Sadly, in times like these, we don’t have Jack Bogle around to calm us down anymore. But having spoken with him personally several times and followed his sage advice and work for decades, I have a feeling I know what he might say. At the end, I’ll tell you why I’m pretty sure this is just what he’d tell me now.

Q: Mr. Bogle, it’s a privilege to speak with you again. It’s been an extremely rough time for the world and certainly for investors. Both U.S. and international equities are down more than 30% from the high reached just a few weeks ago, on Feb. 19! What is going on?? What should financial advisors and investors do??

A: Take a deep breath, Allan. I assure you that hope will return and markets will rebound.

Q: Are you saying stocks have bottomed and will now recover?

A: Of course not. But it’s important to remain calm and have perspective. It’s possible the markets could fall another 15% or 20%. Be sure to keep an adequate portion of your portfolio in bonds.

The Institute of Internal Auditors is giving corporate America only a modestly better grade on governance in 2020 compared to 2019, and any improvement is probably due to the coronavirus pandemic.

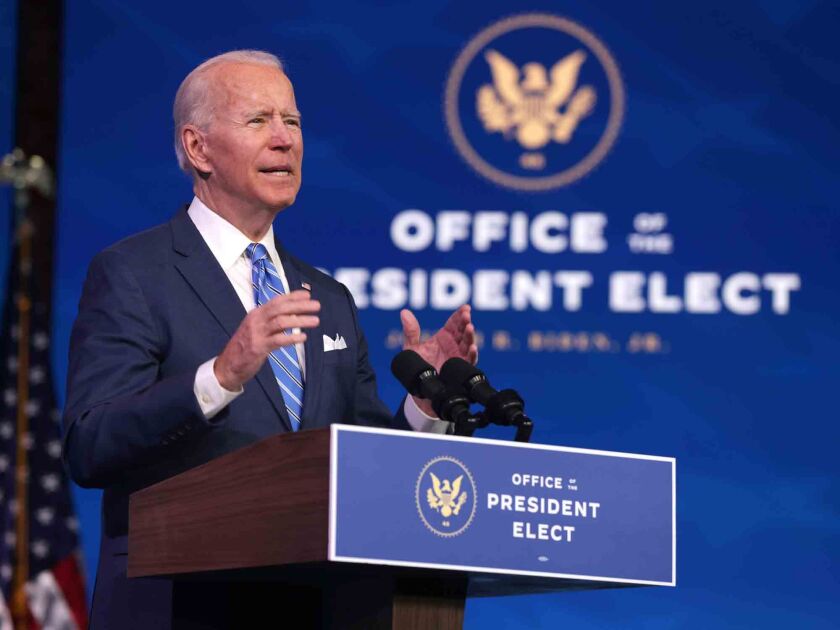

President-elect Joe Biden’s $1.9 trillion COVID-19 relief plan is designed to both pump money into the economy and contain the coronavirus pandemic.

President-elect Joe Biden’s $1.9 trillion economic relief proposal serves as the opening salvo in a legislative battle that could be prolonged by the go-big price tag and the inclusion of initiatives opposed by many Republicans.

Q: What should advisors and investors do now?

A: Individual investors fall into two classes. If they're speculators, they will be scared and it may get worse and they should probably get out. I don't give speculators advice. We clearly have a problem with confidence in the market. Equally clearly, as all market cycles go, we have gone from hope to greed, and now we're at fear. Eventually hope will return, as will greed, unfortunately. But I think it's going to be awhile before we have the kind of greed that we have witnessed in this recent era reappear.

Q: So an investor needs to stay the course?

A: Even if I was pretty confident that the decline will continue — and I think it's likely — you've not only got to get out right, you've also got to get back in at the right time. You must be right twice. So if you get out now, and the market goes way down another 15 or 20%, so many investors will be so scared they won't get in. I was always a stay-the-course kind of investor. I have tended to be comfortable when these things happen. I don't much like them. But on the other hand, we have a system where there has been much too much aberrant behavior. You pay a price for all this and we're paying the price now.

Q: Why shouldn't I take my money out of all of these stock and bond indexes and just put it in cash or a CD?

A: You'll probably end up paying a lot of capital gains taxes if you’ve truly been a long-term investor. And you might be right, short term, to do so. But what are you going to do next? A good bit of this decline likely has already occurred. If you could get out and get into CDs when the market was 30% higher than it is now, that would have been a very nice thing to have done. People are always bullish at the highs and bearish on the way down. So you're buying at the highs and selling at the lows. What sense does that make? I would advise against ever doing 100% of anything. It's never a good idea to time the market. In the long run, investing is not about markets at all. Investing is about enjoying the returns earned by businesses. And the stock market is nothing but a giant distraction in that quest to acquire returns that businesses earn. It over-magnifies everything. Investors get scared. Their advisors get scared. And you get exactly what we're having — a bit of a mess.

The 20 top-performers are largely comprised of low-cost tech offerings.

Q: But people are saying we could see a repeat of what happened to the stock market in 1987 or worse. Do you think that's the case?

A: 1987 was nothing! In a short period — one day — it was pretty much all over. The market went down a bit less than 25%. But by the end of the year, it was up 3%. I’ll repeat: 1987 was an up year in the market. I don't think this one will be. But if people are saying that it could be like 1987, they should pray that it is!

Q: Can you leave us all with some final words?

A: Sure. I was an indexer most of my life. I owned the market. And I was happy to do so. Markets come and go. In my book, I used a quotation that I stole from Shakespeare. A day of movements in the market is like "a tale told by an idiot — full of sound and fury, signifying nothing." I'll say this seems to be signifying a final (at long last) reversal of the long-running bull market that has characterized the recent era.

Why I’m confident this is what Bogle would say now

That perspective has calmed me down again and again, and I suspect has done the same for many long-term investors. I believe his wisdom will endure.

While I consider myself fortunate to have known Jack, there is a more powerful reason I believe this is what he’d say now. Why? Because I adapted this imaginary interview from an actual one he did in the early days of the last market crash, about 13 years ago. The interview was with Businessweek editor Emily Thorton, and was titled, “Bogle: ‘Hope will return.’” In the depths of the last bear, I looked at this article often.

Jack Bogle was right then and his wisdom is just as relevant now. Clearly, he didn’t know the coronavirus was coming, but he knew steep market plunges were part of investing and that each plunge was different. Hope will indeed return. I’m confident Bogle would say that is the message financial planners should be giving to clients.