In the early weeks of the coronavirus pandemic, Truist Financial was searching for ways for customers to get the help they needed without idling on hold or congregating in unsafe clusters outside of a branch.

The Charlotte, N.C., company introduced a cloud-based callback feature for those seeking help by phone and designed an online-scheduling tool for branch visits. Later, when lobbies closed, customers could use the tool to schedule time on the phone with a branch employee.

Another piece to this multichannel approach was a chatbot, which Truist deployed on April 1.

“We wanted to fend off some of those questions that may normally have been buried in a big FAQ or in website content,” said Ken Meyer, chief information officer for digital channels and innovation at the $504 billion-asset Truist. “We looked at it as an opportunity to streamline client questions.”

Chatbots and virtual assistants are not all created equal, said Chris Ward, principal consultant at Mapa Research, a part of Informa Financial Intelligence. Some answer questions and provide support while others, such as Bank of America’s Erica, perform transactions.

But Truist is part of a trend toward financial institutions' adoption of these features. “In the last two to three months, there has been a huge uptick in banks saying we wish we had a bot in place and now we’ll start investing in that space as well,” Ward said.

Banks often hesitate because they are worried the technology won’t be good enough and that customers will get frustrated. But the more customers ask questions, including those riddled with typos and awkward phrasing, the better the bot will become if the underlying artificial intelligence capability is sufficient.

“These things will be somewhat imperfect when you go to market, but they will improve over time the more they are used,” said Ward.

Truist didn’t hesitate: The company rolled out its chatbot a few days after the initial conversation took place. The goal was to set it up quickly, then learn from and refine the work in progress.

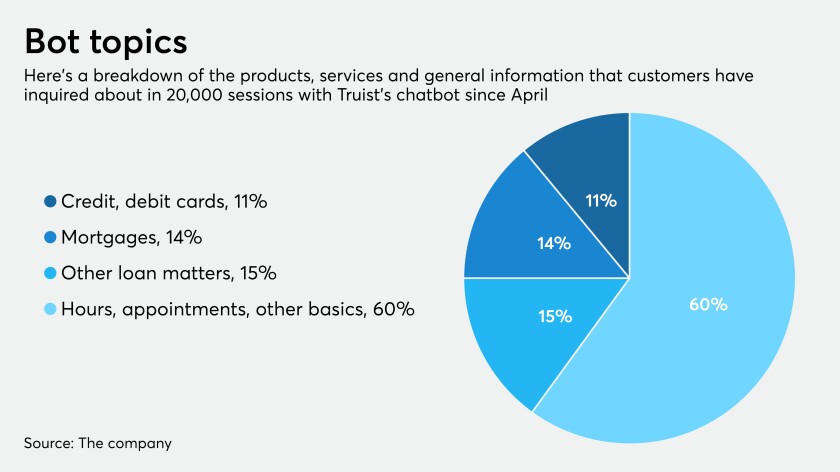

So far the bot has fielded 20,000 sessions, or “20,000 phone calls we were able to avoid, 20,000 clients who didn’t have to sit on hold,” said Meyer. And despite its narrow focus, the bank views it as a valuable learning experience that can be applied to future emergencies and has planted the seeds for new digital tools.

The Internal Revenue Service’s Criminal Investigation Division issued a warning Thursday about a new wave of COVID-19 scams tied to the latest round of stimulus payments, especially targeting taxpayers in the District of Columbia.

Last month's COVID-19 relief bill has accountants recommending some deductions to clients, and wondering about the applicability of others.

The U.S. Small Business Administration plans to reopen the Paycheck Protection Program to small lenders on Friday and to all lenders next Tuesday.

Meyer and his team — which encompasses product management, design employees and engineers — settled on the Einstein Bots from Salesforce as their platform. Salesforce was a longtime vendor for SunTrust Banks, a predecessor of Truist, mainly for customer relationship management capabilities.

The original version only handled mortgage-related questions because those queries caused the biggest backlogs at the contact center, but it later expanded to cover credit card and personal loan issues. The bot also started off as more of an interactive set of FAQs than a conversational agent, offering customers a menu of topics that they could click through to find their answers. As Meyer’s team worked on natural language processing capabilities, it added a “Type your message” box when a customer opens the chat window so they can input their own queries.

Salesforce launched Einstein Bots, which can be deployed across text-based channels, in 2018. The bots are built on the Customer 360 platform, which is intended to be a single, connected source of data about individual customers. Besides handling straightforward queries that customers ask in their own words, the chatbot will have context on the customer and can personalize interactions accordingly.

Customers are routed from the websites of SunTrust or BB&T, the other predecessor company of Truist, to its public-facing online COVID-19 response center. Members of Meyer’s team designed the bot to be as polite as possible (“I may not have the answers you’re looking for, but let’s give it a shot”) in answering common questions. They trained the assistant to understand and respond to those questions, even when words are spelled incorrectly or the phrasing doesn’t align with the prompts that Truist offers, but Meyer acknowledged that improvements will be made over time.

But the bot was never meant to handle topics that strayed from payment issues during the pandemic. Questions about branch hours, for example, will eventually lead the user to a contact number rather than give a direct answer.

That means engagement has been dwindling, most likely because customers are familiar with their relief options by now. But Meyer expects that the chatbot-building process will pay dividends in the future.

“It’s good to have a disaster or emergency-type chat platform,” said Meyer. “God forbid we have another COVID-19 or a hurricane or something like that. This should be part of our normal playbook on how we are assisting clients.”

Moreover, training the bot to understand natural language will come in handy as Truist experiments with new digital products.

“We’re looking at all options in how to engage with this conversational channel, maybe in the form of an [authenticated] chatbot, maybe engaging with an Alexa device or a HomePod,” said Meyer.

He is also optimistic about the appointment-scheduling tool, which Truist originally built in-house but later relaunched with Salesforce. Customers continue to set up calls and branch appointments; Meyer is also exploring the idea of scheduling video calls.

“I don’t think chatbots are taking over the world and solving every client’s problem,” he said. “But you need to have a holistic solution and understand how clients want to engage with you, whether that is through digital, the phone, a chatbot or by going into a branch.”