Sales of recreational vehicles have accelerated so much since the economic shutdown, which has put many antsy travelers on the road instead of in the sky, that dealers like Niel’s RV in Los Angeles can’t keep up.

“Getting inventory has been very difficult,” said General Manager Scott Rogers, who estimates that sales at Niel’s are up 40% this year. “Dealers have just a ton of orders.”

That trend has been welcome news, too, for banks that finance consumer purchases of motor homes, campers and trailers. Those loans, along with marine financing, have become a rare bright spot amid the pandemic recession’s weakening of loan demand.

“At the beginning of the pandemic, there was a lot of uncertainty, but since mid-April demand has skyrocketed, and we've been at record levels into August,” said Michael Lax, executive vice president of RV Marine Sales at the $100 billion-asset Bank of the West in San Francisco.

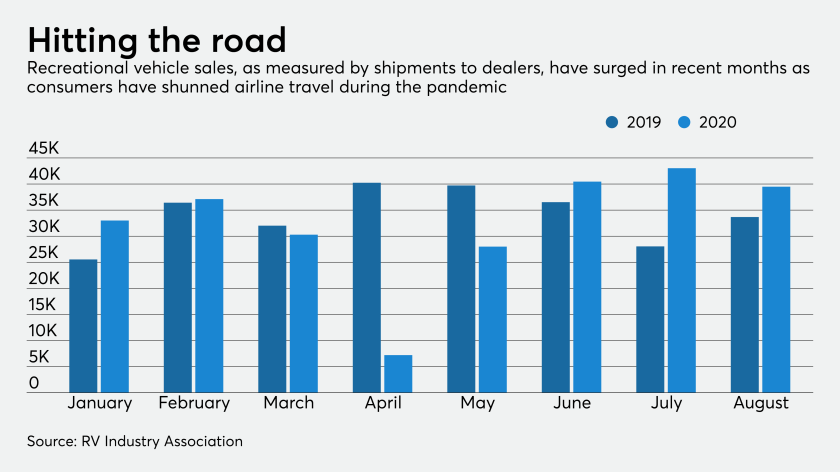

Total shipments of RVs plunged 82% in April from the same month last year as businesses closed and workers were laid off en masse, according to the RV Industry Association. But sales soared in the months that followed as consumers sought to social distance out on the highways.

Total shipments over June, July and August were up 25% from the same three months in 2019, the association said.

“RVing is a safe and compliant way to recreate at a time when the country is essentially shut down for typical vacations,” Lax said. “The industry captured a lot of first-time RV buyers, and we've seen a big uptick in that space.”

Zachary Wasserman, chief financial officer at the $118.4 billion-asset Huntington Bancshares in Columbus, Ohio, said at an event hosted by Barclays Capital in September that RV sales were expected to accelerate through the back half of 2020.

A majority of middle-market CFOs are predicting an economic recovery and revenue increases for their companies in 2021, according to a new survey by BDO USA.

Tax-refund delays and stimulus-payment hiccups could spill into the upcoming tax season as the Internal Revenue Service continues to face challenges related to the coronavirus pandemic and as Congress considers yet another round of direct payments.

With the filing season upon us, a raft of brand new challenges await ahead of the April 15 deadline.

RV financing is often lumped into the same operation as lending for boat sales. Watercraft sales, too, have risen so much that dealers are having trouble keeping them in stock. About eight in 10 boat dealers who were surveyed by researchers at the investment firm Baird said inventory was too low.

But every craze has its risks, the researchers warned last month.

"I am being a bit conservative with my orders going forward when it comes to new boat inventory,” one dealer told Baird, according to its Sept. 8 report. “My thoughts are that the next year or two the market is going to get flooded with boats from those new boaters that did not know what they were getting into or got financed and cannot make the payments.”

Financing for the purchase of RVs, unlike shorter terms for boats, tends to stretch out to about 20 years. Interest rates can run from 4% to more than 15% in some cases.

SunTrust Banks, which combined with BB&T last year to form the $494 billion-asset Truist Financial, has been one of the largest RV financiers in the market. A spokesman for Truist said in an email that strong sales have continued through 2020, but he indicated that the Charlotte, N.C., company is keeping an eye on demand and broader economic trends.

“We believe some of the growth is attributed to consumers choosing to purchase RVs given restrictions on travel and concerns of being in large groups due to the pandemic,” the Truist spokesman said. “We are growing our business strategically and conservatively, with a focus on deep relationships with dealers/brokers and high-quality loans. We are also closely monitoring the industry in light of economic and unemployment trends.”

The boom in sales has not been enough to lure the $184 billion-asset Ally Financial back into the RV financing business that the company exited two years ago. Executives didn’t comment on projections for the industry at the time, only saying the Detroit company wanted to dedicate more resources to auto lending.

“We have not changed our position and are still focused on the auto business,” a spokeswoman said in an email.

Still, lenders in this niche are undoubtedly hopeful for as long a run as possible given that growth is expected to remain light in most other commercial lending categories.

Goldman Sachs researchers said in an Oct. 6 note to clients that third-quarter commercial loan growth is expected to be 7% weaker than a year earlier, with the biggest slowdown in commercial and industrial loans.

“We expect loan growth to be muted and recover only in 2021,” Goldman researchers wrote.

To take full advantage of the RV-lending boom for as long as it lasts, Lax at Bank of the West said he and his colleagues envision growing partnerships with dealers and even original equipment manufacturers.

“We think it's a great time to be in the RV industry,” Lax said.