The final debate is in the books, and the 2020 election between President Donald Trump and Vice President Joe Biden is in just a matter of days. As the country looks to make its choice between two decidedly different candidates, tax preparers are watching the race play itself out from a unique vantage point.

One of the legislative reforms President Trump touts as a signature achievement during his first term is the passing of the Tax Cuts and Jobs Act. The Tax Code changes were sweeping and included major adjustments to the policy on corporate taxation, itemized deductions, and business debt. While some of these alterations were pretty straightforward, many — such as the qualified business income (QBI) deduction — were extremely complex.

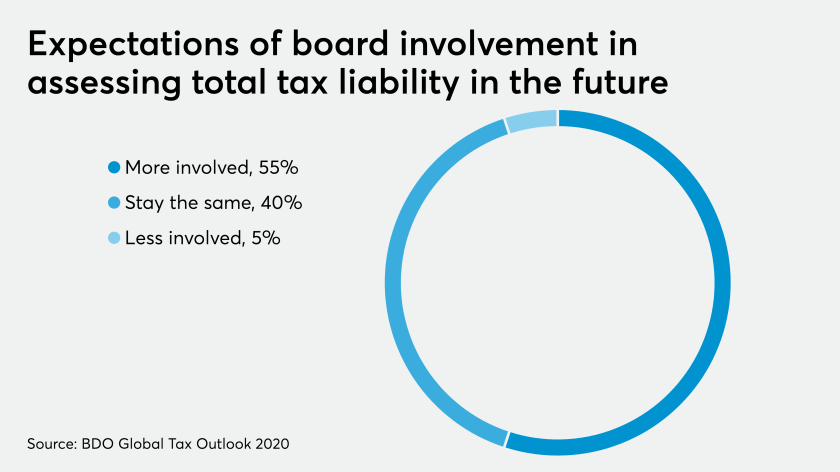

Eighty percent of the business leaders surveyed by BDO in the Americas said the focus of tax legislation changes constantly as the result of the elected party and/or it is difficult to predict.

Wages are set to go up in Florida after voters passed a minimum wage ballot initiative in Tuesday’s election.

Despite lingering uncertainty over the U.S. election, the country’s ultra-rich already have plenty to celebrate from Silicon Valley to Illinois.

As the candidates embarked on their respective campaigns, it quickly became clear that one of the biggest areas of divergence in their positions is tax policy. At the absolute base level, President Trump is proposing to lower taxes further if elected for a second term, while Vice President Biden wants to raise them. Within those broad strokes exist dozens of possible nips, tucks and more significant changes to the U.S. Tax Code. Given these stark differences, how might the election influence the day-to-day lives of tax professionals?

Here are some of the major differences between the two candidates, and how a shift in policy could create the need for major clarifications.

Corporate tax

Under the TCJA, the corporate tax rate was lowered from a maximum of 35 percent to a flat 21 percent. The law also introduced a quasi-territorial tax system for corporations, assuming they paid the one-time deemed repatriation tax. The president is seeking a further cut to the corporate tax rate to 20 percent, while Vice President Biden wants to increase the rate to 28 percent.

That’s fairly straightforward, but what is more complex is Biden’s proposal for a minimum tax. Biden wants to impose a 15 percent minimum book tax on corporations with $100 million or more in net income. This is in response to reports that certain large corporations pay little or no federal income tax due to net operating loss carryforwards or foreign tax credits.

The Tax Code previously included a corporate alternative minimum tax, but the TCJA did away with it. In the event of a Biden win, tax professionals advising corporate clients will need clarity on the types of income that would be taxed (operational, investment, or both), the ins and outs of how a minimum tax would work, and how this may align with any efforts from the Organization for Economic Cooperation and Development (OECD) to install a global minimum tax. Presumably, there would be a gray area to sift through.

The Qualified Business Income deduction

Under the TCJA, the QBI deduction allows eligible taxpayers to deduct up to 20 percent of their QBI, plus 20 percent of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. Income earned through a C corporation, or by providing services as an employee, is not eligible for the deduction. Also, income from certain service businesses is not eligible for 199A if the taxpayer’s taxable income exceeds certain thresholds.

The deduction is one of the most complicated provisions of the TCJA, as it required nearly 50 clarifications from the IRS to flesh out the intricacies. The gig economy alone, which includes a swath of independent contractors — from Uber and Lyft drivers to eBay and Etsy sellers — presents a fundamental challenge to IRS auditors. Are these activities businesses, as defined by 199A (which borrows the definition from U.S. Code § 162)? It’s still not entirely clear.

Meanwhile, Biden is proposing to phase out that deduction permanently for some taxpayers, adding a layer of complexity to an already multifaceted issue. Which taxpayers will no longer qualify? How long will taxpayers need to prepare? After years of learning the ins and outs of the QBI deduction, any change is bound to create some headaches.

Payroll tax

One of the president’s actions that made waves this election cycle was an offer to give employers the option to defer payroll taxes. While many employers chose not to take the deferral, the ones that did have until next April 30 to collect the deferred taxes from employees. However, Trump complicated matters by stating that, if he is reelected, he wants to eliminate that deferred payroll tax.

In the meantime, employers and their employees have no way of knowing whether the deferral will become permanent, throwing a wrench into some firms’ plans. What’s more, Biden is seeking an expansion of the payroll tax by removing the Social Security tax cap — which is currently capped on earners of $137,700 this year and raises to $142,800 next year — for earners who make more than $400,000. Needless to say, that would change things considerably for high income earners, and tax pros will have to be geared up for it.

Expecting the unexpected

Whether it’s Trump or Biden who wins the race to the coveted 270 electoral votes, tax policy is undoubtedly going to go through another set of changes. That will saddle preparers with the onerous task of not only adjusting to whatever new wrinkles emerge, but trying to anticipate what’s most likely to happen. In a year as unpredictable as 2020, it’s not an enviable position, but tax pros who can walk the tightrope will put their clients in the best position to move forward.