Clients aren’t the only ones in pain now. While they are losing quite a bit of money on paper, we are all living with the added fallout of the coronavirus pandemic.

The workload for the advisor has increased exponentially — between phone calls, writing more frequent newsletters, rebalancing, providing a lot of handholding, and dealing with their own staffing issues — they are stressed to the hilt too.

Adding to the agony? Since the majority of advisors charge based on assets under management, they are going to experience significant revenue decline. Why do advisors do this to themselves?

The main reason: An AUM fee is the easiest way to charge people potentially a lot of money and not actually say what they are paying. Touting a 1% AUM fee is much easier than telling them they are paying $20,000 on a $2 million portfolio. People don’t like to hear their fees in hard dollars and advisors are happy to oblige.

The traditional way of charging clients is rapidly falling by the wayside as advisors seek better options. Dont get left behind.

I started my comprehensive financial planning firm in 2004 under an AUM model. I quickly saw the problem with my choice — the value of a client’s portfolio had nothing to do with the amount of work I was doing for them on the planning side. An article written by Bob Veres (a later version was published as “The AUM fee is toast”) and a conversation with a member of Alliance of Comprehensive Planners convinced me to go to a flat fee model based on complexity, which I started in 2007. Other advisors told me I was crazy.

When 2009 hit, I had the last laugh. My business took off as clients left advisors who charged AUM fees and did little to no planning. More advisors became intrigued by my model and I’ve written and spoken about it through the last decade. The result? A handful of advisors used flat fee models before 2009. Now we moved up to a bucketful, but the large ocean of advisors still predominantly operate under an AUM model.

Why didn’t more planners learn the lesson? And will more change after the coronavirus crisis passes?

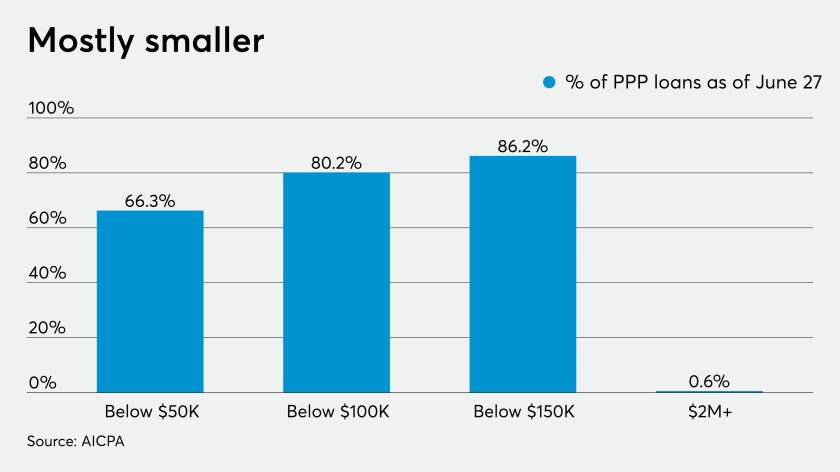

As the time comes for businesses to apply for PPP loan forgiveness, CPAs can provide vital assistance to ensure success for their clients.

Senate Majority Leader Mitch McConnell on Wednesday closed off chances that the Senate would pass anytime soon a House bill that would give most Americans $2,000 stimulus payments.

The initial direct deposits of the second round of economic impact payments are already going out to taxpayers.

I blame the market recovery. As time passed, people forgot the pain. The challenge of switching to a flat fee model was not worth the effort. Revenues were at all-time highs. More advisors added financial planning to their menu of services, along with the additional advisors and technology needed to support that service. They did this to compete for more clients. Why not? They were making plenty of money.

So now they are back in the same place, but even worse than 2009. Our operations manager belongs to a study group and on a recent call, other members were lamenting about staffing challenges, potential layoffs and pay cuts. The pain was palpable on the call and she was thankful for how we chose to work with clients.

As for the future, I thought we would see a change after 2009 and we didn't. I can’t say advisors will definitely make a change to fee structures after this crisis passes, but I think they will.

3 things advisors should know

Hopefully advisors will learn their lesson going forward. For those advisors who are charging only AUM, I have three main points of advice on what to do from here.

1) You cannot change your fee model in the middle of the storm. Take a deep breath, shore up your finances, protect your health, and the health of your employees and clients. Use this time to plan the next steps. We aren’t sure how long living restrictions are going to last, so make the best of it.

If you are providing financial planning, what does it look like? Many advisors provide a financial plan to get a client in the door and they never revisit it. This is a mistake.

In our firm, we provide a comprehensive plan at the beginning of the engagement, and we revisit each part of the plan throughout the year, every year — cash flow analysis, tax planning, projections, insurance reviews, estate reviews, college planning, and investment planning. No one topic receives more glory than the others — this messaging makes the client realize that the important part is the holistic plan, not investment management.

The reviews are by email and phone call, so we have frequent communication with the client. If we identify a hole or a client has a concern, we help them through the issue. By providing a constant drip of reviews and taking care of potential problems when they are first identified, our clients know that we have their back and they don’t question our value.

Our investment manager does a yearly review of asset allocation, but we don’t provide performance reports. This has the nice side effect of saving a ton of money on performance reporting software. We hold the view that performance reporting does nothing more than create drama that does not need to exist — both on the upside and the downside.

2) Plan out what advice you will deliver to your clients in the future. Create a process to deliver that advice efficiently. Figure out how much it costs you to provide that work, and plan to charge accordingly.

When we are over this disaster — and it will end at some point — that is the time to change your fee structure. Whether it be adding hourly advice, charging flat fees, or charging a large planning fee with a small AUM fee, you need to make a change so you aren’t in this pickle again.

3) If you aren’t providing real financial planning, you should. Only by knowing a client’s goals and values can you effectively help them manage their cash flow, savings, and investments.

Most people know you can’t control or time the market, and selling yourself as someone who only helps navigate the market ups and downs is a losing proposition. If that is your spiel, I predict you will be out of business soon or your fees will be seriously compressed.

Times are always changing and black swans are more frequent than most people realize. By maintaining resiliency in your practice with the appropriate fee structure, you, your employees and your clients can better weather the next disaster.