clients are getting touched by people propositioning them with annuities at all times.”