The ever-changing landscape of giving advice has never been so dicey as this year. Perhaps the economic global growth environment we enjoyed in the past decade lulled us all into a sense of complacency. What could go so wrong that we’d be struggling to survive so early into the new decade?

It’s against this challenging backdrop that we continue to advise clients on their financial security. Add in the complexities of this year’s election, and we have a recipe for uncertainty and fear. No matter the outcome, the only thing we can count on is change. Here’s what we need to remember as we continue to advise:

Tax law exists to raise funding for the government to run its many operations, but it also exists to encourage specific sought-after economic and social behaviors. And there is no tax law that is “forever.” In our work with clients, we must always strip away the benefits of tax law as it exists now and review the advice we are giving to be sure it will still stand up if a law changes.

Leaders of the Big Four CPA firms and major companies are stepping in and asking Congress to allow a smooth transition to the Biden administration.

Given the size and number of tax changes proposed by the Biden administration, it’s no wonder advisors face challenges in helping clients prepare for the year ahead.

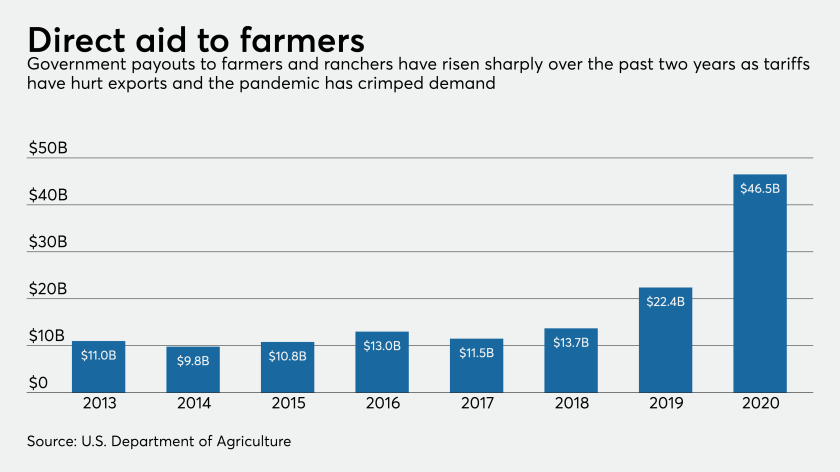

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

Take tax-free muni bonds as an example. What if Congress suddenly deemed the interest from tax-free muni bonds to be too expensive in its quest to raise revenue and decided they were to be viewed as an “elitist” asset? If muni bonds were stripped of their tax-free status, or taxed via a new “Alternative Minimum Tax,” would investing in them still be sensible? And what would happen to the valuations of existing bonds?

Here’s another example. What if in our mad rush to convert retirement money to Roth IRAs, we failed to notice that someday, at this pace, the government will most likely need to tax some if not all Roth distributions? Would our clients still be fiscally OK if they give up a large percentage of their net worth today for a permanent tax-free “promise” that may be yanked away tomorrow?

We hear rhetoric every day out of Washington and in my state, California, that the haves are being too greatly benefited by the tax law and its many avenues of lowering taxes for the wealthy. And the recent “reveal” of Trump’s income tax bill is adding fuel to that fire. So when it comes to tax law, we should expect the unwelcome and review every tax move clients take. If any could be fiscally harmful were the benefits eliminated, we need to have a frank dialogue, disclosing our concerns and reviewing possible alternatives or simply discussing the inevitable increase in taxes and how to be financially prepared to cope.

Portfolio management in an election year can mimic a game of Twister. Wisely, those on the campaign trail seem to be avoiding saying outright that they would like to raise taxes on most individuals. That doesn’t play well in the middle of a global pandemic with an unemployment rate of almost 8 percent. So instead, the politicians are indicating that corporations are fair game. Who’s going to complain about sticking it to Corporate America to pay more taxes versus increasing taxes on individuals? Of course it’s all smoke and mirrors, since businesses will pass through to buyers as much of their overhead, including taxes, as they possibly can.

As a result, investors (or everyday citizens) might be the worst hit initially, as profits could fall substantially and market prices along with them. According to Fidelity, 88 percent of 401(k) holders contributed to their plans in Q2 2020. If these plans are impacted adversely in valuation because markets are falling, then maybe the government will step in with ideas to create more social saving programs such as guaranteed retirement accounts to offset that volatility. We need to be prepared for that possibility.

With respect to estate planning, why has this become a political football? It feels like Washington is changing some aspect of these “lifetime” planning laws as frequently as people change their socks. It’s next to impossible to do estate planning for one generation these days, let alone the multigenerational planning we’d really like to embark upon. Again, it’s a matter of knowing the current laws and making the right moves today without painting ourselves and our clients into a corner they cannot fiscally get themselves out of. And maybe even more important, it’s about taking advantage of the current estate planning laws while we can, while being sensitive to existing and potential new “claw back” rules.

One area to look at closely is the current lifetime gifting rules. If we are nervous that estate limits will be reduced to $5 million or less, as is the frequent campaign trail rhetoric, perhaps wealthier clients should be encouraged to gift up to the $11.58 million current limits now, while they can.

So here’s the bottom line: There are no sacred cows, especially in an election year and the year or two that follow. Expect and be prepared for the unwelcome (and the unexpected). Know that Congress in its endless negotiations can take a perfectly logical idea and twist it into a law that is both illogical and tough to implement, that you’ll probably not have any guidance in place in a timely fashion, and there will be a lot of last-minute “fixes” that may or may not be enacted in a useful way.

What’s an advisor to do? Meet with our clients and review current laws and strategies. Then, let’s collaborate with each other! The most important people in my professional life outside of my clients are my clients’ other advisors, whether they be CPAs, estate attorneys, etc. It's going to take a village to navigate people through this time, so we need to reach out and talk to each other about what we are hearing from clients and what we are seeing as planning opportunities and pitfalls.

We also need to discuss what we are keeping top of mind for our clients and their futures. In this collaborative environment, we should be bringing our best ideas forward. We should also share them with clients, allowing them to hear our views and make informed decisions. And then, it’s like I always say: lather, rinse, repeat.

See you on the other side of the election!